Billionaire Mukesh Ambani’s Reliance Jio Infocomm Ltd., India’s largest mobile phone carrier, is planning its biggest-ever rupee bond sale as it targets gains in market share.

The company is seeking commitments Tuesday for as much as 50 billion rupees ($671 million) of notes maturing in five years at a coupon of 6.20%, according to people familiar with the matter. Jio last tapped the local-currency bond market in July 2018 and is planning to use the proceeds from the current proposed deal to refinance financial liabilities.

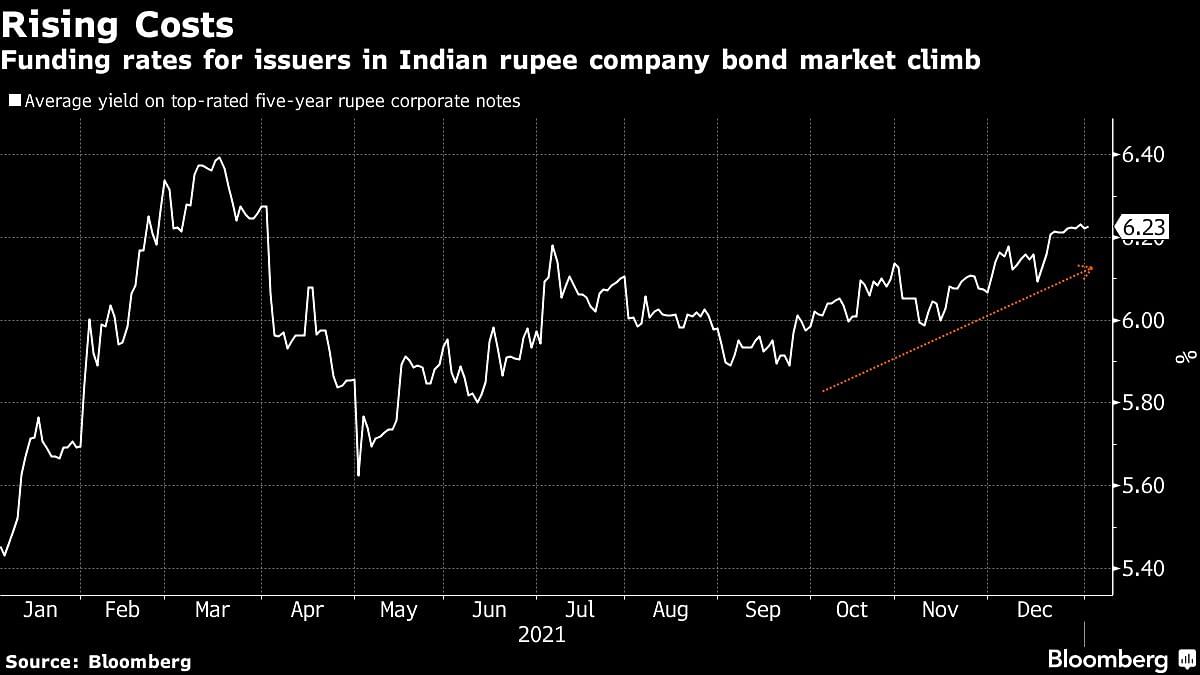

Jio’s entry into the wireless market in 2016 with free calls and ultra-cheap data, unleashed a tariff war in the country and shrank the telecom space from a dozen players to three private sector operators as others exited, merged, or went bankrupt. The top-rated firm is coming to the debt market as the nation’s central bank drains excess liquidity from the banking system as it normalizes policy, pushing borrowing costs for AAA graded five-year corporate debt to near a nine-month high.

Jio is preparing to roll out 5G services in India this year after buying airwaves worth almost $8 billion in March. It was the top bidder in the latest spectrum auctions, underscoring its intent to retain its edge over rivals.

Jio’s parent Reliance Industries Ltd. has hired banks too to arrange a series of fixed income investor calls from Tuesday for a potential multi-tranche dollar bond offering.—Bloomberg

Also read: Reliance Jio emerges biggest bidder for telecom spectrum as it buys 73% of airwaves sold