Mumbai: Indiabulls Housing Finance Ltd., a major Indian shadow lender that’s caught in the crosshairs of the troubles plaguing the industry, is seeking to bring forward a court hearing on fraud allegations after a record share slide.

The development represents an effort to get out ahead of recent headlines that contributed to its share price losing about 8% today after an unprecedented 34% slump on Monday. An Indian court and the police moved last week to begin separate investigations to examine allegations of fraud and misappropriation against Indiabulls and Lakshmi Vilas Bank Ltd., with which it has sought approval to merge.

“We have finally got an opportunity to put out in the public domain what we have anyway been sharing with regulatory agencies,” Gagan Banga, managing director of Indiabulls, said in an investor call late Monday. The court hearing is currently scheduled for mid-December. The non-bank financier is moving applications for an earlier hearing of the petition.

India has been rocked by a crisis among shadow banks, whose lending has been a lifeblood for everyone from small merchants to tycoons. The non-bank financing companies’ balance sheets have come under greater scrutiny after the collapse of IL&FS last year highlighted broader debt concerns. That’s complicating the South Asian nation’s battle against a bad-loan problem that it needs to clear up to help promote investment and revive economic growth.

Both Indiabulls and its target Lakshmi Vilas Bank Ltd. are seeking to increase profitability and bolster capital as the crisis in the shadow banking sector drags on.

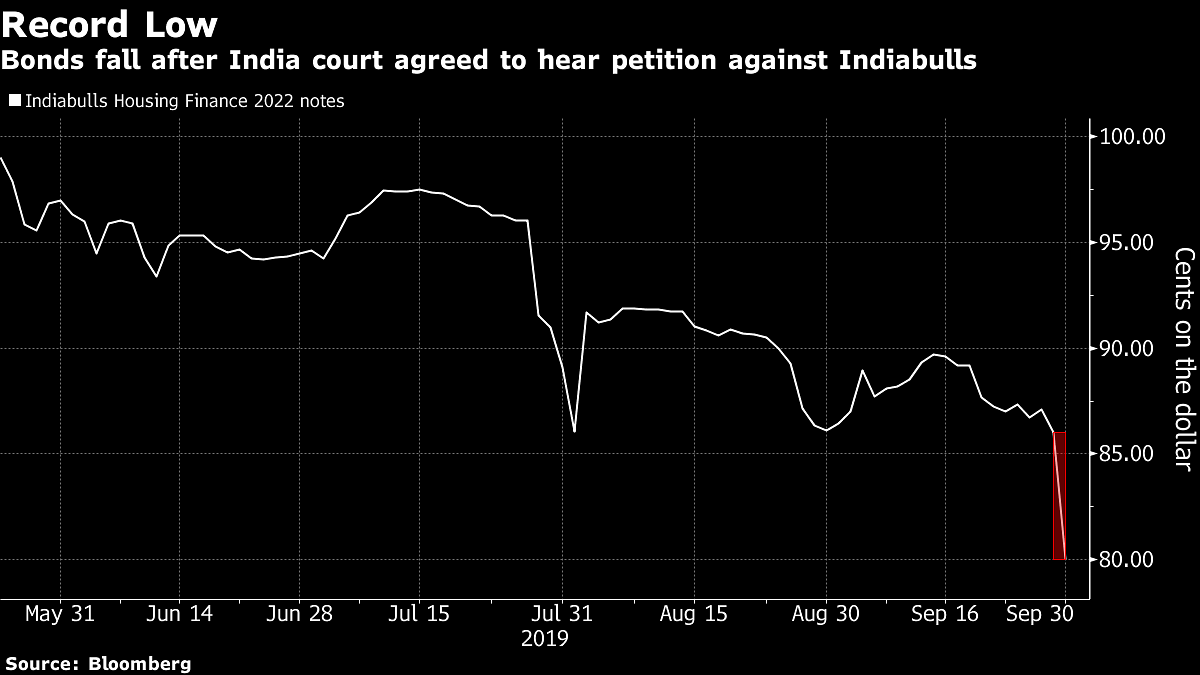

The merger is crucial for the lenders — Indiabulls is looking to diversify its asset base while Lakshmi Vilas Bank needs to raise capital to come out of the lending curbs. Indiabulls’ dollar bonds and shares plunged after the Delhi High Court admitted a petition against the shadow lender and the Reserve Bank of India placed restrictions on the Lakshmi Vilas Bank.

Also read: How a law firm’s apology for ‘false cases’ turned around Indiabulls fortunes in a day

RBI Approval

“It’s not the end of the road as far as the bank proposal is concerned,” Banga said. “In the next month or so, we hope to hear back from the RBI,” and Indiabulls expects to complete the merger process by March.

The shadow bank may also announce a buyback of its overseas bonds next week, and plans to fund the trustee account on its Masala bond in the next to two to three days, Banga said.

Here are other comments made by Banga in the conference call:

- Regarding the merger proposal, none of the regulators evaluating it have found anything of concern so far

- The combined entity will be comfortable on parameters of capital adequacy, asset quality, profitability and Tier 1 capital, and will be better placed than most of the private banks

- The repayments from customers are in excess of repayments to lenders. The company also has cash in excess of 200 billion rupees ($2.8 billion)

- Investment in OakNorth Bank gives the company material buffers in excess of $500 million

- Given the stress in the real-estate market, asset quality is not as good as was a year ago

- Indiabulls has roughly 40% bank borrowings, 40% bonds and 20% other means including external commercial borrowings. It has completely unwound its commercial paper program