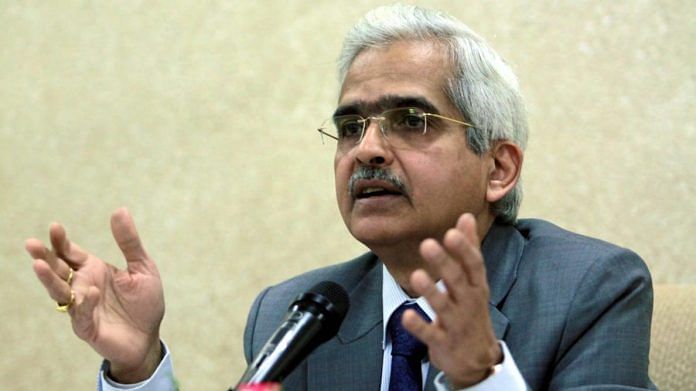

New Delhi: Reserve Bank Governor Shaktikanta Das Thursday said it is closely monitoring the situation at scam-hit PMC Bank and a forensic audit is underway.

Punjab & Maharashtra Cooperative Bank (PMC Bank), among the top 10 urban cooperative banks in the country, was placed under an RBI administrator on 23 September for six months due to massive under-reporting of dud loans.

“PMC Bank situation is being closely monitored. Forensic audit is underway in PMC Bank case,” Das told reporters after a meeting of the Financial Stability and Development Council (FSDC) here.

RBI had imposed withdrawal restrictions on account-holders after it found alleged irregularities to the tune of Rs 4,355 crore due to diversion of money to infrastructure firm HDIL.

On Tuesday, the apex bank enhanced the cash withdrawal limit to Rs 50,000 per account, which was the fourth such increase since PMC Bank was placed under its direct control.

Five persons, including HDIL promoters Rakesh and Sarang Wadhwan, have been arrested by the police in the case.

Several protests have been held by the depositors in Mumbai and at least 10 depositors have died since the alleged scam came to light. Scattered protests have happened in front of the RBI main office in Delhi as well.

Also read: PMC Bank depositors stage protest outside RBI demanding complete money withdrawal

The investigating authorities/ forensic auditors should take cognisance of various articles written in the web-portal ‘moneylife’. Sujata Dalal and others should be complimented for an in-depth and incisive investigation and have made some shocking conclusions: (1) Where are the statutory auditors- M/s Lakadawala ? Have they been questioned by the police? What are their present whereabouts? As stated in the article, the known address pertains to a flat in a housing society inBorivali. The flat is locked and is without any signboards. (2) A General Manager of the Bank, who resigned recently, was previously working in the department of RBI which monitored UCBs. He had also carried out Audit and Inspection of the Bank in that capacity. Why did he leave RBI and how was he allowed to switch his job? Was there any conflict of interest? Interestingly, RBI Employees/Officers Credit Coop Society has kept FDs of sizeable amounts in the Bank. These funds are also blocked. These are linkages between RBI and PMC Bank that raise suspicion. (3) RBI was not willing to part with contents of RBI Inspection Reports. Now under RTI Act, the SC ordered RBI to part with reports of preceding four years. RBI has so far released a report only for one year, that too in a redacted form. The report points out many serious irregularities. Had these been followed up by the RBI, the scam could have come to light much earlier. (4) PMC Bank Administrator appointed by RBI in his previous stint in NAMCO Bank saw NPAs jump by 40%.

These are post-mortem issues. There is now no point in shutting doors after horses have fled the stable. The most shocking revelation made in the portal pertains to fact that the fraud-hit PMC Bank has to spend Rs27 crore/ month to stay in operations and to keep its 137 branches open across six states. Now, more than 70 per cent of loans are loss assets. There is no question of new loans to be sanctioned. But salaries and other operational expenditure will have to be paid. Who will bear the cost? Hapless depositors only! RBI likes to keep such type of fraud-hit coop banks in limbo under administration for an indefinite period without any conclusion. Who foots the bill?

Without setting off a panic, the RBI should do an MRI scan of all major cooperative banks.