New Delhi: India’s Index of Industrial Production (IIP) turned positive for the first time since the pandemic hit the country, even though inflation continued an upward trajectory in October, recording its highest peak since May 2014.

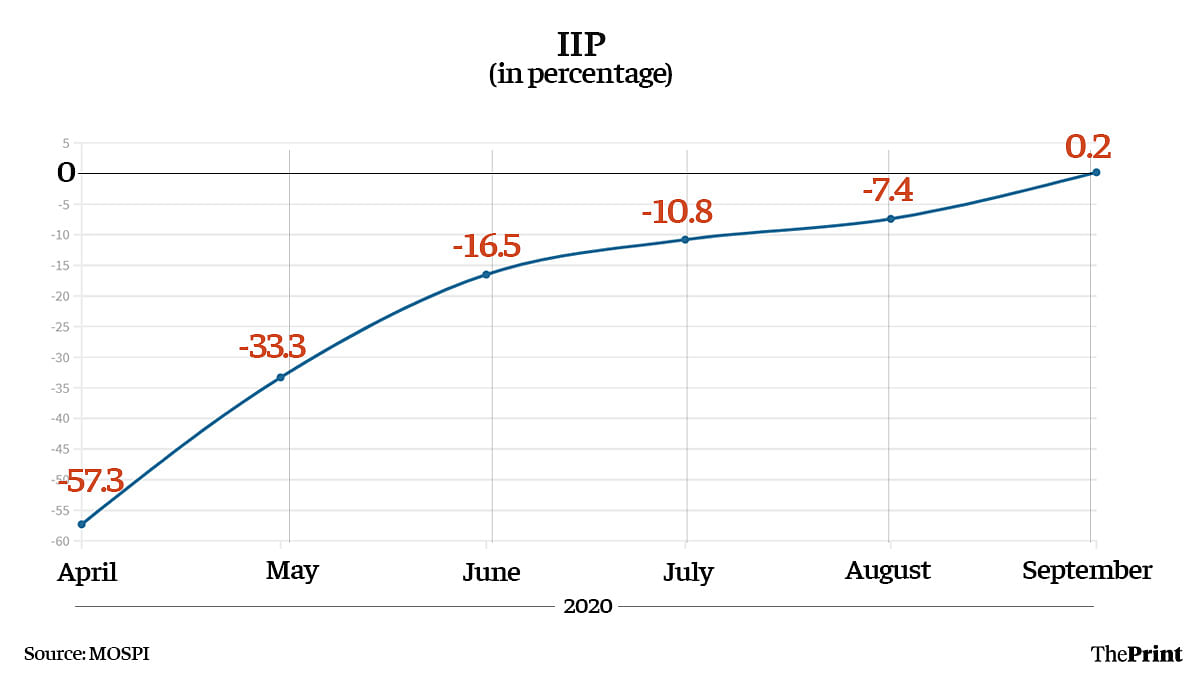

After six months of contraction, IIP rose marginally by 0.2 per cent in September, led by an increase in electricity generation. The metric declined by 21 per cent in the April-September period on account of the virtual halt in production in April and May coinciding with the Covid-19 lockdown, data released by the Ministry of Statistics and Programme Implementation showed.

The manufacturing sector picked up as firms accelerated production in anticipation of the festive season sales, but did not move into the positive growth territory in September, registering a -0.6 per cent contraction in the month. Electricity generation was up 4.9 per cent while mining rose 1.4 per cent. Use-based classification showed that infrastructure, consumer durables and consumer non-durables recorded growth in September though capital goods, a sign of investment demand in the economy, contracted 3.3 per cent in the month.

