New Delhi: Indian airports lag far behind their global counterparts in terms of how much money they make per passenger from sources like duty-free, retail sales and other passenger-oriented services. However, the next four-five years will see them take greater advantage of this highly profitable income stream.

Data from the rating agency ICRA shows that India’s major public-private partnership (PPP) airports — Delhi, Mumbai, Bangalore, Hyderabad, and Cochin — earned an average of $4.3/customer in 2023-24 from non-aeronautical sources, the term used to describe duty-free, in-store sales, and other passenger services.

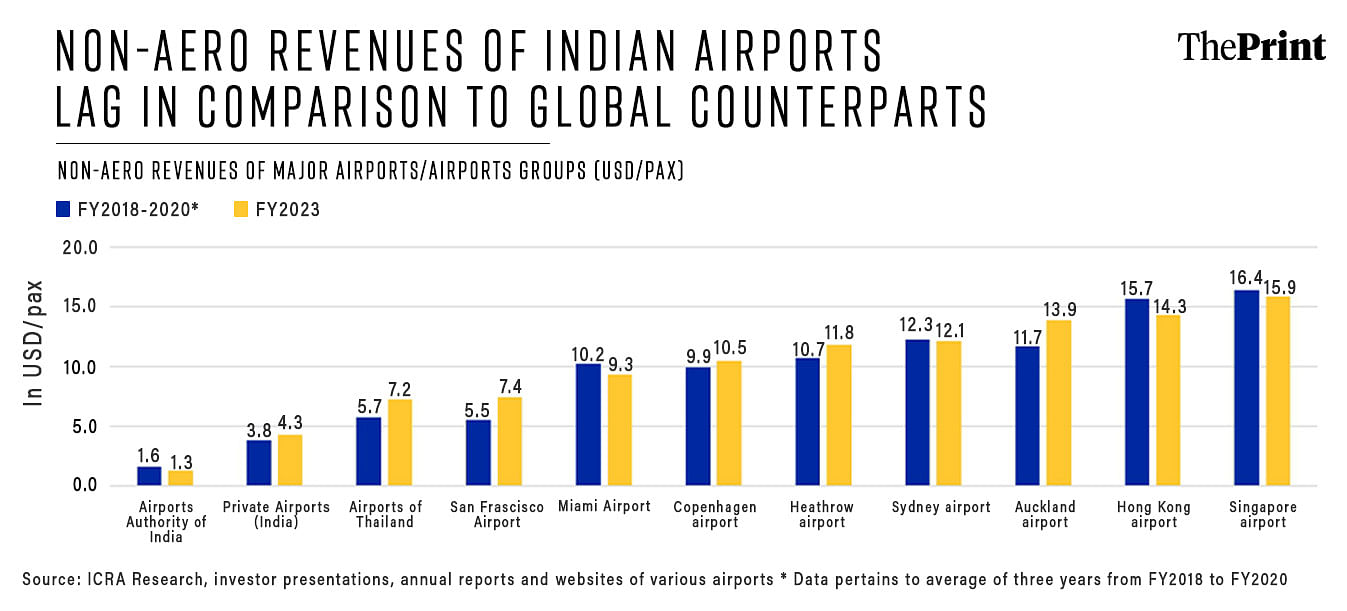

For airports run by the public sector Airports Authority of India (AAI), this number is even lower at $1.3/passenger. According to ICRA, this figure averages a much higher $7.2-15.9/passenger for major global airports.

Non-aeronautical revenues are important for an airport to bolster income, especially since aeronautical revenues, which include landing fees, aircraft parking charging and user development fees, are largely regulated. Since non-aero services are not regulated, airport operators are free to set prices for such services.

“Non-aero yield per pax (passengers) at private airports in India are lower compared to major airports across the world, majorly on account of lower proportion of international and transit passenger traffic… Generally, a higher share of international passenger mix results in relatively better non-aero yield,” Vinay Kumar G, vice-president and sector head of corporate ratings at ICRA Limited, told ThePrint.

Kumar added that over the next four-five years, the non-aero revenues at Mumbai and Delhi international airports are likely to reach around $7/passenger. This growth will be driven by expectations of relatively strong growth from the duty-free segment, premiumisation of retail outlets at the airport, as well as improvement in the yield from advertisement, car parking and rentals, he added.

However, he added: “While the non-aero revenue at select Indian airports is likely to match some of the global peers in the coming years, one should note that difference in the purchasing power parity also results in variation in the non-aero yield per passenger of Indian airports compared to that of global airports”.

That is, although Indian airports might increase their retail offerings for passengers, revenue from this stream is also dependent on whether the passengers themselves are capable of spending high amounts at airports.

With India witnessing a post-pandemic spending shift boosting international leisure travel, its international passenger traffic is expected to rise to 100-110 million in the next four years by 2027-28, from around 70 million in 2023-24. This growth in international passenger traffic will also help boost non-aero revenues.

