New Delhi: The National Small Savings Fund (NSSF) has for long been a safe refuge for the savings of millions of middle-class Indians. But one glance at the manner in which the Narendra Modi government has been dipping into it to fund cash-starved public sector firms, and that reputation could take a serious knock.

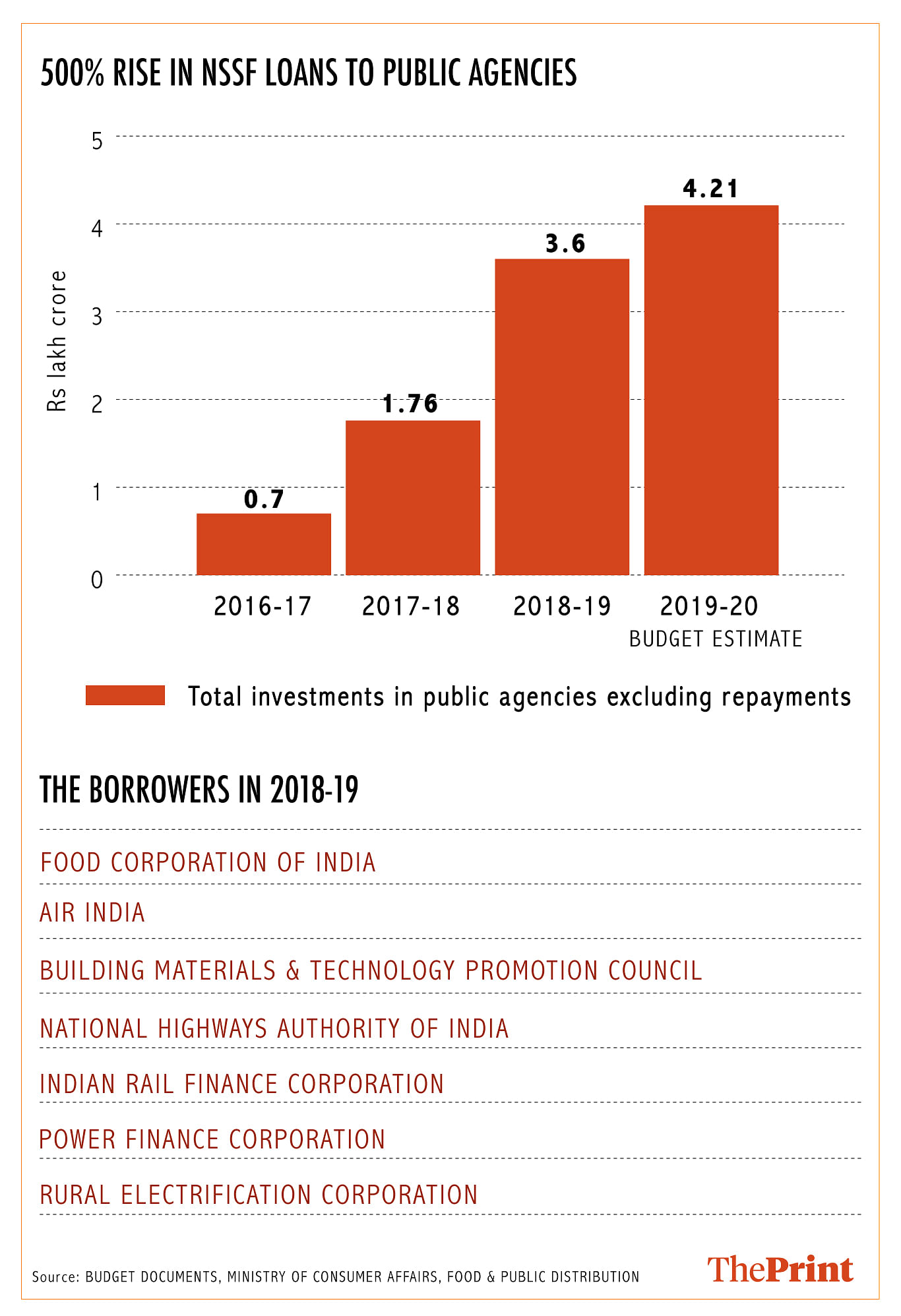

Loans from NSSF to state-owned companies, ThePrint has found, have jumped 500 per cent since 2016-17. That some of these PSUs don’t have the capacity to repay these loans on their own raises serious questions about the safety of the small savings, even though the central government implicitly guarantees these deposits.

