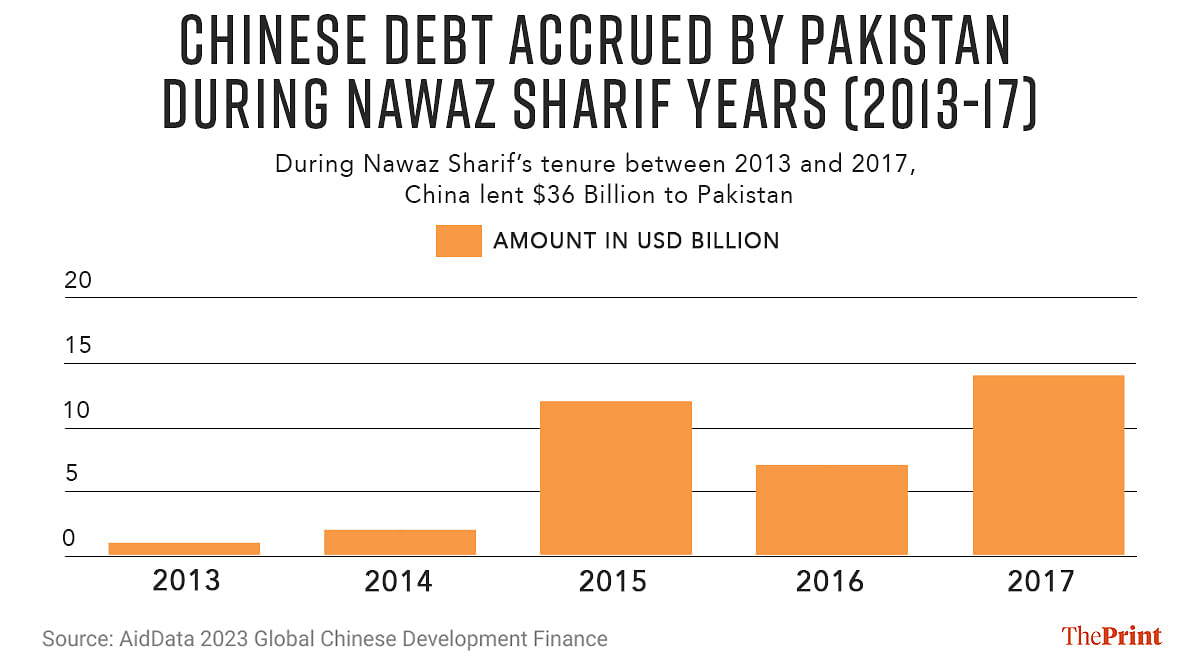

New Delhi: Close to $69 billion ($68.91 billion) — that’s the total sum of money China has lent Pakistan. A considerable chunk of this ($55.8 billion) was lent between 2013 and 2021, with $33 billion lent during a three-year period, from 2015 to 2017, a study has revealed.

AidData, a research lab at the College of William and Mary in the US, calculated Pakistan’s total debt owed to China in a report published on 6 November. Researchers also found that Beijing funded 433 projects in Pakistan between 2000 and 2021.

Islamabad has received funding from the International Monetary Fund (IMF) 23 times since 1958, and 14 times since 1988, highlighting the persistent balance of payment issues it faces. In July of this year, the IMF agreed to a new $3 billion stand-by arrangement in an effort to grant Pakistan time to solve its debt crisis.

What is new, however, is the understanding of the full scope of the amount Islamabad owes to Beijing — nearly $23 billion higher than data made available by the World Bank during the same period of 2000-2021.

The estimate by AidData surpasses that in the World Bank’s International Debt Statistics, which stands at $46 billion during the same time period, according to media reports.

“Pakistan’s chronic economic challenges have meant that it has always been historically reliant on foreign fund inflows to manage its economy,” Uzair Younus, director of the Pakistan Initiative at the Atlantic Council’s South Asia Center, a US-based think tank, told ThePrint.

“In recent years, China has emerged as a key provider of funds, along with Saudi Arabia and other multilateral partners like the World Bank and the ADB (Asian Development Bank). There is a growing recognition in Pakistan that this cannot be sustained and that reforms which break this dependency are a need of the hour,” Younus added.

The new information from AidData also assumes significance, given that Pakistan is gearing up for elections on 8 February — former prime minister Nawaz Sharif, under whose tenure Pakistan received $36 billion worth of Chinese loans, returned to the country in October and is expected to lead his party, the Pakistan Muslim League-Nawaz (PML-N), to another general election victory.

“It is important to keep in mind that neither of these figures capture Pakistan’s outstanding debt to official creditors in China. Whereas outstanding debt is measured as cumulative loan disbursements minus loan repayments, AidData only provides data on lending commitments,” Bradley Parks, executive director of AidData, told ThePrint.

