Predictions that crude could return to $100 per barrel signal that things may get a lot worse for rupee in final 3 months of 2018.

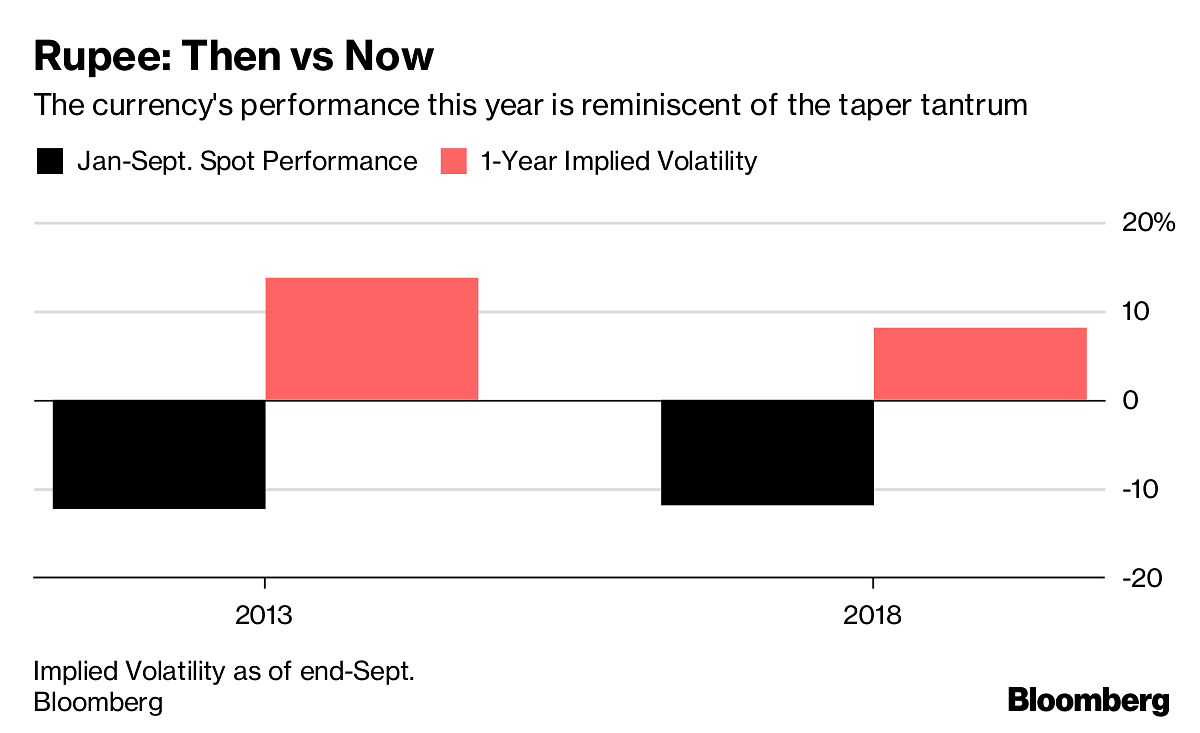

Mumbai: Move over taper tantrum. The Indian rupee looks set to outpace losses seen in 2013 as efforts by policy makers to stem its rout fall flat in the face of rising oil prices and relentless foreign outflows.

Down more than 12 per cent as Asia’s worst currency in 2018, predictions that crude — India’s biggest import — could return to $100 per barrel signal that things may get a lot worse for the rupee in the final three months of the year. Back in 2013, the currency had rallied in the October-December period following a two-quarter plunge of more than 13 per cent on indications the Federal Reserve would wind back stimulus.

“It’s pretty difficult to see a huge turnaround in the rupee,” said Khoon Goh, the head of research at Australia and New Zealand Banking Group Ltd. in Singapore. The underlying causes for the rupee’s weakness — higher oil and foreign outflows due to higher U.S. rates — will still remain, he said.

The rupee has been setting one record low after another recently, with overseas investors having pulled a net $9.1 billion from Indian stocks and bonds this year amid an emerging-market selloff. Strategists have been playing catch up as losses accelerate, with the median year-end estimate for the currency now at 72 per dollar versus 69 at the end of August.

ANZ is far more bearish, with a forecast of 74. That compares with the rupee’s latest record low of 72.9750 reached on Sept. 18, and is 1.5 per cent weaker than its close of 72.9125 on Monday. Indian markets were shut Tuesday for a holiday.

One positive for the rupee is that its implied volatility has remained lower than in 2013. That also perhaps explains the lack of aggressive intervention by the Reserve Bank of India in the currency market, even as policy makers have taken other measures. The RBI has for long maintained that it steps in only to curb undue volatility and doesn’t target any particular level of exchange rate.

As comparisons are made with 2013, there has been some speculation that the central bank may revisit a policy it employed that year of opening a foreign-exchange swap window to meet the entire daily dollar requirements of Indian oil-marketing companies.

For now, the oil surge means that India’s current-account deficit is estimated to widen to $75 billion in the fiscal year to March, or 2.8 per cent of gross domestic product, according to Bank of America Merrill Lynch. That would be the highest since fiscal 2013.

The RBI has limited options to meaningfully influence the rupee’s trajectory in the near term, which implies that the currency will remain exposed to the ebbs and flows of global tides, according to Siddhartha Sanyal, an economist at Barclays Plc. He predicts the rupee will depreciate to 74.50 per dollar by end-December – Bloomberg