New Delhi: The Narendra Modi government’s ambitious plan to revive bankrupt state-owned electricity distribution firms through its Uday scheme seems to have failed in its objectives.

When it launched the Uday scheme in November 2015, the government said it would not only address the problems afflicting the power sector but also that of the banking sector.

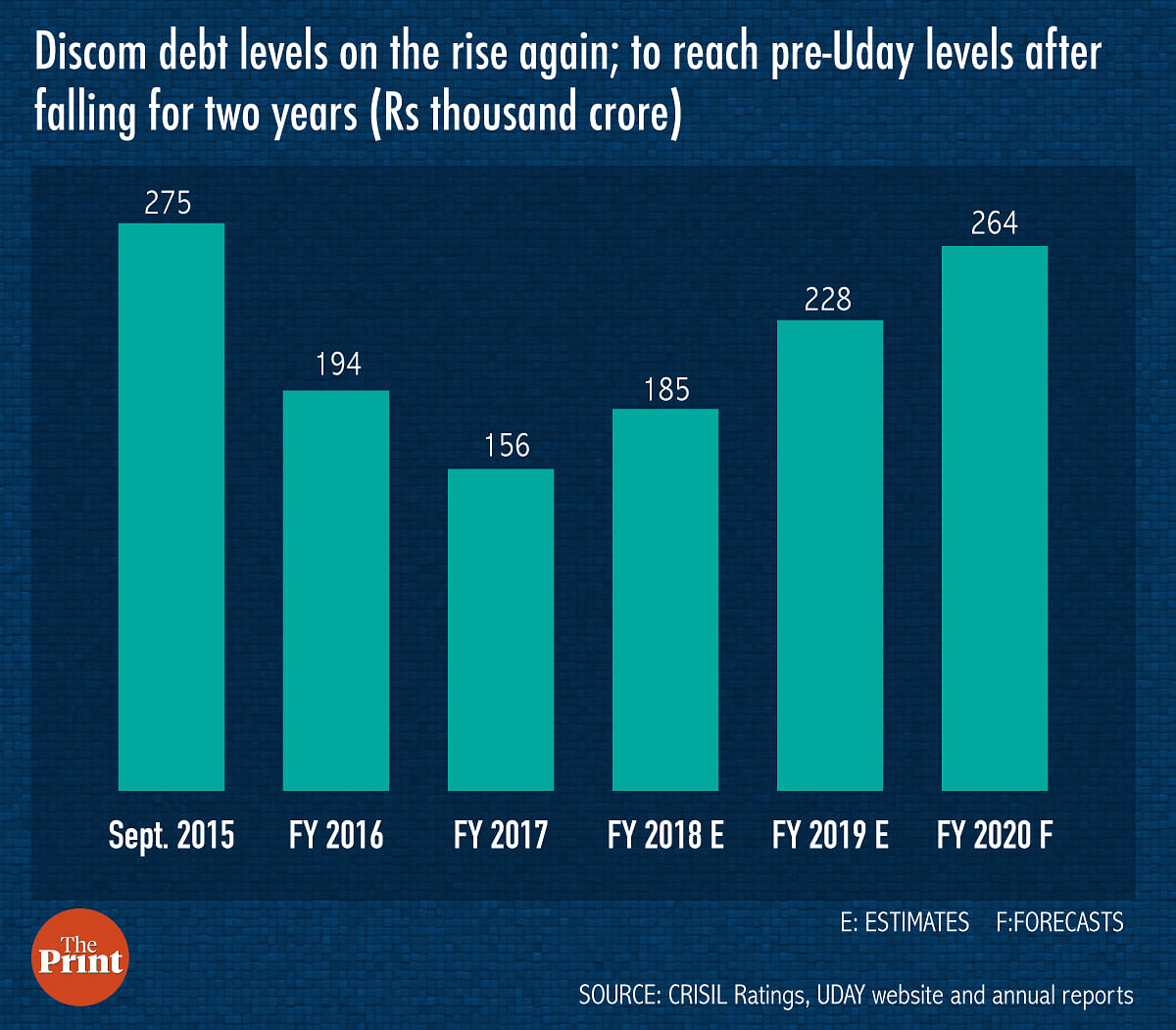

Three years on, however, most of the state-owned electricity distribution firms are again battling high debt levels, ratings agency Crisil said in a report Monday, adding that the debt levels of these discoms in 2019-20 is set to increase to the levels seen before the implementation of the government’s Uday scheme in November 2015.

The debt levels could increase to Rs 2.6 lakh crore by March 2020 from Rs 2.28 lakh crore as of March 2019 and Rs 1.85 lakh crore as of March 2018, the report said, adding that the discom debts were at Rs 2.75 lakh crore as of September 2015 and subsequently fell to 1.94 lakh crore as of March 2016 after the implementation of Uday.

The UDAY scheme

The Ujwal DISCOM Assurance Yojana (Uday), launched in November 2015, envisaged state governments taking over 75 per cent of the utilities’ debts, thus reducing the interest burden on the discoms. In turn, the discoms were to improve their financial and operational parameters and become more efficient.

