According to Ravi Venkatesan, greater powers over management and decision making will enable banks to tap capital markets and strengthen their balance sheets.

The head of one of India’s largest state-run banks says the government needs to ease its grip over the lenders or risk slowly killing off the sector.

Tight government control makes it hard to attract talent or take the tough decisions needed to address the bad debts weighing down the banks, according to Ravi Venkatesan, the outgoing chairman of Bank of Baroda. Government-controlled lenders need to consolidate if they are to avoid losing yet more market share to private-sector peers, but this is better achieved after the banks get stronger rather than merging weak banks, he said.

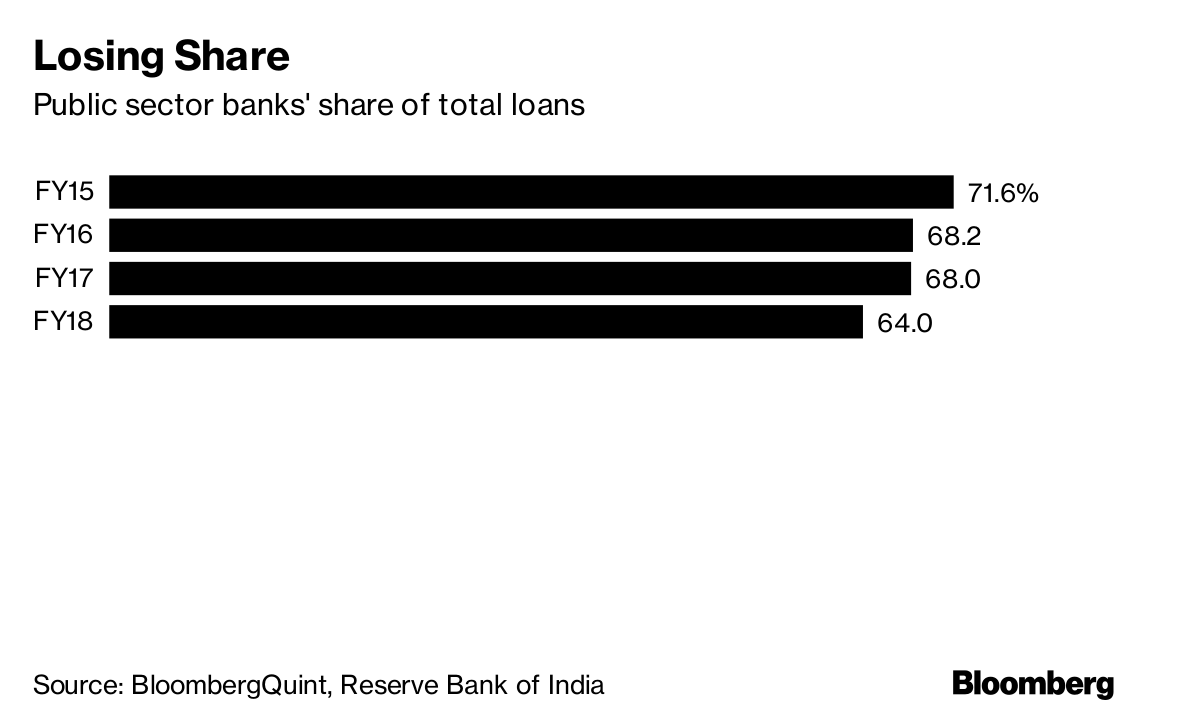

“India needs fewer, better capitalized, and better run public-sector banks,” Venkatesan said in a recent interview. “But what is happening today is privatization by default rather than intent, as public sector banks hemorrhage market share and capital.”

Almost 70 per cent of new deposits went to private banks in the latest fiscal year and they’re estimated to corner nearly 80 per cent of incremental loans through 2020 as mounting bad debt erodes capital and constrains lending at state banks. Weak balance sheets and laws that require the state to hold at least 51 per cent of their shares have left public lenders dependent on the government for new capital.

Venkatesan, 55, and his Chief Executive Officer P.S. Jayakumar, 56, were uncharacteristically hired from outside India’s vast state bank network in 2015, as part of Prime Minister Narendra Modi’s attempts to overhaul the system. The former Microsoft Corp. India chairman said both he and Jayakumar, a former Citigroup Inc. managing director, took pay cuts to join Bank of Baroda and be part of “something big.”

The prospect of an overhaul is daunting. India’s public banks are estimated to hold 90 per cent of non-performing loans, and 11 of these 21 banks are operating under an emergency program supervised by the Reserve Bank of India (RBI), which restricts their new lending. Icra Ltd., the local unit of Moody’s Investors Service, estimates India’s total loans will grow between 8 per cent to 9.5 per cent in the years through March 31, 2020, of which about 80 per cent will go to private banks.

Government-controlled lenders also suffer from 85 per cent of total frauds, according to a Reserve Bank of India report. State-owned Punjab National Bank (PNB) lost $2 billion in a scam earlier this year which wiped out its profit and forced it to turn to the government for more capital.

“Public sector banks are systemically more accident prone,” said Venkatesan, a Harvard Business School alumnus, without naming any bank. “The decline will accelerate” unless the lenders reform, he said.

He recommends the government start by allowing banks’ boards to hire their own management and free them up to decide strategy. At present, all senior appointments are made by a government-appointed panel.

Once they have greater powers over management and decision making, state banks should be able to tackle their bad loan issues more effectively and eventually tap the capital markets to strengthen their balance sheets, Venkatesan said. At that point, the government should be prepared to pare its stake in the lenders.

RBI Governor Urjit Patel weighed in to the debate earlier this year when he said that state ownership of the banks impedes supervision. Patel was speaking soon after the PNB fraud came to light, amid statements from government officials that politicians have to unfairly take the blame for any scams while supervisors get away relatively easy. Similar to Venkatesan, Patel had also noted that the RBI cannot remove management of state-run banks, nor can it force a merger or trigger the liquidation of these lenders.

