New Delhi: Excess indebtedness, farmers’ protests demanding loan waivers, erratic weather and poor supervision by lenders has meant that delinquencies in the small loans category have again risen, snapping a declining trend since the COVID-19 pandemic-induced spike.

This trend of rising loan defaults is not restricted to individual borrowers, with credit rating agencies now highlighting this trend among unsecured business loans as well.

Notably, it was a fear of this eventual rise in delinquencies that led the Reserve Bank of India (RBI) last year to slam the brakes on the rapid growth of unsecured loans.

According to the RBI, all collateral-free loans to individuals belonging to low-income households—those with an annual income of up to Rs 3 lakh—are treated as microfinance loans, the category that is now seeing rising delinquency.

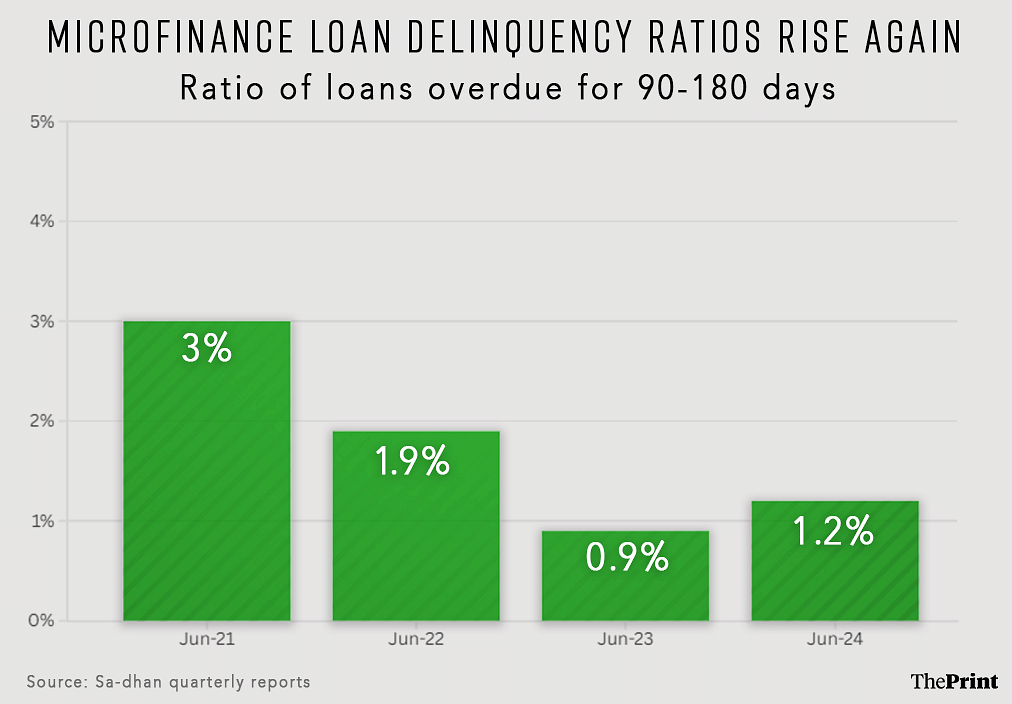

Data compiled by Sa-Dhan, a New Delhi-based microfinance industry self-regulatory body, shows that the share of microfinance loans more than 90 and less than 180 days past due (dpd) rose to 1.2 percent in June 2024, compared to 0.89 percent in June 2023.

This breaks a declining streak in this proportion since it spiked to three percent in the quarter ending 30 June 2021.

As of June 2024, an additional 9.1 percent of microfinance loans were overdue for more than 180 days.

The 90-day mark is significant because, according to RBI rules, loans where the principal amount is overdue for more than 90 days are to be classified as non-performing assets.

“A default ratio of less than 5 percent is manageable,” Shobhit Goyal, founder and CEO of Beyond Financial Score (BeFiSc), a Noida-based fraud and risk management platform, told ThePrint. “It’s when it goes beyond 5 percent that it becomes a problem, and this is happening in unsecured lending.”

A multitude of problems

The robust growth of the microfinance and unsecured lending sector has brought with it gains as well as considerable consternation on the RBI’s part.

