New Delhi: A major point of discussion surrounding private sector investment is whether it has been slowing down because banks aren’t lending to companies. While it may be true that corporate loans are no longer a focus area for banks, data shows that corporates are increasingly looking beyond banks to raise their funds, perhaps pointing towards a changing role for banks in the economy.

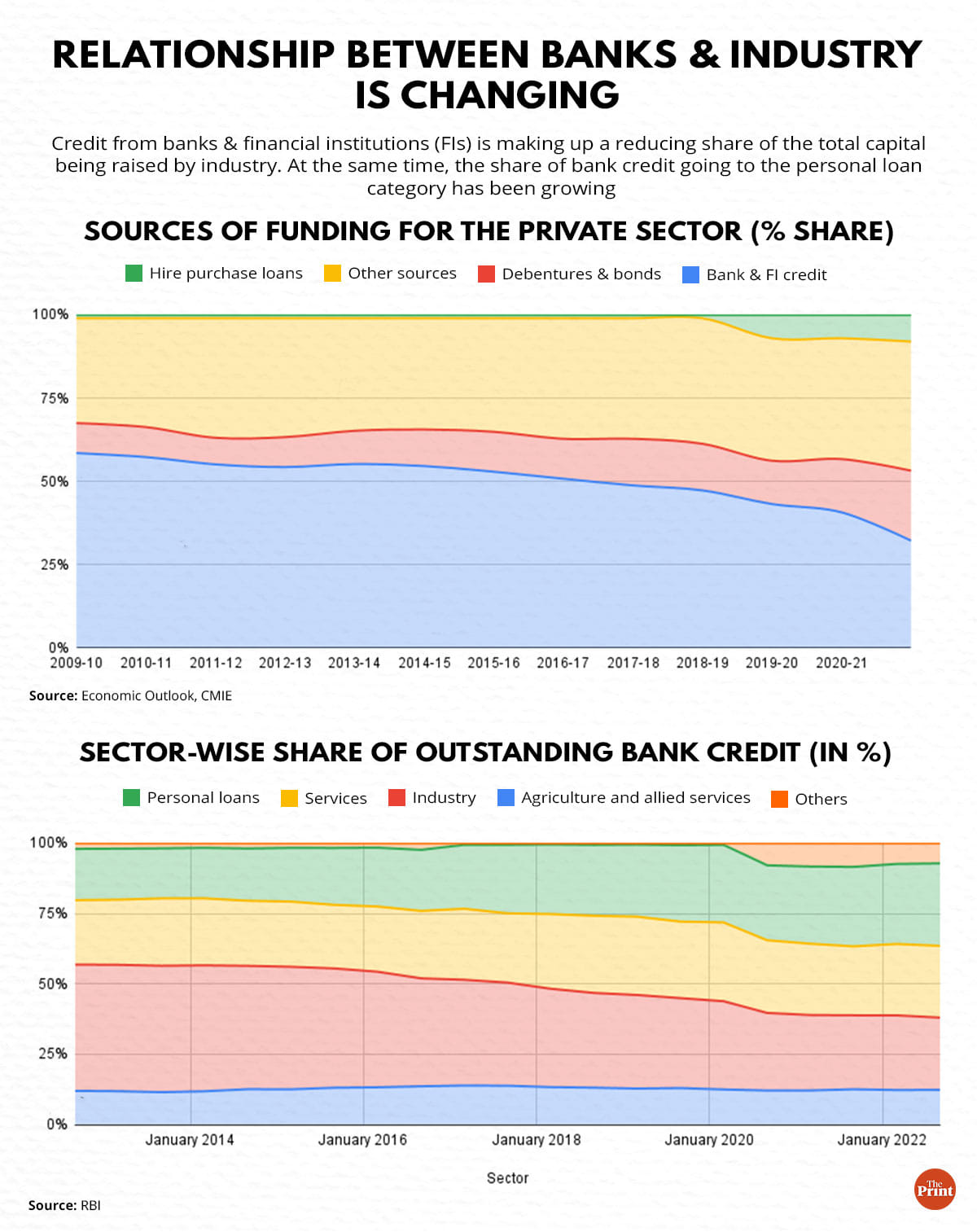

Data from the Economic Outlook database of the Centre for Monitoring Indian Economy (CMIE) shared with ThePrint showed that even as recently as 2009-10, banks and other financial institutions provided as much as 58.5 per cent of the funds corporates raised for their investments. By 2021-22, this proportion fell to 32 per cent.

