Mumbai: Shashikant Rathi, who has dominated India’s local bond underwriting business for over a decade at Axis Bank, says the industry now faces its biggest challenge since the global financial crisis.

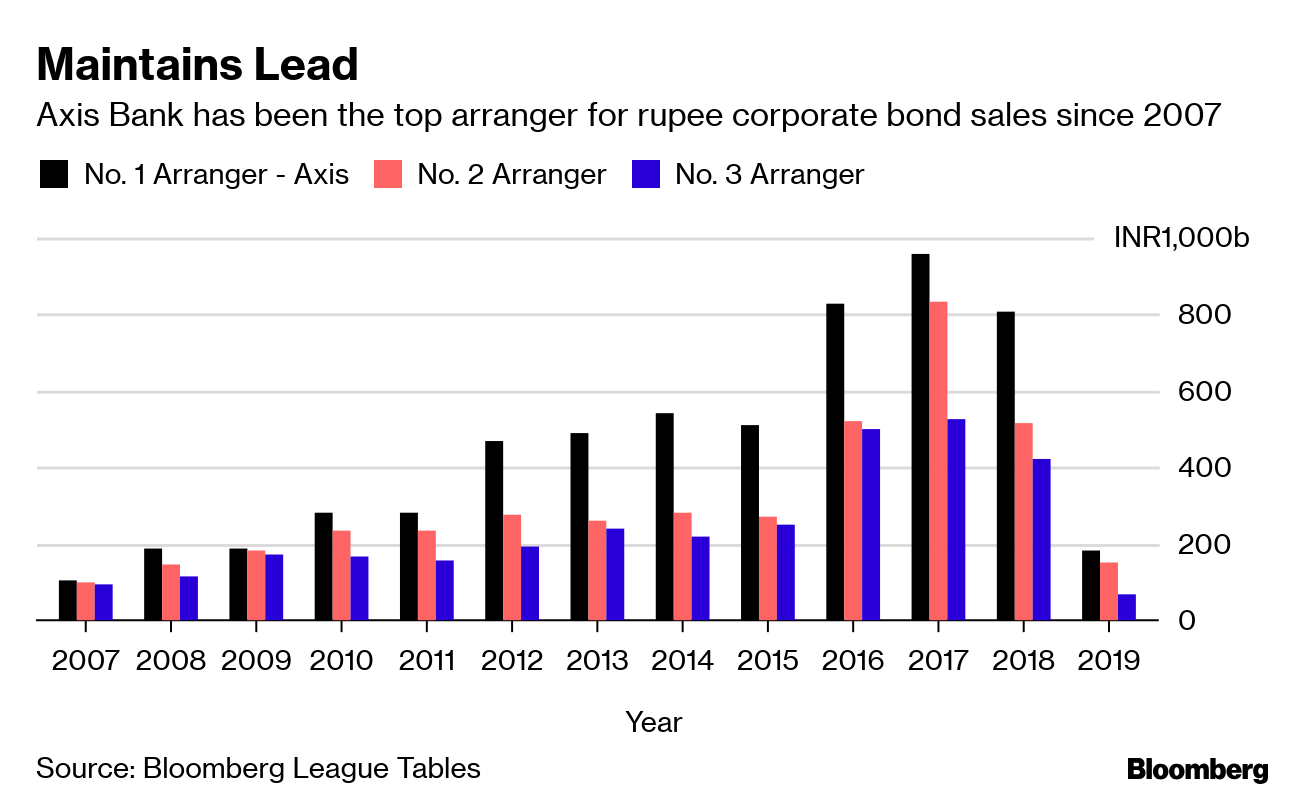

Shock defaults since last year by shadow bank IL&FS group and a new electronic bidding platform have disrupted the $108 billion market where underwriters like Rathi help companies raise money by selling debt securities. Sales of rupee corporate bonds that tend to pay the highest fees have fallen this quarter to a 2016 low.

“The market is in complete chaos,” Rathi, the 41-year-old executive vice president and head of treasury and markets at Axis Bank in Mumbai, said in an interview. “I haven’t seen such a crisis since the 2008 Lehman bankruptcy.”