According to budget documents, in 2018-19, the NSSF gave loans to many state-owned units, including the financially-stressed flag carrier Air India, Food Corporation of India (FCI), National Highways Authority of India (NHAI), Indian Rail Finance Corporation (IRFC), Power Finance Corporation (PFC), Rural Electrification Corporation (REC), and Building Materials and Technology Promotion Council (BMTPC).

Also read: Modi & his top ministers are risk-averse, invest their money in gold, FDs and land

Is public money safe?

The increasing instances of the Modi government dipping into NSSF funds are an indication of its growing reliance on off-budget borrowings to reduce its fiscal deficit. But more worryingly, it has raised questions of the government’s prudence in allocating NSSF funds to state-owned enterprises which do not have strong balance sheets to repay these loans.

“It is imperative that the small savings are safe. The government owes it to small savings depositors to not divert those funds to riskier entities and organisations. What the government has been doing in the last few years is not only an example of off-budget borrowings, but is also highly dangerous to the safety of small savings,” said Rajeev Gowda, a Rajya Sabha MP of the Congress.

“Actions such as these open the door for financial laxity. Eventually, the government will find a way to pay back the small saving depositors, but there could be consequences of the government playing such games to keep its fiscal deficit in check.”

The total NSS funds were estimated at Rs 16.85 lakh crore in 2019-20, as against Rs 14.8 lakh crore in 2018-19.

Of this, around one-fourth of the funds were given as loans to state-owned firms in 2018-19 and 2019-20. In comparison, less than one-tenth of the total NSSF funds were outstanding loans to state-owned agencies in 2016-17 and 2017-18.

Outstanding NSSF loans to state-owned enterprises, excluding repayments, are budgeted to cross Rs 4.2 lakh crore in 2019-20, an increase of around 17 per cent from Rs 3.6 lakh crore in 2018-19. This figure stood at Rs 1.76 lakh crore in 2017-18 and Rs 0.7 lakh crore in 2016-17.

The number for 2019-20 could increase drastically if the government further dips into these funds towards the close of the financial year to achieve its fiscal deficit target, as it has done in the last few years.

Brijesh Upadhyay, general secretary of the RSS-affiliated Bharatiya Mazdoor Sangh, said the biggest problem is that public money is not recognised as the people’s money, and there are no rules and regulations about how to invest these funds.

“Be it small savings or money with banks, there are no regulations on how to invest these funds,” he said, citing loans given to business enterprises by banks as well as those given by NSSF to state-owned firms like Air India and FCI. “They are not earning on their own… How will they repay them?”

Upadhyay pointed out that there is a “design defect” in economic policy, and the whole problem needs to be tackled on a holistic basis, rather than in an isolated manner.

T.K. Rangarajan, a Rajya Sabha MP representing the Communist Party of India (Marxist), said the way the government is operating at present, it is not going to take responsibility for any depositors.

“We are crossing a dangerous period as the depositors are not aware of their rights and the government is not bothered about the depositors,” he said.

A finance ministry spokesperson did not respond to requests for comment from ThePrint.

Also read: Financial sector needs bold reform to fix slowdown. Modi govt has time & numbers to do it

Lack of options for lending

The fund, part of the public account of India and set up in 1999, initially made all its investments in special central and state government securities, besides a small amount in the India Infrastructure Finance Company Ltd (IIFCL).

State governments used to be major borrowers from the NSSF, but their demands dried up after they were allowed to raise funds from the market in January 2017.