Following a marked acceleration in the growth of unsecured loans, the RBI, in November 2023, took strong action to curb this growth, and also to rein in shady recovery practices associated with such loans.

Yet, some damage had already been done. According to a note by the Gurugram-based credit rating agency ICRA, the strong growth of unsecured credit over the last two years “has accentuated concerns about potential overleveraging of borrowers in certain regions”.

In other words, small borrowers were borrowing from multiple lenders at the same time, and were now finding themselves over-extended and unable to repay some or all of their loans.

“Further, farmers’ protests and the Karz Mukti Abhiyan in certain regions, especially Punjab and Haryana, have impacted collections and the asset quality,” ICRA added in the note. “This, along with climatic conditions and operational challenges, including employee attrition, would keep the asset quality under pressure in the near term.”

A senior official in the RBI told ThePrint that preventing this eventuality was a major reason behind the central bank’s curbs and warnings last year.

“The (RBI) Governor categorically spoke about the rapid growth in unsecured lending and asked banks and non-bank financial companies (NBFCs) to clamp down on this, but nothing happened,” the official said, declining to be named as he was not authorised to speak to the media. “We were forced to take steps then because the fear was that these unsecured loans would start hurting the financial health of the sector.”

Lenders at fault too

While borrowers have certainly made hay while the credit sun shone, the lenders themselves are also at fault for not performing adequate checks before lending out their money.

“Lenders offering unsecured small loans do consider the credit score of the borrower, but it is not a rule that they must,” Goyal of BeFiSc explained. “They often give out loans even when the credit score is low.”

He said the second part is that they are not doing continuous monitoring of the customer, which is leading to defaults, adding that the third issue was one of frauds—where borrowers deliberately take multiple small loans with no intention of repaying them.

According to Goyal—who advises financial institutions and provides them with technological solutions on better recognising the repayment capacity of a borrower— the guidelines for a Rs 10,000 loan are very different from a loan of more than Rs 1 lakh.

“It is relatively very easy to get a loan of Rs 10,000-1,00,000 because you will not be checked as vigorously,” he explained. “Usually, just PAN and Aadhaar are enough. Deeper checks like income levels and ability to repay are not being done, and that is what is leading to the defaults.”

In all such cases, greater scrutiny on the lender’s part would have gone a long way to curb irresponsible lending and subsequent delinquencies, Goyal pointed out.

This is a view held by other industry analysts as well.

“Microfinance is at an important juncture wherein prudent lending practices grounded in deep understanding of the borrower’s repayment capacity needs to be the focus area for sustainable growth,” Prateek Mittal, assistant vice president and sector head of financial sector ratings at ICRA, told ThePrint.

That said, the microfinance industry is not unaware of the need to fix things. In August this year, the Microfinance Industry Network, a Gurugram-based self-regulatory body, issued fresh ‘guardrails’ to its members to prevent a further rise in delinquencies.

The first of these guardrails was to limit the number of microfinance lenders per borrower to four. That is, a borrower cannot borrow from more than four lenders at the same time. The second step is to limit a borrower’s overall microfinance indebtedness to Rs 2 lakh.

Contagion spreading to small businesses as well

According to India Ratings and Research (Ind-Ra), a Mumbai-based credit rating agency, the contagion of loan delinquency is spreading from unsecured loans given to individuals to such loans given out to small businesses, as well.

“Post the microfinance segment, early signs of stress are visible in the unsecured business loan segment with an increase in credit costs and higher-than-expected write-offs,” Karan Gupta, head and director of financial institutions at Ind-Ra, said.

“On-field attrition, pressure in certain end-borrower segments and overleveraging of borrowers are the factors that have contributed to this asset quality pressure,” he added.

In a note, Ind-Ra said that pent-up demand post Covid-19 had led to micro-enterprises seeing significantly higher orders, which pushed them to borrow more for working capital requirements in 2022-23 and 2023-24. However, this trend is now slowing.

“With on-ground demand now plateauing, the added expansionary business cost and rising competition have started to bite into the margins of micro-enterprises, leading to cashflow challenges,” Ind-Ra added. “This has led to a rise in delinquencies to a certain extent.”

(Edited by Radifah Kabir)

Also Read: India’s manufacturing workers saw prices rise faster than incomes even as their productivity fell