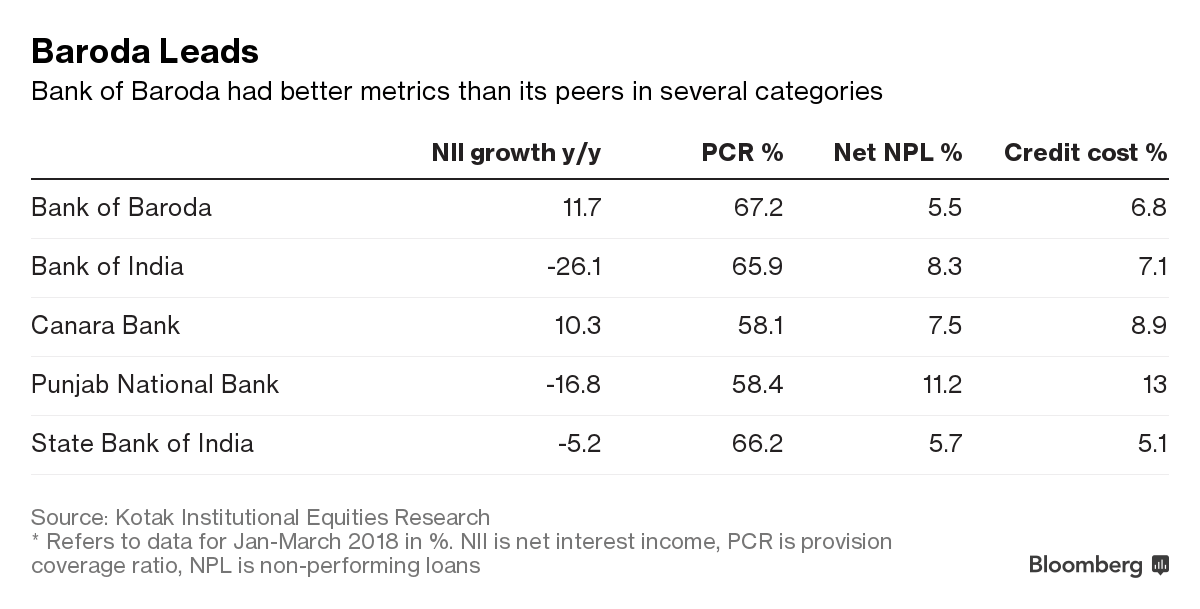

Under Venkatesan’s watch, Bank of Baroda has sought to differentiate itself. While it has to follow government rules on cleaning up bad debt, the lender has also focused on digitization to save costs. On several metrics, it’s performing better than its peers. Last week, it posted a profit of 5.3 billion rupees for the June-quarter, three times what analysts were predicting. More than four-fifth of the analysts tracking the bank give it a buy rating, the highest ratio in at least five years, data compiled by Bloomberg show.

“This management has put Bank of Baroda right ahead of the public sector pack,” said Soumen Chatterjee, head of research at Guiness Securities Ltd. “We are recommending clients buy the shares.”

Even so, investors in Bank of Baroda haven’t made money over the past three years, the second-worst performance among 10 lenders that form India’s Bankex Index. The bank’s shares traded at 151.75 rupees in Mumbai on Monday, lower than the 172.69 rupees consensus 12-month price target based on a Bloomberg survey of 35 analysts.

Investors are uncertain about whether Bank of Baroda’s bad loans have indeed peaked, they’re concerned the government will force mergers, and they’re unsure if CEO Jayakumar will get another term, said Venkatesan, who’s due to retire next month.

“My confidence is high that as the uncertainty reduces around these three issues, the share price will reflect the strength of Bank of Baroda’s underlying business,” he said.- Bloomberg

Mother of all NPA s is political corruption and interference in lending decisions of the baks.It started with conducting huge loan melas long back

Sir this is NOT a duplicate comment

This the first time i have gone through your report and put my comment.

Mother of all NPA s is political corruption and interference in lending decisions of the baks.It started with cond ucting huge loan melas long back

Sir this is NOT a duplicate comment

This the first time i have gone through your report and submitted my comment.

Mother of all NPA s is political corruption and interference in lending decisions of the baks.It started with co

ucting huge loan melas long back.

Sir this is NOT a duplicate comment. This the first time i have gone through your report and submitted my comment

Mother of all NPA s is political corruption and interference in lending decisions of the baks.It started with conducting huge loan melas long back.

One can speak such thing if he has shown result All most aa Public Sector has progressed in NPA to brake these one should be accountable like in private sector If there is no acountability then they will enjoy their lives with easy money and drowning hard earned tax payer money

I am Ex-BOB Executive, having left the Bank to join Private Sector Bank & I can say that It was indeed a mistake of Finance Minister Arun Jaitley to have put faith & trust in this gentleman, who is Non Banker , Ravi Venkatesh as BOBChief..!

His is a case of Sour Grapes! Had he received extension,his comments would have been opposite! He would have praised Modi sky high!

So , fact of the matter is, he has No Spine to show..

As compared to freedom enjoyed by Banker’s during UPA FM P.Chidambaram & puppet PM Dr. Manmohan Singh, Modi Govt has certainly given more freedom to Local Bank BOARD but , these Bankers are unhappy because of stringent Accountability imposed by Modi Govt..

All NPA’s which have NOW come out in the open, belong to UPA era, were hidden for years with protection from Corrupt UPA Ministers..

It is very dangerous to give more freedom than now, to these Bankers, whose willful Collusion , resulted into hitherto unreported, hidden NPA monster ..