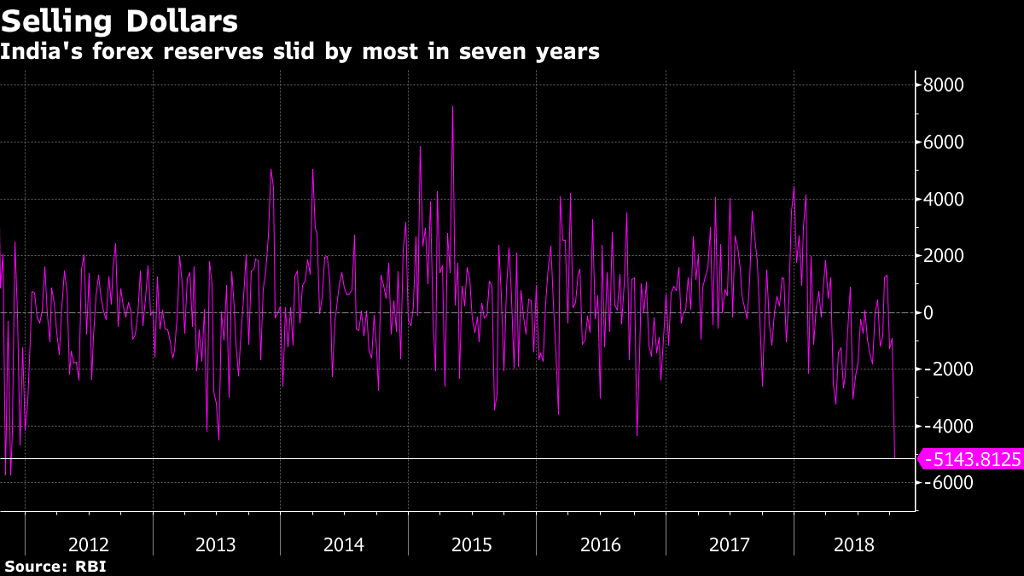

Forex reserves fell to $394.47 billion as the Reserve Bank of India sold dollars to shore up the sinking rupee.

New Delhi: India made the biggest dent in its foreign-exchange reserves in seven years as the central bank stepped up action to prop up Asia’s worst-performing currency.

Reserves dropped by $5.14 billion in the seven days ended 12 October to $394.47 billion, the biggest weekly decline since November 2011, as the Reserve Bank of India sold dollars to shore up the rupee, helping it end a losing streak that extended for six weeks.

Most of the drop in reserves seems to be because of accelerated central bank intervention, according to Kotak Securities Ltd.

Foreign investors have been exiting India’s equity and bond markets as concerns grow about the nation’s current account deficit amid rising fuel prices and borrowing costs. A series of defaults at a local non-bank financier have added to the turmoil in markets.

This data “clearly indicates significant intervention from the central bank and they now seem to be drawing a line in the sand,” said Anindya Banerjee, a foreign-exchange analyst at Kotak Securities in Mumbai. It shows the central bank doesn’t want to see the rupee go beyond 74 to the dollar, he said.

The rupee has declined for six straight months in a row, the longest losing streak since 2002, as rising oil prices fueled concerns about a widening current-account deficit and inflation amid a rout in emerging markets. The rupee touched a record low of 74.4825 on Oct. 11

Foreign funds took out about $13 billion from local bonds and stocks so far this year, resulting in the rupee declining about 13 percent. The rupee gained 0.4 percent on Friday to 73.3250 per dollar. – Bloomberg

George Soros famously attacked the pound in 1992, and the Bank of England could not stop him. INR is losing one rupee against the dollar for each $ 1 billion taken out by investors. The link is not so clear cut. However, it does underline how fragile the rupee has become, dependent on the kindness of strangers. A more robust export performance would prevent this kind of vulnerability.