New Delhi: The Reserve Bank of India has found that its inflation-targeting policies over the last year may have slowed economic growth more than it eased inflation. The central bank had raised interest rates by a cumulative 250 basis points or 2.5 per cent between May 2022 and February 2023 in an effort to rein in inflation.

The RBI, in its Annual Report 2022-23 released Tuesday, conducted an analysis of the effects of its monetary policy decisions.

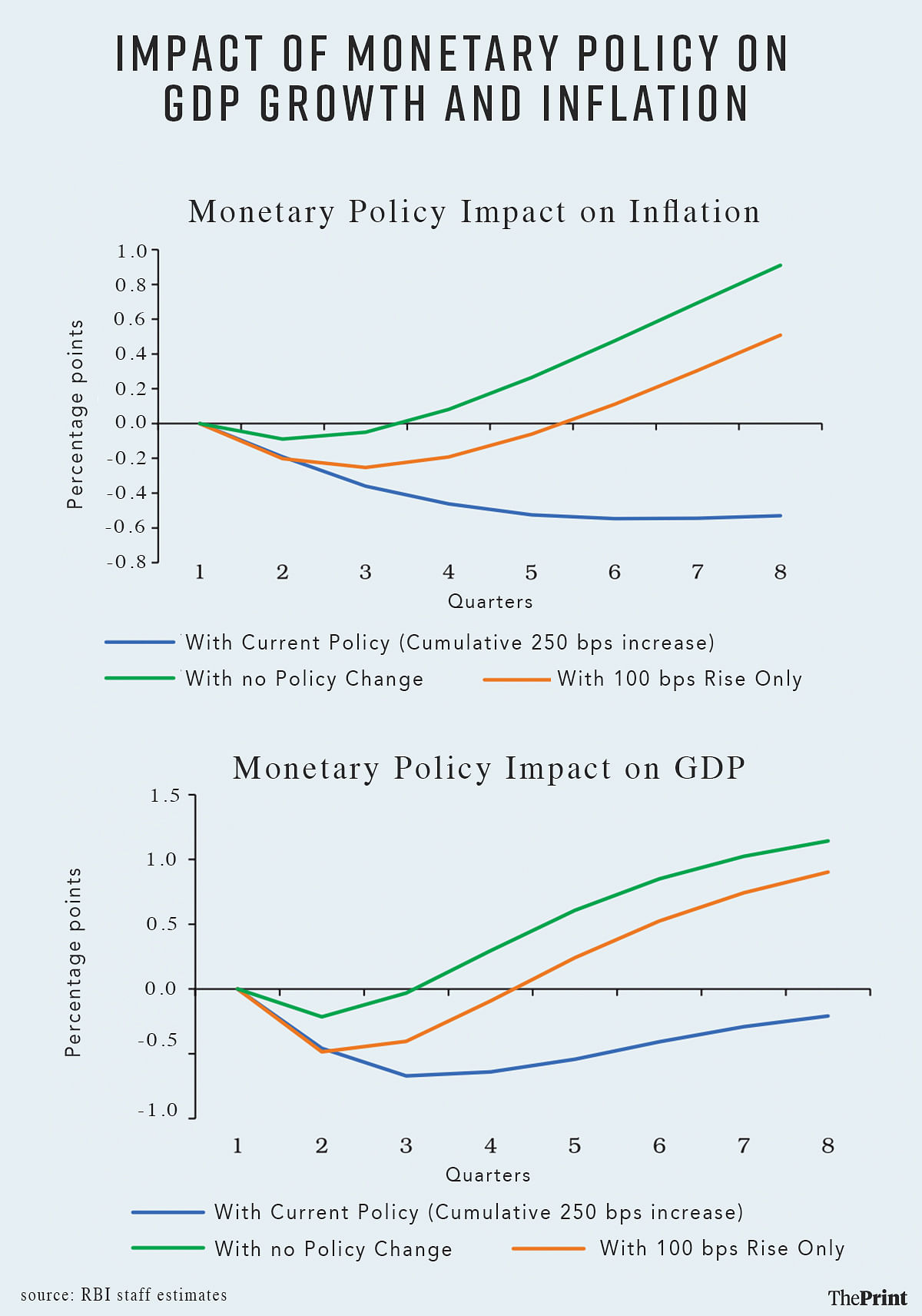

In the analysis, it compared the policy it followed with two hypothetical models. One was if the RBI had done nothing to combat inflation, and the other was if it had front-loaded its interest rate hikes in a single 100-basis point hike.

The actual policy it followed was to spread the cumulative 250 basis point hikes over six decisions between May 2022 and February 2023.

This policy has resulted in growth being “sacrificed”, but inflation also easing, the central bank found.

The RBI conducted a long-run analysis, starting from April-June 1998, of the relationship between real GDP, consumer price inflation (excluding food and fuel), gross fiscal deficit of the central government, and the policy interest rate.

Having established the relationship between these variables, it then used this to further analyse the period starting April-June 2022.

“The simulation results from this exercise suggest that, under the no policy change scenario, inflation would have remained above 6 per cent throughout, reaching a peak of 7.3 per cent by the end of the 8th quarter (April-June 2024),” the annual report said.

Basically, the analysis found that, if the RBI had done nothing to control inflation, the rate of inflation in April-June 2024 would have been about 90 basis points (bps) or 0.9 percentage points higher than it was in April-June 2022.

On the flip side, GDP growth would have been about 1.2 percentage points higher.

The second scenario

Under the scenario, where the RBI front-loaded its rate hikes into a single 100 basis point rate hike, inflation would have been lower by about 0.25 percentage points compared to the no policy change scenario, the RBI said, adding that growth would have been lower by about 0.3 percentage points.

“However, under the current tight monetary policy (the actual policy being followed), inflation is estimated to have eased by more than 50 bps compared to a rise in inflation of about 90 bps under policy repo rate left unchanged (scenario),” the RBI said.

“The efforts to control inflation by maintaining current policy stance might have sacrificed growth by about 65 bps (0.65 percentage points),” it added.

The RBI, in its report, noted that its interest rate hikes have a lagged impact on inflation and growth. That is, a one percentage point increase in the policy rate leads to a maximum impact of a 0.3 percentage point fall in GDP growth in the third quarter from when the action was taken.

The impact on inflation is with a higher lag, it said, with the peak impact of a 0.22 percentage point reduction in inflation taking place in the fifth quarter from when the rate hike was implemented.

As an example, let’s say both growth and inflation were 5 per cent in April-June 2022, and the RBI hiked interest rates by 1 percentage point. What the RBI is saying is that this would have resulted in growth slowing to 4.7 per cent by October-December 2022 and inflation easing to 4.78 per cent by April-June 2023.

(Edited by Richa Mishra)

Also Read: RBI’s net income rises to Rs 2.35 lakh crore on forex gains in FY 2023, shows annual report