Loans from the NSSF started in earnest in 2016-17, when a debt of Rs 70,000 crore was granted to the FCI as the government tried to provide a lower amount than warranted by the food subsidy in that year’s Union Budget. This route also provides the NSSF with a way to deploy its high-cost funds and earn a return to repay the public.

However, in a note last month, Standard Chartered Bank economists led by Anubhuti Sahay pointed out that while states have shifted from the NSSF to market borrowing as the cost of funding is cheaper, the central government is using rising NSSF flows for fiscal deficit-financing and off-budget borrowing via public agencies. They pointed out that, given the current growth and interest rate environment, it will remain “a key source of financing the central government’s fiscal deficit for now”.

According to the economists, the public account, of which the NSSF is the major component, funds one-third of the central government’s fiscal deficit once off-budget expenditures are included.

Also read: Outlook for India’s growth is bleak and RBI forecasts this year nail it

‘Proxy for govt borrowing’

The Modi government has been criticised by economists for what is seen as fudging of fiscal deficit numbers in the budget by deferring its liabilities through off-budget borrowings by state-owned firms.

The government has set a fiscal deficit target of 3.3 per cent of GDP for 2019-20. The fiscal deficit was recorded at 3.4 per cent in 2018-19 and 3.5 per cent in 2017-18, broadly in line with the targets envisaged for those years.

“The government is using the NSSF route as a proxy for government borrowing. If the government had borrowed itself, it would have been reflected in the fiscal deficit numbers,” said D.K. Srivastava, chief policy adviser at EY India.

“Whether it is to support Air India or provide the food subsidy to the FCI, it is an indication of the pressure on central government finances.”

Srivastava, who was a member of the 12th finance commission, said this is an issue of non-transparency. “There was an earlier instance when the government used oil bonds for subsidising oil companies,” he said.

A committee under former RBI deputy governor Shyamala Gopinath, set up to review the small savings framework, had recommended using NSSF funds to finance India’s infrastructure growth. In its 2011 report, the committee pointed out that the money could be invested in securities issued by IIFCL, NHAI and IRFC at an interest rate of at least 1 percentage point above government security yields of similar maturity.

Also read: Ridiculous, foolish, atrocious – How Modi govt fans are slamming it on economic policies

Political class has lost all credibility. They are busy in dividing people based on caste and religion. God save, we are moving towards a theocratic state, and some people prefer to call it nationalism.

Raiding the middle class for distribution of money to the many Yojanas for the lower classes seems to have become the easiest option for the govt. Secondly, to hide poor fiscal performance, changing the goal posts or falsifying data has become a habit for this dispensation. The desire to be in power at any cost is leading the govt to deprive the citizens of their basic economic rights.

As Secretary DEA, Shri Subhash Goel was in the thick of all this. When he suggested a sovereign bond issue abroad, he seems to have assumed that global investors – in their hunt for yield – would be the docile, tethered cows that LIC and NSSF have become. They would simply write out checks for $ 10 billion – to begin with – no questions asked. At this rate, the rating agencies might have some tough decisions to take.

Shri Subhash Garg.

This is very worrying. Especially the loan given to Air India. It may never come back, because the borrower itself is ready to fly away!

What are the other “options” ? These PSUs, we all know how much fuel guzzlers they are, are basically essential services that are/can not be fully compensated through other /corporate means. They are gobbling up cash, but what are the alternate means to tackle the cash burn out problems in these sectors. Make management efficient/ work culture more competitive ……we all know its a mighty task if not impossible. Any other means? Look at Air India….should be do away it then altogether? Most think so….Recently Subramanian Swamy argued that if Air India is ever privatized, he will go to Courts against such decision. Puts up valid reasons why sick as may be Air India is, it is but an essentially a “necessity” for Govt of India. The problem is that Govt just does not have surplus money in the coffers and talking of how to spend the money is what columns such as this and many others in days to come deal with ! What about some “out-of-the-box ” lateral thinking about how to generate more money that the usual suspects of tax, exports etc. ?

My 2 cents,

Regards,