New Delhi: In March 2021, India’s urban cooperative banks (UCBs) were staring at a mountain of bad loans. Weighed down by weak governance and outdated technology, their cumulative gross non-performing assets (GNPAs) stood at Rs 36,459 crore. A century-old cooperative banking model appeared to be steadily losing relevance in a fast-digitising financial ecosystem.

But the latest Reserve Bank of India (RBI) data shows that UCBs are quietly clawing their way back, with gross non-performing loans declining to Rs 23,072 crore as on March 2025.

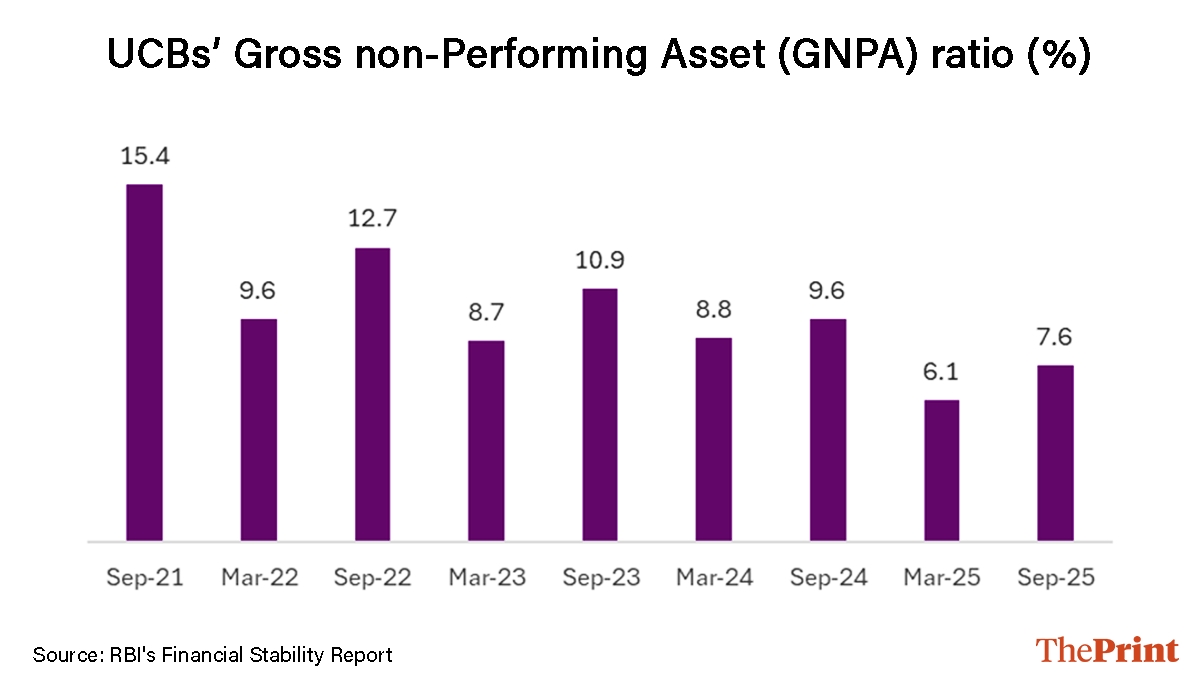

According to the Reserve Bank of India’s Financial Stability report released Wednesday, the GNPA ratio of UCBs has more than halved—from 15.4 percent in September 2021 to 7.6 percent in September 2025.

The net non-performing assets (NNPAs) have seen an even sharper correction, dropping from 8.7 percent to just 2.5 percent over the same period.

GNPA reflects the share of total loans that have turned bad, while NNPA indicates the residual stress after banks set aside provisions to absorb potential losses.

The RBI’s Trends and Progress in Banking report, released Monday, attributes the improvement to a reduction in high-value loans. Exposure to large borrower accounts of Rs 5 crore and above—responsible for nearly a third of UCB NPAs—has declined from 25 percent in March 2021 to 23.4 percent in March 2025.

“A key reason behind the decline of bad loans across UCBs is the improvement in loan recovery and collection efforts over the last few years,” Prabhat Chaturvedi, the chief executive officer of the National Urban Cooperative Finance and Development Corporation Limited (NUCFDC), told ThePrint.

To strengthen the sector, the government set up the NUCFDC as an umbrella organisation in March 2024, tasked with enabling a digital overhaul, improving governance standards and providing financial assistance to UCBs.

Suresh Prabhu, former Union minister and the head the committee that formulated the National Cooperative Policy 2025, said that while digitalisation has helped improve transparency, efficiency and cost of operations, it alone will not bring down NPAs.

“There is also a need for quality management, pre-sanction evaluation methodologies and constant tracking of industry performance apart from the company,” Prabhu, also a former chairman of Saraswat Co-operative Bank, told ThePrint.

