Mumbai: Surging oil prices have battered market sentiment toward major energy importer India, pushing down the rupee to a record low and dragging stocks and bonds. With few signs the commodity boom will end soon, investors are bracing for more possible losses.

Investors including Quantum Asset Management Co. and ICICI Securities Primary Dealership Ltd. recommend holding on to cash. Stock traders are also treading cautiously, with TCG Advisory Services saying it’s pivoting to software and pharma exporters that tend to benefit from a weaker rupee. The central bank faces a challenging task as well in keeping interest rates low amid risks that inflation will accelerate and market volatility will rise.

“When you have a situation where because of global factors and supply shock you are likely to see a slowdown in growth, spike in inflation and forthcoming hike in interest rates, there are very few spaces to hide,” said Mihir Vora, director and chief investment officer at Max Life Insurance Co. “In times like this cash is the only safe haven.”

Here’s a snapshot on the impact on key asset classes:

Rupee:

The rupee, which declined to a record low of 76.9812 on Monday, may extend losses to 77.50 per dollar by year-end, according to Standard Chartered Plc.

Given that India relies on imports to meet about 85% of its oil requirements, the nation may be one of the most exposed in Asia to about 60% jump in Brent prices this year. The surge in crude threatens to worsen price pressures, hurt finances and roil the economy’s recovery.

“The future trajectory will be a function of how high oil prices sustain,” said Gaura Sen Gupta, economist at IDFC FIRST Bank Ltd. “If sanctions on Russian oil and gas go through, it implies a far tighter crude oil market, which will maintain a depreciation pressure on the rupee.”

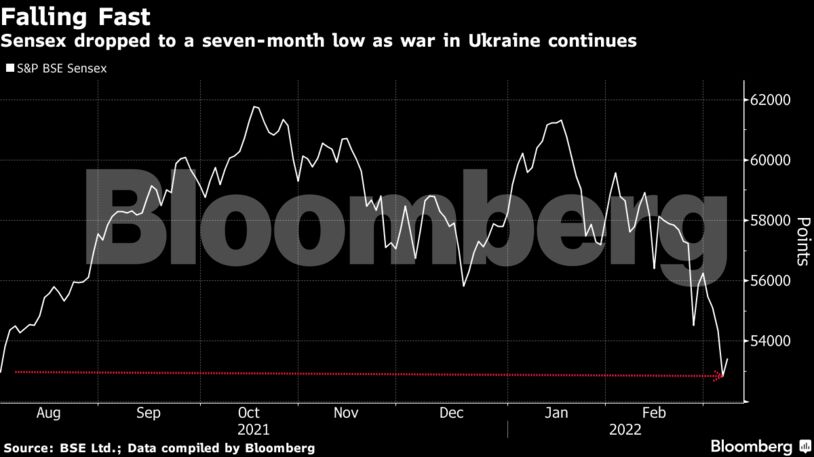

Stocks:

The S&P BSE SENSEX Index declined 2.7% on Monday and gained 1.1% on Tuesday, trimming the losses this year to 8.3%. The failure of the index to hold the upper border of the so-called Ichimoku weekly cloud at 54,000 saw the benchmark test and hold important support in the 52,400 area. Any drop below this level may bring the pivotal 50,000 support into focus amid worries that higher oil prices may squeeze company profits.

“With rupee now at a record low, overseas investors will continue to sell local stocks and bonds till there are signs of a resolution of the conflict in Ukraine and commodity prices begin to stabilize,” said said Chakri Lokapriya, chief investment officer at TCG Advisory Services.

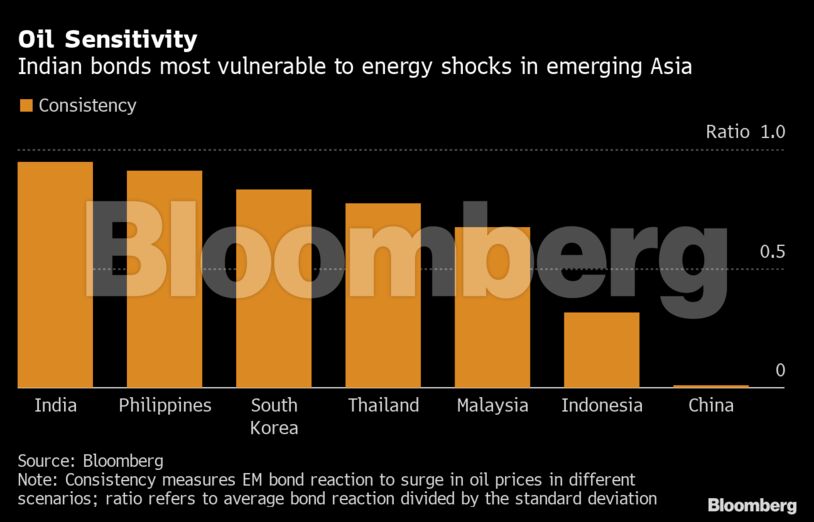

Sovereign Bonds

Bonds look among the most vulnerable to an oil-price shock in Asia’s emerging debt markets. Yields jumped an average of 10 basis points during the most significant crude spikes in recent history, according to a Bloomberg analysis of seven such events dating back to 2015. Yields are up more than 20 basis points in about two weeks despite assurances from policymakers that there will be no further bond auctions until the end of the month.

“It’s better to stay on cash as much as possible,” said Naveen Singh, executive vice president and head of trading at ICICI Securities Primary Dealership. “Once the new supply of bonds start in April, it might be a bloodbath.” – Bloomberg

Also read: Rupee sinks to lifetime-low as Ukraine crisis threatens to push India’s oil-import bill