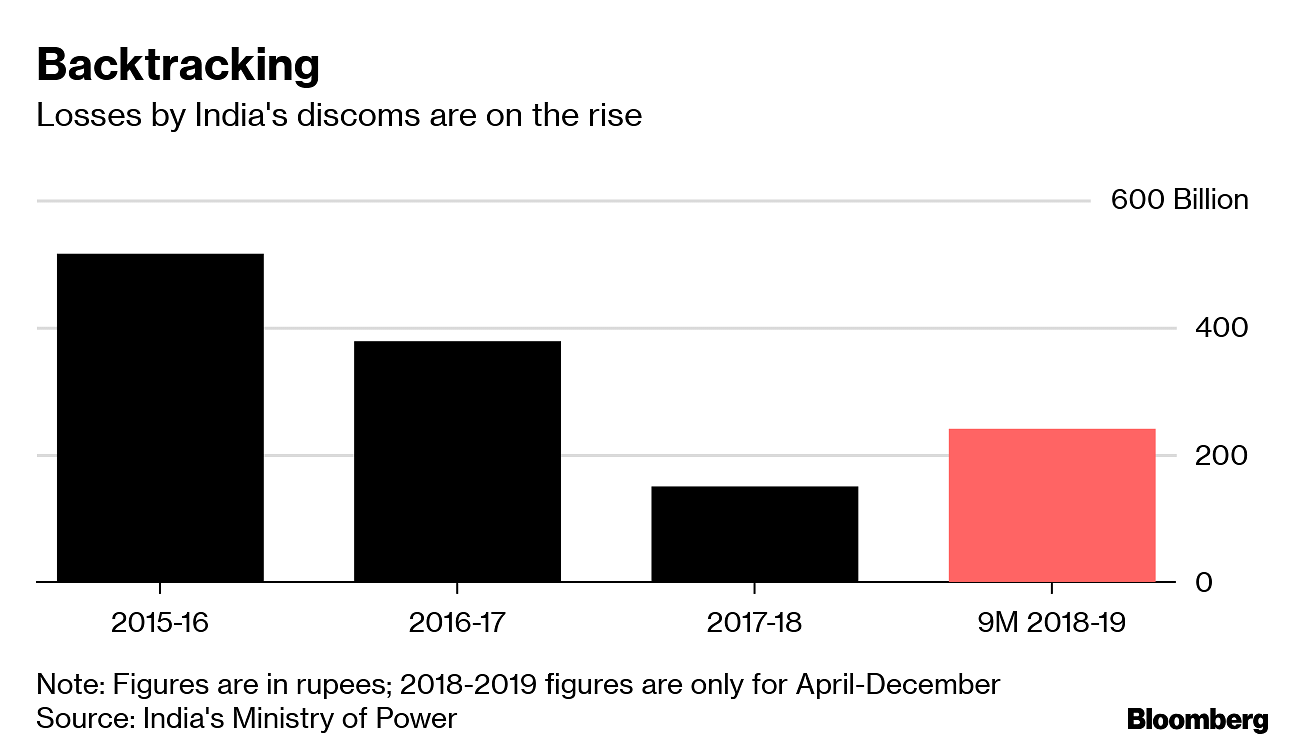

New Delhi: Losses by India’s power retailers are set to rise, reversing two years of declines they enjoyed since Prime Minister Narendra Modi’s government unveiled a plan to make the ailing utilities profitable.

Combined losses by state distributors that signed up for the federal government’s reform plan in the first nine months of the fiscal year rose to about 240 billion rupees ($3.4 billion), a 62 percent jump from a year earlier, amid an increase in coal and power costs, according to Ajay Kumar Bhalla, India’s power secretary.

“We may not have achieved targets, but we feel we have done well,” Bhalla said, pointing to success installing new meters and improving billing and payment collections. “Structural issues have been addressed, and we expect them to yield positive results.”

Full-year earnings by the companies, known as discoms, could improve as most states are scheduled to make subsidy payments during the last quarter of the fiscal year, which ended in March, he said.

As part of Modi’s power industry revival plan, called UDAY, states took over 75 percent of the debt of their distribution utilities to help ease their debt burdens. The discoms were then given operational targets to reduce losses, while the federal government contributed with energy efficiency schemes, such as expanding the use of energy-saving of LED lights and deploying solar irrigation pumps. All but two of India’s 29 states have signed up.

The stalled recovery will sustain discoms as the weakest link in India’s electricity supply chain. Many are saddled with large debts from selling power below cost or from poor billing and collections. The financial mess impedes their efforts to serve low-paying consumers, such as rural homes and farmers, while also stifling their power purchases and ability to make timely payments to electricity generators.

Coal Costs

State-run Coal India Ltd., the country’s biggest supplier of the fuel used for power generation, said average coal prices during the nine month period rose 11.6 percent. Power costs also increased as some generators had to import coal to bridge a domestic supply shortfall. Average spot electricity prices rose 28 percent from a year earlier to 4.08 rupees per kilowatt hour during the nine-month period, data from Indian Energy Exchange show.

The discoms’ inability to pass on such cost increases remains a key hurdle for revival of the electricity distribution sector, according to Debasish Mishra, a partner at Deloitte Touche Tohmatsu in Mumbai.

Distributors also continue to lose money on every unit of electricity sales. The UDAY reform plan aimed to eliminate these losses by closing the gap between the cost of power supplied and realized revenues. In the first nine months of the last fiscal year, the difference was 0.34 rupees per kilowatt hour, according to Bhalla. That’s a 21 percent rebound from the same period a year ago.

Power Losses

The industry has shown some improvement on the amount of power that’s lost through theft or poor metering. That share, known officially as aggregate technical and commercial losses, has narrowed to 19.7 percent, Bhalla said. That’s down from 21.4 percent in the same period last year. However, that’s still above the 15 percent target set under the UDAY plan.

The power losses in large electricity consuming states — including Uttar Pradesh, Maharashtra and Madhya Pradesh — have increased from levels seen five years ago, according to data from the ministry’s website tracking the progress of the plan. Some states have shown improvement, such as Rajasthan, Haryana and Bihar, but are still lagging targets. On an average, distributors continue to lose revenues on about a fifth of the electricity they provide.

“The plan was a well-designed carrot so many discoms bought into it, but there was no stick,” said Vinayak Chatterjee, chairman of infrastructure services firm Feedback Infrastructure Service. States fell behind in enforcing measures to check thefts, improve billing and collections and root out systemic corruption, he said.

Also read: Indian electorate cares about electricity – but the power sector remains deeply challenged

Bravado and putting tax payers money in endless black hole if I have to sum up. We will never see an end and neither the law change by segregating wires and supply business would go through for vested political interest.

Why this term ATC loss can not be thrown into Indian ocean for ever. This keeps avenue open for utility to manage the mismanagement and manipulate data under clever business words. Result is showing ..with increasing losses. One may argue 100% electric supply connection so increase in loss!

Regulators are happy to endorse State view year after year rather than taking truly independent view. State giving subsidy in transparent way wold not have any opposition from honest tax payers. So why allow mismanagement and political towing of DISCOMs. Wonder why private DISCOMs don’t make loss and remember Act gives them fixed return on equity as well.