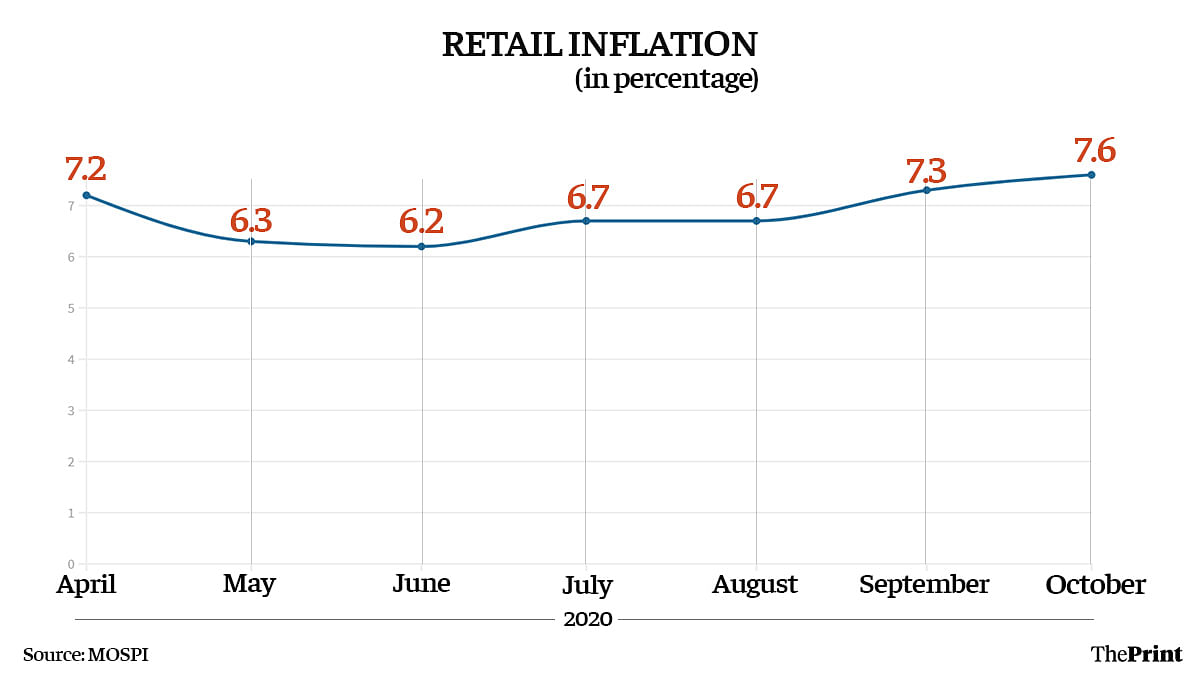

Retail inflation, based on the Consumer Price Index, rose to 7.61 per cent in October, higher than the revised 7.3 per cent in September, mainly on account of rising food prices. Food price inflation was at 11 per cent in October as against 10.7 per cent in September. This was on account of rising prices of vegetables, pulses and eggs.

Responding to a query from ThePrint at a press conference Thursday, Finance Minister Nirmala Sitharaman had said the increase in inflation was on account of the prices of perishable food items, that too because some districts producing these items were flooded. She added that the government is taking immediate measures, such as imports and medium-term measures like better storage infrastructure, to ensure prices don’t go up further.

Her comments were made before the release of the inflation data for the month of October.

Also read: Indians saved more in Q1, preferred to invest in mutual funds and hold cash, RBI says

Govt, RBI cautiously optimistic

The government and the Reserve Bank of India (RBI) have been hopeful of the economy seeing a strong recovery. RBI Wednesday even talked about the economy turning the corner faster than expected in the third quarter itself. However, it had flagged the “unrelenting pressure of inflation” as a major downside risk to the recovery of the Indian economy.

It pointed out that inflation showed no signs of waning despite steps taken by the government such as imposition of stock limits, import of onions and potatoes, and temporary reduction in import duties.

“There is a grave risk of generalisation of price pressures, unanchoring of inflation expectations, feeding into a loss of credibility in policy interventions and the eventual corrosion of the nascent growth impulses that are making their appearance,” the RBI said in its November bulletin.

Devendra Kumar Pant, chief economist, India Ratings & Research, in a note said core inflation also rose to 5.77 per cent in October as against 5.6 per cent in the year ago period.

Protein-based items like egg, meat and fish, oil and fats, vegetables, pulse and products led to food inflation rising to a six-month high, Pant said, adding that while food inflation may decline with the onset of winter and arrival of fresh onion crop, core inflation is likely to remain elevated in 2020-21.

He also said there is likely to be an extended pause on policy rates with the RBI’s Monetary Policy Committee grappling with a situation where inflation has breached 6 per cent for three consecutive quarters, and India is in a recession with two consecutive quarters of negative growth.

Rahul Bajoria, chief India economist at Barclays, also ruled out a rate cut in the RBI’s December monetary policy review.

“Although perishable food price pressures appear to be peaking and should have a greater downward impact on inflation, several factors, such as higher operational and labour costs, will likely prevent a large drop in inflation over the next three to six months. The elevated inflation trajectory will effectively rule out a rate cut in December…”, he said in a note.

Also read: Modi govt announces Rs 2.6 lakh cr stimulus package ahead of Diwali to boost jobs, housing

The MPC may have to consider rate increases at some stage.