Between a record-low currency, high oil prices, and a looming election, India’s inflation rate could take a hit.

New Delhi: India’s headline inflation data may be subdued for now, but there are mounting risks that are difficult to ignore: a record-low currency, high oil prices, and a looming election that’s prompting the government to raise food prices to placate farmers.

Data due Friday evening will probably show consumer prices rose 4 per cent in September, according to the median of 35 estimates in a Bloomberg survey of economists. That pace is faster than the previous month’s, but bang on the target set by the Reserve Bank of India.

Inflation within target and signs that demand may be cooling in the world’s fastest-growing major economy prompted the central bank to keep interest rates on hold last week, and lower the forecast for gains in consumer prices. The RBI expects inflation in the range of 3.9 per cent to 4.5 per cent in the second half of the fiscal year to March 2019, down from 4.8 per cent projected earlier.

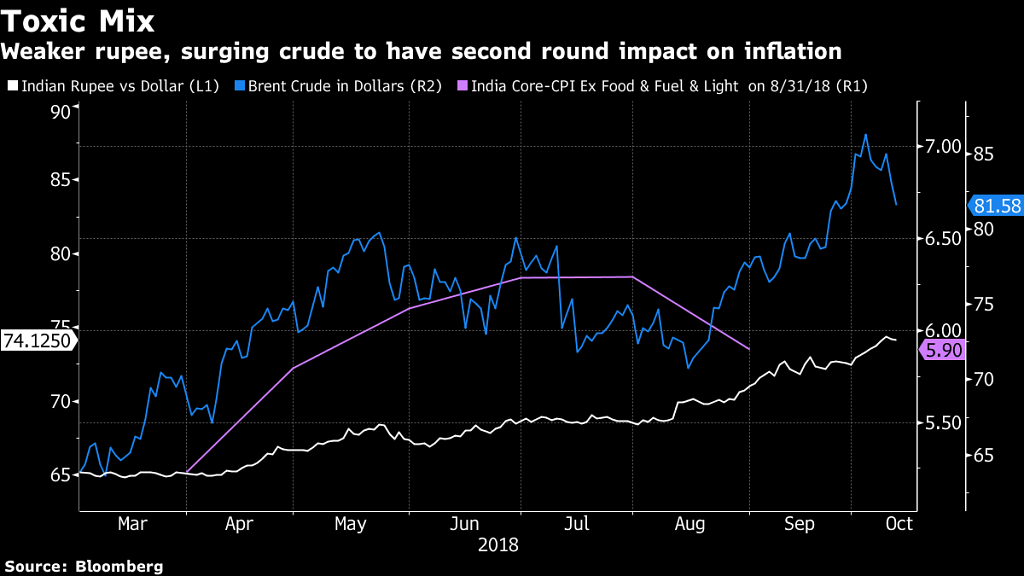

While headline inflation has eased in recent months, the core measure, which strips out volatile fuel, food and electricity prices, has been sticky at around 6 per cent.

“We expect core inflation to stay sticky at 5.87 percent due to the steady build up of demand-pull price pressures,” said Rupa Rege Nitsure, chief economist with L&T Finance Holdings Ltd. in Mumbai. “Moreover, sustained spikes in Brent crude prices and massive rupee depreciation have clouded the outlook for inflation despite a favorable statistical base.”

That’s reflected in the Monetary Policy Committee’s change in policy stance to “calibrated tightening” from neutral, signaling it’s not done with rate hikes yet. It said that while low food inflation provided comfort, surging oil and volatile financial markets could lead to higher price pressures.

India, which imports more than 80 per cent of its oil needs, is vulnerable to increasing crude prices. Together with the rupee, Asia’s worst-performing major currency this year, this worsens the outlook for inflation and the current-account gap. Besides, the government’s move to raise support prices for farm produce will add to the inflationary pressures.

According to the central bank, a 20 per cent increase in the price of the Indian basket of crude to $96 a barrel would dent growth by 30 basis points and stoke inflation by 40 basis points. The price of Brent crude, the benchmark for half the world’s oil, is hovering above $80 per barrel as impending American sanctions squeeze Iranian exports and an economic crisis in Venezuela disrupts supplies.

“We do not think that the RBI’s rate-hike cycle has come to an end,” said Sujan Hajra, chief economist at Anand Rathi Financial Services Ltd. “Yet, with the real policy rate at 250-300 basis points, headroom for the RBI to carry out rate hikes is limited unless inflation crosses 5 percent consistently.” – Bloomberg