The CMIE is an independent business information think tank.

Correspondingly, funds raised from the market in the form of bonds and debentures have seen an increasing share in the total capital raised by corporates, the data showed — from 9 per cent in 2009-10 to 21 per cent in 2021-22.

On the other hand, banks, for their part, are delivering a higher share of their credit to the personal loan category, and a shrinking share to industry, RBI data shows.

In other words, where banks used to be a major source of funding for the private sector, their role in this regard is shrinking. Instead, they seem to be focussing more on personal loans.

The reasons for this shift, according to economists, are manifold. One of the factors at play is the fact that banks themselves consciously decided to shift their lending away from large corporate loans as a response to the non-performing assets (NPA) crisis that they had been facing from 2014 onwards.

“When the NPA problem happened, there was an asset quality review done by the RBI in 2015,” Madan Sabnavis, chief economist at Bank of Baroda, explained. “Essentially, it was a case of large loans locked up in the infrastructure sector, and there was also a push for banks to rework their business models to reduce their NPAs.”

This was also a time when there was hesitancy on the part of banks to lend large amounts to corporates, he added.

“So, there was a situation where banks consciously took a decision to move to retail lending, where the risk of default was much less,” Sabnavis said.

Also Read: RBI ban on 3rd-party loan recovery agents not a fix. It’s like AP’s microfinance ban mistake

Higher trust among households

The other reason industry is moving more towards the market to raise funds has to do with the nature of the funds themselves, and the increased willingness of the public to lend to corporates directly through the market.

“As far as industry is concerned, it is focussing on longer-term financing and therefore relying relatively more on raising bonds directly from households and other stakeholders,” D. K. Srivastava, chief policy advisor at Ernst & Young (EY) India, said. “They rely on banks for relatively shorter-term needs. There is possibly also more trust among the public, which means that they are willing to lend directly to the corporates by subscribing to bonds rather than use banks as intermediaries.”

The interest in the bond market as a source of funds is also driven by larger corporates that are AAA rated — the highest possible rating, which allows them to raise funds from bond issuances relatively cheaply. So, these corporates choose to issue bonds instead of borrowing from banks.

The shift from bank credit to the bond market is something that has come to the notice of the RBI as well, with deputy governor M. Rajeshwar Rao pointing to this phenomenon in a speech he delivered in October.

“While bank credit has historically been a dominant source of financing in India, the same has been supplemented over the period by non-bank channels, which have grown significantly in the last one decade or so,” Rao said. “India now has more than 10 crore demat accounts and there has been a spurt in the entities accessing (the) primary market to raise funds.”

The deputy governor added that the corporate bond market has also grown significantly, and that there has been a “steady increase” in corporate bond issuances, with the outstanding amount having crossed Rs 40 lakh crore as of March 2022.

“As we all know, (the) corporate bond market acts as a risk diffuser within the financial system, redistributing the risk among a larger set of investors,” Rao added.

Another reason for the shift is that large companies have been able to use the pandemic period effectively to reduce their debt, according to Sabnavis, who said that several large corporate houses took advantage of low interest rates and their own high profits to pay back their past loans.

Importance of personal loans

An important factor determining the increasing share of credit flowing to personal loans is the behaviour of non-banking financial companies (NBFCs), who themselves are active participants in the debt markets.

“When you are looking at the debt market, about 70-80 per cent of the borrowing has been coming from NBFCs,” Sabnavis explained. “The NBFCs raise these funds and then lend them on, largely to the consumer credit segment.”

Further, the profitability of the banks themselves and the expansion of their business is also a consideration driving the growth of personal loans.

“As for banks, they have to continue increasing their loan books, and so if the share of industry is falling, then they would have to try to give more personal loans to ensure that their overall loan book continues to grow,” said Srivastava.

(Edited by Theres Sudeep)

Also Read: Bank credit has bounced back, but rising interest rates & inflation can be new hurdles