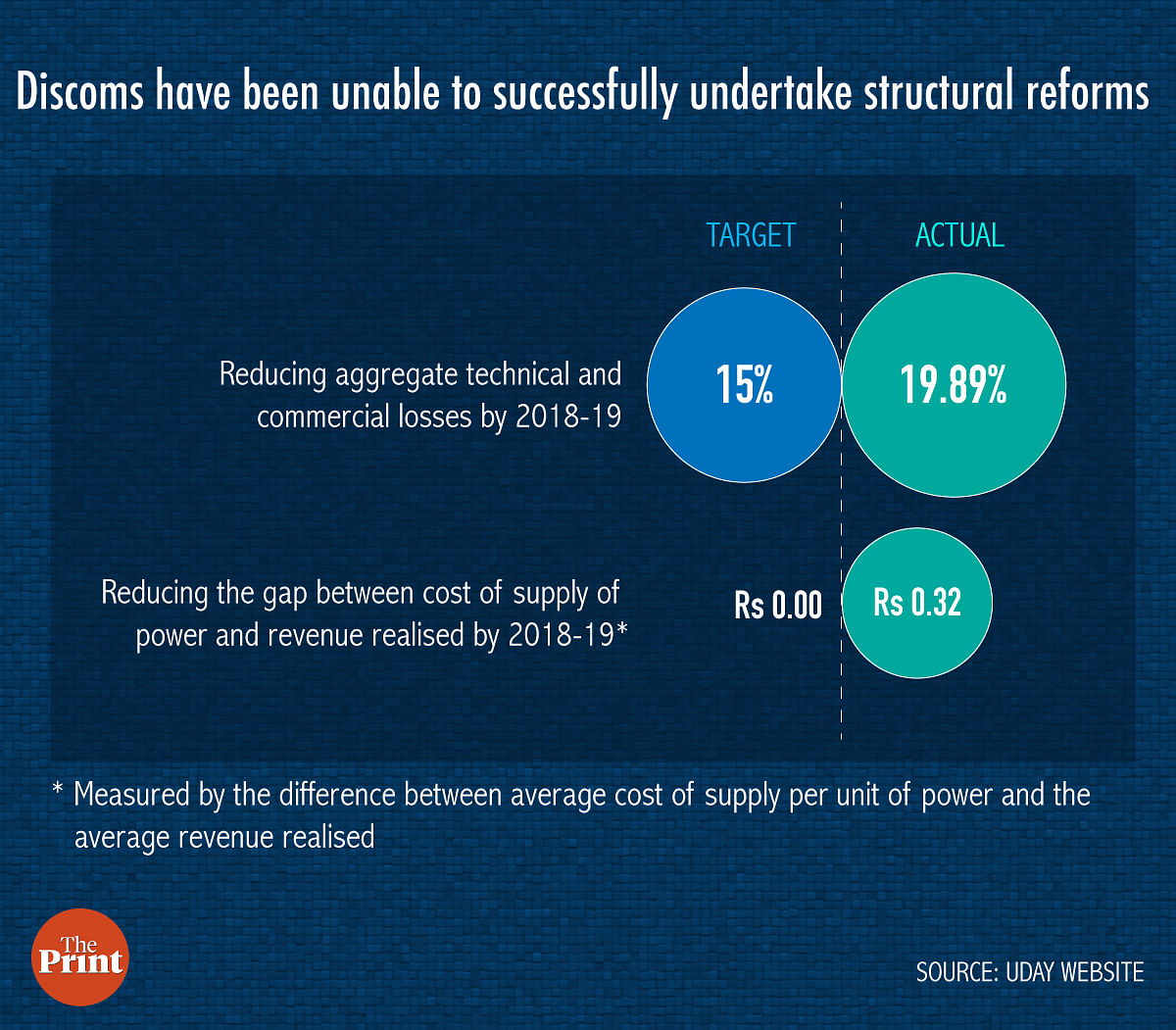

However, more than three years after it’s rollout, most of the discoms have been unable to meet financial targets such as reducing their aggregate technical and commercial losses to less than 15 per cent and reducing the gap between the cost of supply of power and revenue realised to zero.

Also read: Modi govt scheme to cut discom debts makes little headway, targets unlikely to be met

States may implement another bailout: Crisil

The rise in the discom debts may force states to either go in for another “bailout” of the discoms or take “hard decisions” to get the discoms back into shape, the report said.

Crisil said the discoms needed to reduce their AT&C (aggregate technical and commercial) losses by 900 basis points to 15 per cent by 2018-19 and implement regular tariff hikes of 5-6 per cent per annum as part of the structural reforms but failed to do so.

“While discoms enjoyed the benefit of debt reduction, structural reforms have been slow to come by. For instance, AT&C losses reduced by only 400 bps by December 2018 from pre-UDAY levels and average tariff increase were a paltry 3 per cent per annum,” the report said.

Crisil’s analysis is based on data of discoms from 15 states that account for 85 per cent of the aggregate technical and commercial losses.

Subodh Rai, senior director, Crisil ratings, said that further improvement in operations may face challenges because the focus on new rural connections without adequate tariff hikes can increase losses. “Add to that, the funding needs for budgeted capital expenditure, and the external debt of discoms would balloon to Rs 2.6 lakh crore by the end of fiscal 2020.”

‘Not enough fiscal room for bailout’

The report also pointed out that states may not have enough fiscal room to undertake another bailout as 9 of the 15 states were breaching the 25 per cent debt to GDP cap set by the fiscal responsibility and budget management act. Uday had adversely impacted state finances as Uday bonds had increased their debt liability and added to their fiscal deficit.

“That makes structural reforms of discoms, especially ensuring cost-reflective tariffs and a material reduction in AT&C losses using measures such as smart metering, a critical need. Any delay would increase the pain for the power sector, especially for the generating companies, investors and lenders,” the report added.

Also read: Modi’s power industry revival plan takes a hit as discom losses rise

Socialism obsessed Modi doesn’t have the gall to privatize discoms.

Yeh toh hona hi tha.