How airports make money

For airports, revenue is primarily derived from aeronautical services such as domestic and international landing fees, aircraft parking charges, user development fees, baggage x-ray charges, and non-aeronautical services such as retail, cargo and duty-free. In India, aeronautical services are regulated by the Airports Economic Regulatory Authority (AERA).

“Airport development is capital-intensive, requiring construction of runways, terminals, and cargo and passenger handling facilities. Against this investment, airport operators earn revenue from two sources — aeronautical and non-aeronautical,” Manish Gupta, senior director and deputy chief ratings officer at CRISIL Ratings, explained.

He added that aeronautical sources are driven by traffic volume (passengers and flights landing and taking off) and tariffs. These tariffs are regulated and calculated to allow companies to earn enough to pay back the debt taken for developing the airports and to offer a regulated return on equity for building the infrastructure.

Shifting to higher profitability

Only three of the 14 airports run under the PPP mode in 2022-23 registered profits, according to official data, and airport operators are looking at increasing revenues from non-aero sources as these require lower capital compared to aeronautical services, and have high margins, yielding higher profits.

Shantanu Gangakhedkar, senior consultant-aerospace and defence at consulting firm Frost & Sullivan, said that there are multiple reasons airports or airlines, despite doing well, could report losses. These include heavy investments in upgradation and expansions, and the purchase of new equipment for modernisation, either on passenger-related amenities such as self-check-in kiosks or on the operational side such as operations enhancement.

He added that, for airports, aero revenues have been stagnating and their focus is thus increasingly on adding new non-aero revenues as well as enhancing the existing ones. “The aim of many airports is to increase the share of non-aero revenue, especially for larger Tier-1 hub airports.”

In a recent post-earnings call following the January-March 2024 quarter, Saurabh Shah, deputy chief financial officer at Adani Enterprise, which operates six airports including Mumbai, Ahmedabad and Lucknow, said the company is looking to grow revenues from non-aeronautical services to 75 percent from about 25 percent.

“Currently, the ratio is, except Mumbai, very skewed. About 75 percent comes from aero and 25 percent from non-aero in our six airports. Mumbai is better at about 50-50… We are constantly trying to move that ratio towards how it is being done at the international level —75 percent which may come from non-aero to 25 percent which comes from aero,” he said, adding that there would be “a very big change” in the next two-three years in the ratio of aero and non-aero revenues.

According to Sanjay Lazar, CEO at aviation consultancy firm Avialaz Consultants, the market has changed rapidly over the last 20 years, with a great move towards non-aero revenues.

“It must be noted that, on an average, non-aero revenues are about 40-50 percent of the overall airport revenues, but account for 70-80 percent of the actual airport profits,” he said.

In other words, Rs 100 of revenues through non-aeronautical sources would result in a final profit of Rs 70-80 for the airport, a higher profit amount than from aero sources.

“The margins on non-aero revenues are very high, and the percentages will increase as we go forward,” Lazar said.

An industry-wide change

It’s not just the Adani Group that’s trying to transform the revenue streams at its airports. The other major private sector player GMR Airports Infrastructure is also making similar moves, as is the public sector AAI.

The AAI has revised its policy for granting licences to operate commercial facilities like F&B and retail, at its airports, among other steps.

GMR Airports Infrastructure, which operates major airports like Delhi International Airport, Hyderabad International Airport, and Goa’s Manohar International Airport, is also working on strengthening revenues from non-aero services.

For the group, revenue from non-aeronautical services in FY23 stood at Rs 3,830.97 crore or 57.24 percent of all revenues. This was a growth from Rs 2,488.19 crore in revenue from non-aero services in FY22. GMR has not yet made data for FY24 available.

The rise of ‘airport cities’

Lazar, quoted earlier, said that over the next decade, the concept of airports will change drastically.

“We can expect to see the emergence of airport cities — integrated urban centres built around airports, offering a mix of commercial, hotel, residential, and recreational facilities,” he said. “These airport cities will serve as magnets for investment, innovation, and job creation, catalysing economic growth in their surrounding areas.”

According to him, the creation of multi-modal mega transport (MMT) hubs, around the airport hubs could catapult India into a league that very few nations can boast of. These would then serve not just as transportation hubs, but as dynamic centres of urban development.

“The PM’s vision of ‘Gati-Shakti’ can be tweaked to envelope this force multiplier effect of MMT hubs. By leveraging their connectivity, accessibility, and economic potential, airports will play a crucial role in shaping the urban landscape of tomorrow’s India,” Lazar said.

Senior aerospace consultant Gangakhedkar echoed this view, adding that in most large-scale projects such as airports, the initial investment as well as operating costs are extremely high but the economic benefit these establishments bring to the economy — both direct and in-direct — are usually multi-fold and benefit the overall society and carry on over multiple decades.

(Edited by Uttara Ramaswamy)

Also Read: Mission ISHAN, India’s push for ‘one nation, one airspace’, will benefit airlines & passengers alike