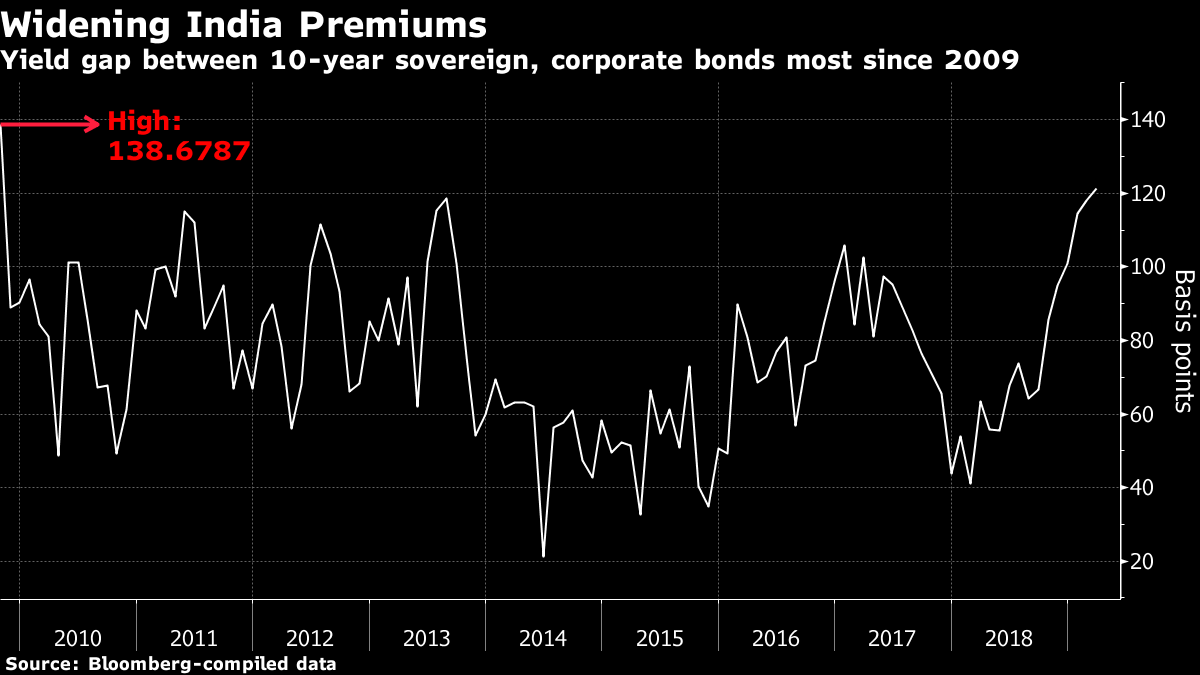

A surprise rate cut by the central bank last month and expectations of further easing as early as April haven’t lowered funding costs much, with spreads on top-rated 10-year corporate paper near the highest levels since 2009. It may take until after Indian elections in May for the market to settle down and issuance to pick up, says Rathi.

The bumps have slowed India’s drive to make the local corporate bond market bigger. Rathi is trying to weather it by doing what he’s always done, using long-standing relationships to arrange more deals.

India’s company debt market remains puny compared with the funding needs of the $2.6 trillion economy, and big issuers are still for the most part limited to quasi-state enterprises. Policy makers are trying to change that. Starting April, large companies will be required to meet 25 percent of their annual funding requirements from the bond market.

Overall rupee bond sales have risen nearly 15 percent so far this year, but that’s mainly driven by issuance by state firms that don’t tend to pay underwriting fees. Deals that bankers rely on to earn commissions involving notes without AAA ratings have dropped 49 percent this quarter from the last three months of 2018, according to data compiled by Bloomberg.

Complicating matters for arrangers is the introduction of an electronic bidding platform, which enables investors to put in buy orders for any issuer without going through a broker. New rules last year that required investors to make some of their bids on the e-platform, which can be viewed by the public, caused rupee bond sales to slump.

Rathi said there remains a big role for arrangers in India’s primary market, which isn’t fully developed.

“Issuers still need arrangers as we are the bankers who can give them a firm commitment, advise on the right borrowing level and help market-making,” he said.

The credit market slump is a threat to one of the world’s fastest growing economies, affecting everyone from electronics shop owners to home buyers. That’s because such business owners and consumers depend on shadow banks, and those lenders themselves are now having trouble getting financing.

Such non-bank financing firms have provided 30 percent of all new loans in the economy over the past three years, according to Nomura Holdings Inc. research.

Companies also have been coughing up more for money. The spread of top-rated 10-year corporate paper over similar government bonds has climbed to around 121 basis points, not far from levels last seen in 2009.

In spite of the market’s weakness, Rathi is still making big deals. He helped raise 70 billion rupees ($1 billion) as the lead underwriter this month for Reliance Industries Ltd., the country’s biggest corporate issuer.

Rathi hails from the Marwari community in the western state of Rajasthan, a community that counts among its own other business notables including billionaires Kumar Mangalam Birla and Lakshmi Mittal. A chartered accountant, Rathi is a fan of the investment style of Howard Marks, the co-founder of Oaktree Capital Group.

“I’m a conservative risk taker,” Rathi said. “I will not take undue risk, and tend to change my strategies as the need of the hour is.”

Rathi’s next aim is to place his bank among the top three arrangers for Indian corporate issuers selling foreign currency bonds — something which he hopes to achieve with his database of more than a thousand Indian companies. Axis Bank is already among the leaders in arranging so-called masala bonds, which are rupee notes sold to offshore investors.

“In fact, in Singapore, we are known as the masala bank,” Rathi said.

Also read: Rupee’s advance seems to be causing some discomfort for RBI