With Bank Indonesia raising interest rates, more economists are betting the Reserve Bank of India will do the same.

All eyes are on India’s central bank to see if it will follow Indonesia in raising interest rates to help calm financial markets amid an emerging-market rout.

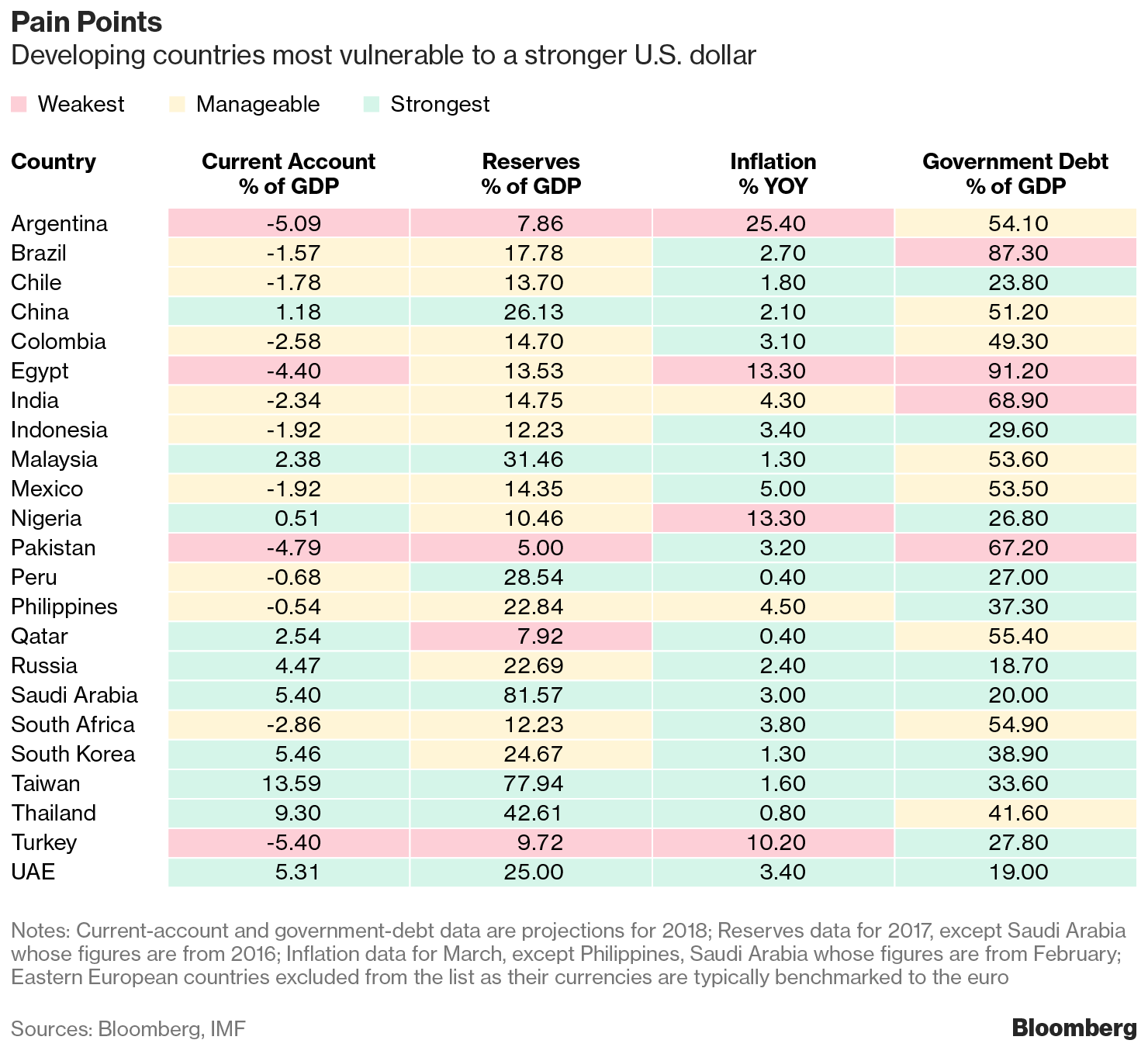

Both countries are part of the so-called ‘Fragile Five’ club — economies that are heavily reliant on foreign inflows and vulnerable to rising U.S. interest rates — and are coming under strain as investors dump bonds and stocks and currencies weaken.

