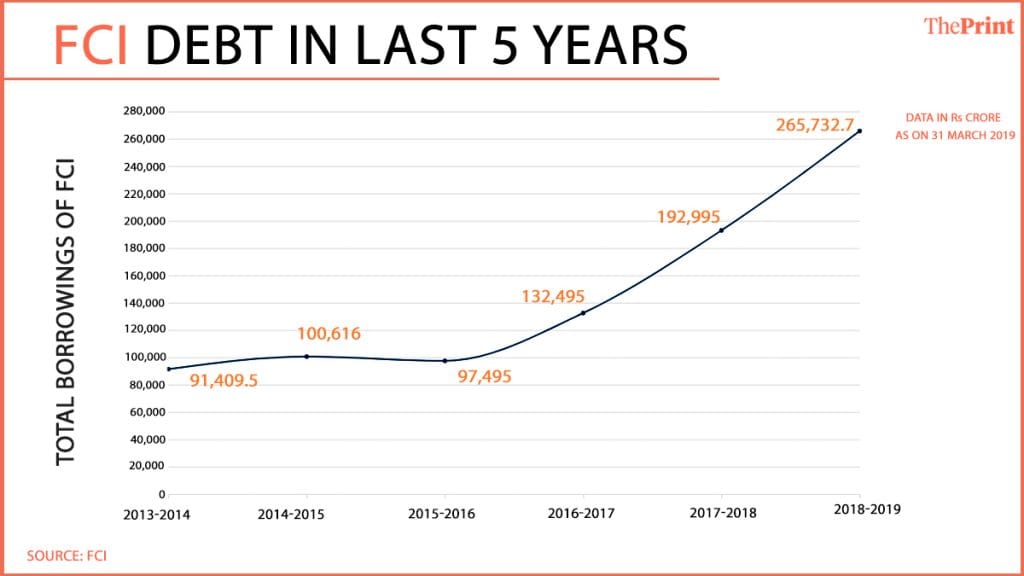

New Delhi: The Food Corporation of India, the agency that administers the National Food Security Act, has seen its debt almost triple in the five years of Narendra Modi government.

The FCI, which has no income stream of its own and is completely reliant on the Union government to meet its debt obligations, has seen its total debt levels zoom to Rs 2.65 lakh crore in March 2019, up from Rs 91,409 crore in March 2014 — an increase of over 190 per cent.

The debt levels started increasing sharply in 2016-17, when the government resorted to giving loans to the FCI from the National Small Savings Fund (NSSF) to fill the gap between the actual food subsidy the government should have provided for in the budget, and what it actually did, on account of fiscal constraints.

ThePrint reached out to the FCI for comment but it did not respond.

Also read: ‘Fudge Corp of India’ – How Modi govt uses FCI to keep fiscal deficit artificially low

Financials at a tipping point

The FCI is the government agency that manages the procurement and distribution of foodgrains. Set up in 1965 under the Food Corporations Act, it is responsible for procuring foodgrains at minimum support prices, storage and maintenance of adequate buffer stock, and distribution through the public distribution system.

The central government fixes the minimum support price for procurement of foodgrains as well as the issue price at which they are supplied to the states. The difference in these two prices, along with the distribution costs, are reimbursed by the government to FCI in the form of food subsidy, making the corporation completely reliant on the central government.

However, the last few years have seen the government progressively budget much less than what is required as food subsidy. To compensate for the shortfall, the FCI has been borrowing from the NSSF every year. As of 31 March 2019, Rs 1.91 lakh crore of the FCI’s debt is through the NSSF, according to the government’s own data.

The FCI’s borrowing pattern shows it borrows mainly through four routes — cash credit limit sanctioned by banks, Government of India-guaranteed redeemable non-convertible bonds, unsecured short-term loan limit, and National Small Savings Funds loan. It also uses Ways and Means Advances from the government, but repays them before the end of the year.

“Ideally, the entire amount of food subsidy incurred in a year should be provided for in the Union budget. For more than a decade, governments have not paid it fully and FCI had to borrow from banks against sovereign guarantee,” said Siraj Hussain, former agriculture secretary who is now a visiting senior fellow at the Indian Council for Research on International Economic Relations (ICRIER).

“Then, the government started giving through Ways and Means Advances. When even that became insufficient, the NSSF route was taken three years back. Eventually, it is the government that has to repay these loans through food subsidy. The FCI’s financials seem to be at a tipping point, and bank consortiums may be reluctant to continue giving loans.”