India has around 1,457 urban cooperative banks operating through nearly 11,500 branches and serving over 9 crore customers. UCBs remain critical to grassroots financial inclusion, catering largely to local traders, the self-employed, small businesses and lower-income households.

The RBI data suggests that their balance-sheet strength has improved as well. The Capital to Risk-Weighted Assets Ratio (CRAR) of UCBs rose to 18 percent in September 2025, up from 12.9 percent in September 2021. As per RBI norms, UCBs are required to maintain a minimum CRAR of 11 percent.

Nearly 92.1 percent of UCBs were comfortably above this threshold as of March 2025.

CRAR measures a bank’s capital relative to its risk-weighted assets and serves as a key indicator of its ability to absorb losses and protect depositors. A higher ratio signals greater financial resilience.

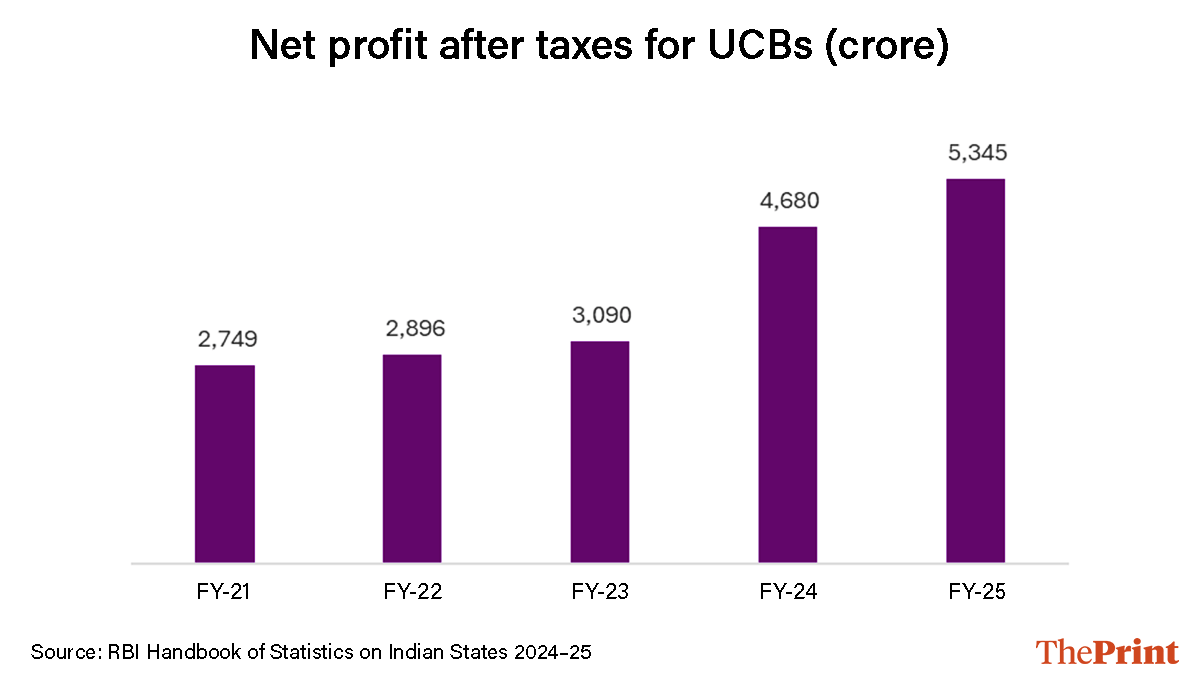

Overall, UCBs’ net profits after tax reached Rs 5,345 crore, growing by 14.2 percent in FY2024-25 and almost doubled since FY2020-21, reflecting a consistent rise in profits supported by reduced provisioning on account of improving asset quality.

A key reason behind decline of bad loans across UCBs is improvement in loan recovery & collection efforts, says Prabhat Chaturvedi, CEO of NUCFDC.

Chaturvedi attributes the improving financial metrics of UCBs partly to sustained efforts by the Ministry of Cooperation, which has been pushing technology adoption and governance reforms.

A senior official in the ministry told ThePrint on condition of anonymity that several closed-door meetings were held with the RBI, NABARD, the finance ministry and other stakeholders to diagnose the sector’s problems and chart corrective measures.

One of the most significant outcomes of these deliberations was the creation of the NUCFDC. “The role of NUCFDC is to help all cooperative banks transform with modern technologies and provide financial assistance to the banks when needed,” the official said.

Chaturvedi said the NUCFDC is expected to soon reach a paid-up capital of Rs 300 crore, a milestone that would qualify it for Self-Regulatory Organisation (SRO) status—allowing it to complement the RBI’s supervisory oversight of UCBs.

Also Read: Politics, influence, caste — the murky loan dealings of Gujarat’s cooperative banks

Digital overhaul of urban cooperative banks

While the rapid expansion of digital banking—ranging from instant credit to smartphone-based payments—transformed India’s financial sector over the past few years, cooperative banks largely missed this wave.