With Bank Indonesia raising interest rates on Thursday and pledging to take strong action to restore confidence in financial markets, more economists are betting the Reserve Bank of India will do the same, possibly as early as its next policy decision on June 6.

“As our Asian neighbors have shown, signaling an end to the accommodative stance may be required to contain financial stability risks,” said Priyanka Kishore, lead Asia economist at Oxford Economics Ltd. in Singapore. “The implications of a prolonged pause in an environment of rising global rates cannot be completely ignored.”

Here are some strikingly similar developments between the two countries that suggest why India may follow suit:

Foreigners Exit

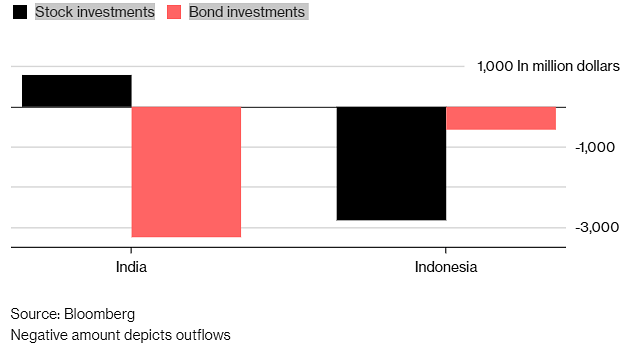

Bonds in both countries have faced a selloff, with investors pulling out $3.3 billion this year from India’s market. But unlike Indonesia, investors are actually net buyers of stocks this year.

Wary Foreigners

India and Indonesia Asset Markets Witness Outflows

The outflows have contributed to declines in India’s rupee, Asia’s worst performer this year, and rendered ineffective a series of measures taken by authorities to revive bond demand.

While the Reserve Bank of India has intervened through bond purchases, sentiment is dour. Its intervention in the foreign exchange market is tightening liquidity in the banking system and driving up borrowing costs. That could throw a 5.5 trillion-rupee ($81 billion) government borrowing program into jeopardy as well as threaten a nascent economic recovery.

But it’s not all gloom-and-doom. The selloff in emerging markets will be temporary, as JPMorgan Asset Management sees a revival in demand for these nations’ bonds and currencies when the dollar’s strength begins to wane.

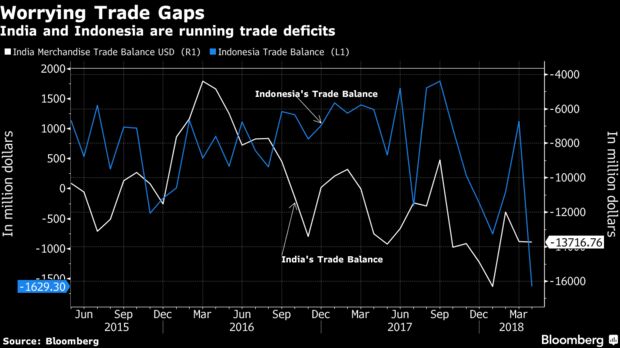

Trade Gap

Both countries run sizable trade deficits, which make them more reliant on foreign flows to help finance import needs. Indonesia posted its biggest trade gap in four years in April, while in India, which is the world’s third-largest oil consumer, rising crude prices will widen the shortfall.

Analysts at Rabobank International led by senior economist Hugo Erken have calculated that if India ceases to attract substantial investment in equities and securities, the country could be looking at a shortfall of $19 billion this year, with implications for its overall current-account.

Pranjul Bhandari, chief India economist at HSBC Holdings Plc, estimates the current-account deficit will widen to 2.3 percent of GDP in the 2019 fiscal year from 1.9 percent in the previous year.

Forex Reserves

India’s foreign exchange reserves have fallen $5.9 billion to $419 billion in the four weeks to May 4, according to data from the central bank, as it likely stepped up intervention in the currency market. That mirrors Indonesia’s reserves dropping to a 10-month low as Bank Indonesia drained more than $7 billion of reserves in three months to arrest a slide in the rupiah.

Inflation Pressure

The central banks in the two countries are inflation targeters, and both have been cutting interest rates in recent years to bolster their economies. Inflation may come under pressure this year as rising oil prices and weaker currencies boost import costs. Bank Indonesia hiked rates even though it forecast inflation will remain within its 2.5 percent to 4.5 percent target band. RBI policy makers have been sounding more hawkish recently, and a pick-up in inflation to 4.6 percent in April gives them more reason to feel that way.

– Bloomberg