Also read: Modi govt ‘risks’ National Small Savings Fund by using it to support struggling PSUs

Why food subsidy bill has been rising

The food subsidy bill has been on the rise on account of multiple factors. The implementation of the National Food Security Act, 2013, increased the number of beneficiaries while reducing the sale price of rice and wheat. At the same time, procurement prices have been on the rise with higher minimum support prices and rising procurement by the FCI.

“The FCI buys high and sells low, managing on subsidies paid by the government. India’s food subsidy bill has risen rapidly, doubling in six years (Rs 1.7 lakh crore in financial year 2018-19, or 0.9 per cent of GDP). Yet, India’s food subsidies have remained relatively stable as a percentage of the GDP,” said a Bank of America Merrill Lynch Global Research note in August.

“The government has struggled to pay these subsidies recently and has released amounts much lower than the funding shortfall at the FCI,” it said, adding that the government may have close to Rs 2 lakh crore of unpaid /carried-forward subsidies to the FCI.

“The FCI has no inherent cash flows with which it can repay its debt. A reduction of inventories will only partly help in deleveraging. The government of India must at some point provide the FCI with the Rs 2 lakh crore in unpaid dues,” the note pointed out.

Also read: Why Indian economic tiger became puppy with tail between legs & what markets want Modi to do

Modi and gang came to power to loot India.

If loot someone has to benefit. who?. R u saying he or his government team has takenoney into their pockets. Look with people like Prashant Bushan if true they wud have made merry of thid

Modi is only interested to go on foreign tours, building statues, buy private jet like Trump, he and his party are enjoying their lives very lavishly, desh gaya bhaad mein, why they will bother

Please correct the last line of second para. It should be more than 290 per cent, not 190 per cent.

Its 290 percent. Not 190 percent.

Well, we don’t know who is the most corrupt? Now they say FCI. When he was rail minister, they said, railway ministry most corrupt. Or, is it the police, or RTO. Perhaps, municipality. No one has bothered to write a thesis for MA, M Phil or doctorate. Nor ha any Nalsar gal has cared. Now IIT and IIM are phoren-coated elite. They just do not care. So the task falls on Rahul or Yechuri. But their vision is hampered. Blinkers are of iron. Others are beneficiary segments. We also have farmer and anti- farmer lobbies.

Howdimodi zindabad

People ask dismissively, What Big Bang reforms ? 2. Dismantle FCI. Stop procurement of wheat and rice for the PDS. In fact, no PDS at all. Work out what subsidy a poor / lower middle class family should receive, send it to them directly, credited into their Jam Dhan accounts. The private trade will buy, transport, stock, sell food grains, with no Essential Commodities Act to hobble them. 3. This cannot be done overnight, true. Farmers will be affected, will have to adapt. But this should be the ideal to aim for. Kuchh reformist impulse hai hi nahin.

Completely agree. Fci create a dead weight loss.

Farmers should be compensated by opening the export import markets for food. I can easily supply to food deficient China.

Fantastic idea. Why not possible. So many bank accounts opened. Gas subsidy is given thru bank accounts. All pension using jeevsn pramaan aadhar linkage. Ensures no leakage. If given directly risk is farmers may not be able to buy fertilisers et. At full cost and production/ productivity may suffer

Actually the purpose of PDS is to provide food grains at very cheap rate to Bpl families dismantling it and providing direct cash say 6000 per year won’t help as then these guys will need to purchase at direct market rate of food grain which is quite high I don’t think 500 per month is enough, ration shops is still needed for them the system of procurement can be made more efficient using technology to prevent corruption

1. Giving freebies and food subsidies is not proper as there is nobody in the country who is actually hungry. No survey can prove it. To provide subsidies by taking loans is an increasing public burden . When we don’t have surplus money why should we spend at all to appease the voters?

2. FCI is a white horse and a most corrupt Deptt of the Govt. Rambilas Paswan is taking monthly from all the Regional Managers throughout the country.

3. Govt has already bankrupted the LIC, Pension Funds and now attacking the National Savings Schemes in which the middle class is putting their savings. It shall also refuse to refund the savers their money.

YOur item NO 2 about the Union Minister’s relationship with his Regional Managers proves that this BJP Govt is just as corrupt as any that has gone before it.