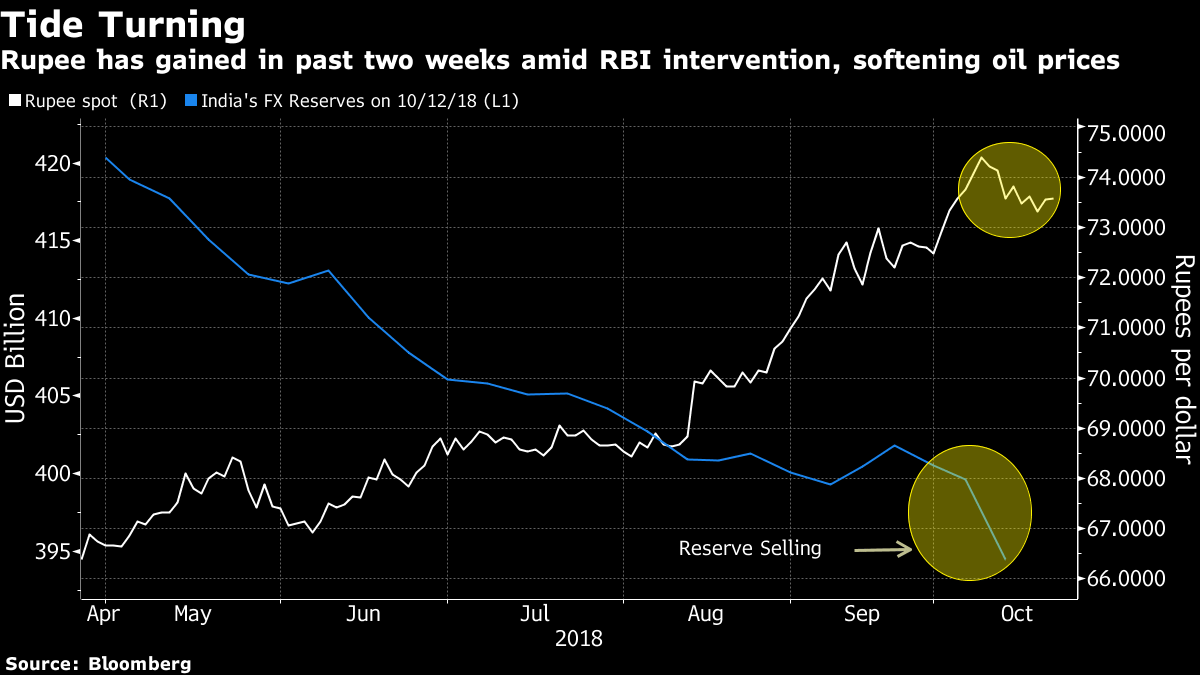

India’s forex reserves plunged $5.14 billion in the week ended 12 Oct. — the biggest drop in 7 years — hinting at the central bank’s intervention.

Mumbai: The appears to have moved away from its hands-off exchange rate strategy as the rupee plumbed fresh lows earlier this month.

The country’s foreign-exchange reserves plunged $5.14 billion in the week ended Oct. 12, the biggest drop in seven years, hinting the central bank intervened to stem the rupee’s losses from getting out of hand after it held interest rates at an Oct. 5 meeting.

While it may be too early to conclude that the RBI will step in frequently to defend the rupee on such a magnitude regularly, the intervention along with a fall in oil prices helped steady the currency, according to analysts at Natwest Markets Plc and Standard Chartered Plc.

“This reserve selling was mostly due to USD/INR buying pressure after the FX market reacted negatively to the RBI decision,” said Maximillian Lin, an emerging-markets Asia strategist at NatWest in Singapore. The intervention helped limit further weakness in the rupee, a move helped by a decline in oil prices and a softer dollar, he said.

The rupee lost more than one percent in three sessions after the RBI’s rate decision, sinking to a record 74.4825 on Oct. 11. Asia’s worst-performing currency then recovered to advance over the past two weeks, though ING Bank NV has said the bounce will soon give way to another round of declines.

“The strong intervention appears to be aimed at containing the losses post the RBI policy, and they may also have been worried about this spilling into the equity market,” said Gopikrishnan MS, head of foreign exchange, rates and credit for South Asia at Standard Chartered in Mumbai.

The rupee on Wednesday rose, reflecting gains in other emerging-market Asian currencies, gaining 0.4 percent to 73.28 as of 9:13 a.m. in Mumbai, halting two days of declines. – Bloomberg