The markets are likely to become jittery if national and regional opposition parties form ‘opportunistic alliances’ against the NDA.

Indian equities may be Asia’s second-best performers this year, but the brokerage unit of the nation’s biggest private bank has advice for investors: load up on large caps and raise cash to buy into declines.

The strategy is based on the premise that the biggest companies will weather the volatility induced by the political uncertainty before next year’s national ballot more smoothly than the smaller stocks that led the $2.2 trillion market to multiple records in 2017.

“In a year ahead of the general elections, the likelihood of equity as an asset class outperforming, and that too on a big base, is not large,” HDFC Securities Ltd.’s Chief Executive Officer Dhiraj Relli said in an interview. Investors must realign their portfolios to “protect their profits and raise cash to buy during market panics,” he said.

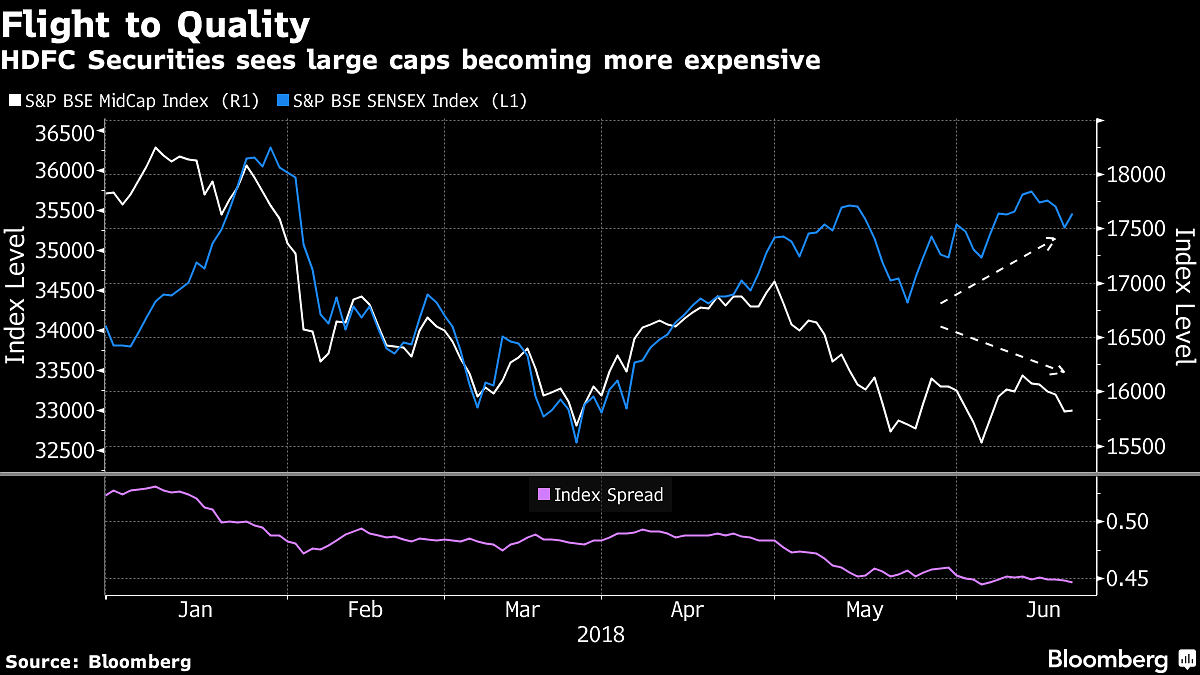

The S&P BSE Sensex’s 4.3 per cent gain this year has masked a selloff in mid- and small-sized stocks, sparked largely by the stringent margin requirements imposed earlier this month that prompted traders to flee these counters. The losses have left smaller firms trading near the biggest price discount to the Sensex since December 2016, a gap that is likely to widen as the flight-to-quality trade plays out, Relli said.

While the economy has grown, expanding at the fastest pace in nearly two years in the January to March quarter, improvement in company profits has lagged. Average net income of the 50 Nifty companies is projected to have risen 17 per cent in the April-June period from a year ago, slowing from more than 24 per cent growth in each of the previous two quarters.

Earnings have in the recent years been “plagued by skepticism, false starts, consistent downgrades and a few structurally challenged segments,” making investors doubtful about further sharp expansion, Relli said.

Below are some of Relli’s views on specific topics:

What factors will impact stocks in the next 12 months?

Positive factors could include: good rainfall, economic growth, inflation that is “under control,” a likely pause in local interest rate hikes after September, improvement in global sentiment toward emerging markets and oil stabilizing at about $65. Negative factors could include: a further oil rally (impacting Indian interest rates, inflation and currency), expectations of a hung parliament and a rise in interest rates overseas resulting in continued emerging market under performance.

How do elections impact investor sentiment?

Investors will increasingly focus on the possible outcomes of the next general elections due in April or May 2019 and prospects for Prime Minister Narendra Modi’s Bharatiya Janata Party. The market could become jittery if national and regional opposition parties form “opportunistic alliances” against the ruling coalition.

What are the themes for equity investors?

Consumer-oriented businesses such as consumer goods, auto and auto-parts makers, as well as banks and financial services will continue performing well and should be accumulated during “sharp temporary selloffs.” Investors should reweight their equity portfolios toward larger stocks, as 2017’s bull run drove up weightings of small and mid-caps. NOTE: The Sensex rose 28 per cent last year, while gauges of mid- and small-sized companies surged at least 48 per cent each.

What is your outlook on fund flows?

Local money has piggybacked on the domestic rally. That’s helped insulate us from selling by foreign investors, which has been large intermittently from August. Only when there is a sharp selloff, resulting in the Nifty going below 9,600, will we see serious outflows by local investors. Foreign fund flows will be a function of their view on the rupee and the attractiveness of Indian equity/debt market returns versus those of developed markets. India’s high consolidated gross fiscal deficit to GDP and current-account deficit to GDP may make it vulnerable to negative sentiment for EMs, though low external debt to GDP and high foreign reserves may prevent meaningful negative impact. – Bloomberg

Shubhalakshmi Panse headed the Allahabad Bank, Archana Bhargava was managing director at the Union Bank of India and so on.

Pl correct urself. Arcana Bhargava was not CMD of Union Bank but United Bank