Risks to global growth have risen in the last three months and tilt to the downside, the IMF said on eve of its annual meetings in Bali.

New Delhi: The International Monetary Fund said the world economy is plateauing as the lender cut its growth forecast for the first time in more than two years, blaming escalating trade tensions and stresses in emerging markets.

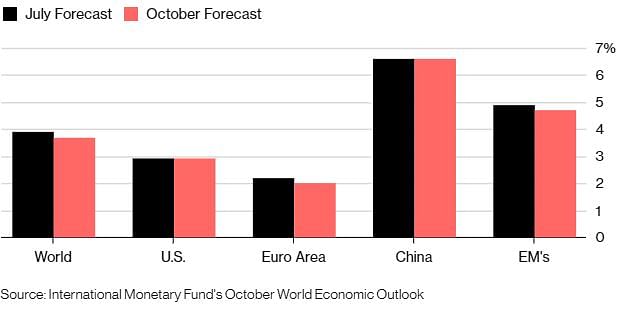

On the eve of its annual meetings in Bali, Indonesia, the fund on Tuesday projected a global expansion of 3.7 percent this year and next, down from the 3.9 percent projected three months ago. It was the first downgrade since July 2016.

The fund left its 2018 U.S. forecast unchanged but cut its expectation for next year, citing the impact of the trade conflict.

“The outlook is one of less balanced and more tentative expansion than we hoped for last April,” IMF Chief Economist Maurice Obstfeld said in the report.

Risks to the global outlook have risen in the last three months and tilt to the downside, the IMF said. Threats include a further inflaming of the trade war between the U.S and countries including China, and a sharper-than-expected rise in interest rates, which would accelerate capital flight from emerging markets.

Slipping a Little

The IMF cut its 2018 GDP forecast for the world, euro area and emerging markets

The warning comes as finance ministers and central bankers from the IMF’s 189 member nations prepare to meet this week in Bali, Indonesia for the annual meetings of the fund and its sister institution, the World Bank. The Trump administration’s trade dispute with China is expected to be front and center, as are the consequences of the Federal Reserve and other major central banks tightening monetary conditions after a decade of easy money.

President Donald Trump has slapped tariffs on $250 billion in Chinese goods this year, and Beijing has retaliated with levies $110 billion of American products. The IMF projections don’t take into account Trump’s threat to expand the tariffs to effectively all of the more than $500 billion in goods the U.S. bought from China last year.

China Downgrade

The IMF also cut its outlook for China as a result of the tariffs, shaving its projection for growth next year to 6.2 percent, down 0.2 point from three months ago.

The euro area will expand 2 percent this year, down 0.2 point from July, as a result of weaker than expected growth in the first half of the year.

The fund upgraded its forecast for Japan slightly to 1.1 percent growth this year, up 0.1 point from July.

Several emerging markets had their forecasts cut, including Argentina, Brazil, Iran and Turkey, reflecting factors including tighter credit.

The IMF said it expects inflation to accelerate around the world this year, due largely to increasing commodity prices. Core inflation, which excludes volatile items such as energy, will vary from country to country, it said.

In the U.S., the core personal consumption expenditure index, the Fed’s preferred measure for inflation, will rise to 2.1 percent in 2018 and 2.3 percent next year, as the government’s fiscal stimulus pushes growth above potential, the IMF said.

Productivity Challenge

Over the longer term, the IMF sees aging populations and sluggish productivity growth as a major challenge to advanced economies. Global growth will slow to 3.6 percent by 2022-2023, as growth in rich nations falls back to potential, it said.

Most of the “meager gains” from growth have gone to the well off, fueling support for protectionism and anti-establishment leaders, said Obstfeld. “Policymakers must take a long-term perspective to address this malaise. Inclusive fiscal policies, educational

investments, and ensuring access to adequate health care can reduce inequality and are key priorities,” he said. -Bloomberg