Closing that gap is now NUCFDC’s top priority, with a renewed push to bring UCBs at par with mainstream digital financial services.

At the Co-op Kumbh 2025 in November, Union Cooperation Minister Amit Shah launched two new mobile applications—Sahakar DigiPay and Sahakar DigiLoan—aimed at enabling faster and paperless transactions for cooperative bank customers. “Sahakar DigiLoan will enable paperless access to loans with Aadhaar e-sign and Video KYC,” said Chaturvedi.

He added that greater automation through the Sahakar Credit Engine and training under Sahakar Paathshaala would make loan approvals “smarter and faster”.

The rollout of Aadhaar e-sign, mobile-based onboarding and video KYC is intended to place cooperative bank customers on the same footing as users of commercial banks. Chaturvedi stressed that technology is also critical to addressing legacy weaknesses. “With more technology comes higher transparency.”

Apart from improving customer experience, NUCFDC is also building a digital ecosystem to prevent frauds and ensure compliance.

Monitoring compliance

The Sahakar Compliance Monitoring Service ensures a 100 percent compliance with RBI norms by using automated tracking, alerts, and centralised monitoring. The tool links UCBs core-banking data directly with RBI’s DAKSH supervisory portal, thereby enabling continuous tracking of compliance gaps and cyber incidents.

The DAKSH portal is RBI’s advanced supervisory monitoring system. It is used to enhance compliance monitoring through regular communications, streamlining inspections, and managing cyber incidents.

The NUCFDC has also rolled out the Sahakar Risk-Based Internal Audit (RBIA) Service, replacing manual audits with automated, risk-driven assessments.

“In this tool, the purpose is to automate a risk-based audits framework for internal audit, concurrent audit, third party audits, and information security audit. It will strengthen internal governance and compliance,” Chaturvedi said.

Together, these digital systems are aimed at fixing what the RBI has long flagged as weak internal controls—one of the primary reasons behind repeated failures in the cooperative banking sector.

Slow growing loan book

While fundamentals remain strong, the latest Sahakar Trends Report of July 2025, jointly published by NUCFDC and TransUnion CIBIL (a credit information company based in India), highlights that UCBs’ loan growth has been modest over the past decade.

The loan portfolio grew from Rs 1.85 lakh-crore in 2013 to Rs 3.48 lakh-crore in 2024, an increase of less than double over 11 years.

In comparison, NBFCs’ (non-banking finance companies) loan portfolio grew aggressively from Rs 6.5 lakh-crore in 2013 to more than Rs 20 lakh-crore in 2024.

“Even though UCBs offer lower interest rates, many customers prefer loans from NBFCs because they are faster and provide superior customer experience,” the report states. This has led to shrinking of UCBs share in India’s total credit market from 3.5 percent in 2013 to 1.3 percent in 2024.

According to Chaturvedi, the focus on controlling bad loans have forced cooperative banks to become more conservative on loan growth initiatives. “Some of the customers are availing loans from NBFCs or scheduled banks due to their digital capabilities and better customer experience.”

But as digital systems scale, Chaturvedi believes that UCBs’ loan portfolio will grow as there is a massive scope in the market given India’s financial inclusion index is still at 67 percent, according to the RBI, in 2025.

The index measures accessibility of financial services, products and literacy among individuals and businesses.

However, according to Janak Raj, senior fellow at Centre of Social and Economic Progress, UCBs and NBFCs cannot be strictly compared as they cater to different segments of society and have different business models and growth strategies.

“The expansion in the balance sheets or loan/investment portfolio of UCBs and NBFCs is influenced by their capital position or their ability to raise capital. Segments/entities with higher capital adequacy ratio can grow their balance sheets at a faster pace relative to others,” Raj told ThePrint.

Easing regulations to support expansion

To expand business opportunities for UCBs, the RBI has taken some steps to ease norms in 2025.

In February 2025, the RBI increased the individual housing loan limits for UCBs across bank tiers—up to Rs 60 lakhs for Tier-1 banks, up to Rs 1.4 crore for Tier-2, up to Rs 2 crores for Tier-3 and up to Rs 3 crores for Tier-4. This allows UCBs to enter higher-value segments, dominated by bigger banks.

In December 2022, the RBI came up with a four-tiered regulatory framework for UCBs based on deposit size to come up with targeted regulatory norms. The Tier-1 banks have a deposit of up to Rs 100 crore; Tier-2 between Rs 100 crores to Rs 1,000 crore; Tier-3 between Rs 1,000 crore to Rs 10,000 crore; and Tier-4 with more than Rs 10,000 crore.

Chaturvedi called these steps as a step in the right direction. “The RBI is playing a proactive role in regulating UCBs, it is currently in the process of consolidating all regulatory guidelines so that it becomes easy to comprehend and adhere for bankers,” he said.

(Edited by Ajeet Tiwari)