Also read: Infra lender to emergency creditor — BRI 2.0 is China’s new strategy to ensure its debts are paid

Chinese emergency lending & Pakistan

Pakistan is the third-largest recipient of Chinese overseas funding after Russia and Venezuela between 2000 and 2021. According to the AidData report, Russia received a total of $169 billion in loans, while Venezuela received $113 billion in loans — mostly between 2006 and 2016 — from China, during this period.

The long term loans, defined as loans with maturities longer than one year, are but one half of the story in understanding the situation of indebtedness between countries and Beijing.

As the AidData report notes, there is a perception that China’s flagship overseas lending programme, the Belt and Road Initiative, is a “shadow” of its former self. However, this perception derives from understanding one half of Beijing’s lending practices.

The other half of the story lies in China’s ramping up of short- or medium-term renminbi yuan (RMB) denominated loans, unrelated to public investment projects, involving multiple Chinese retail/commercial banks rather than its policy banks such as the Export-Import Bank of China or the China Development Bank (CDB).

Between 2000 and 2013, China provided roughly $412 billion credit for infrastructure projects to low and middle-income countries — for the rehabilitation, expansion or maintenance of physical infrastructure. This was roughly 66 percent of its total lending of $628 billion during the fourteen-year period, as AidData’s report found.

Since the launch of the BRI, infrastructure lending commitments to low- and middle-income countries have fallen 65 percent in 2014 to 31 percent in 2021.

In 2013, emergency rescue lending was a mere 5 percent of China’s overall lending portfolio. This amount increased to 58 percent by 2021, the AidData report found.

This is important because between 2012 and 2021, Pakistan has received at least one emergency rescue loan from China every year and in 2020, Beijing rescheduled at least one of the loans Pakistan owed to it.

About 83 percent of China’s total emergency rescue loans including “rollover” loans were issued to countries in financial distress, according to AidData. The fact that Pakistan received one for a year for a decade suggests that Islamabad’s economy is not just facing a short-term liquidity crisis but also a decades-long solvency crisis.

“The status quo is not sustainable and an overhaul of the broader economy, such that Pakistan can mobilise internal resources and generate sustainable growth, are the need of the hour,” Younus said to ThePrint.

Spectre of ‘rollover’ loans

Further understanding short-term emergency funding requires an explanation of the term “rollover” loans.

“China’s emergency rescue lending activities in Pakistan present both a measurement challenge and reporting challenge because many of the loans are entering the front door as short-term debts with maturities of 12 months or less, and exiting the back door as long-term debts with de facto maturities in excess of 12 months. This is the issue of so-called “rollover debt,” said Parks.

“Rolling over debts with de jure maturities of 12 months or less year after year is effectively a loophole in international reporting rules that allows governments to underreport their true levels of public debt exposure to China (and other external creditors). The World Bank is very much aware of this loophole — and concerned,” Parks added.

In the case of Pakistan, if one adds the “rollover” debts owed to China, even a conservative addition would see Islamabad’s total debt owed rise to $102.85 billion. But there are multiple challenges in considering “rollover” debts as a part of the total, owing to the opacity in reporting of such agreements.

Parks clarified about the loans counted in the AidData report by saying, “The loans that are counted by AidData but not by the World Bank include balance of payments (BOP) loans from China Development Bank, ICBC, Bank of China, and SAFE (State Administration of Foreign Exchange) as well as the State Bank of Pakistan’s borrowings under its swap facility with the PBOC (People’s Bank of China).”

There have been cases where Chinese emergency lending has been used to pay loans owed to the IMF as well. In the case of Argentina, the dollar holdings of its central bank (Banco Central de la República Argentina or BCRA) was perilously low.

China’s central bank, the PBOC, stepped in and helped Buenos Aires service debt payments to the IMF to the tune of $9.3 billion in RMB, thereby staving off defaulting on the IMF loans, AidData found. By allowing Argentina to preserve its low dollar reserves, the PBOC protected its own dollar denominated loans given to Argentina.

In the case of Pakistan, Younus asserted that this does not occur, adding, “This is not how IMF lending works. In fact, Chinese rollovers and even access to Saudi funding are linked to the IMF program, and both the Chinese and the Saudis coordinate with the IMF when it comes to strategies that are necessary to maintain economic stability in Pakistan.”

This does not change the fact that it could happen in the future, as seen in the case of Argentina. The vast sums of money owed by Islamabad is not clear, but it is clear that Pakistan has received at least $102.85 billion in both short-term and long-term loans from various agencies and banks from China, raising questions over its long-term economic sustainability.

However, Younus believes that conditions Pakistan will have to agree to in order to receive the IMF aid could help manage its debt burden.

“Pakistan is currently in an IMF program and is expected to enter into a new one by the end of the first quarter of 2024. The conditions that have been agreed to as part of these programs are expected to help manage the debt burden and stabilise the macroeconomy,” said Younus.

This is an updated version of the report

(Edited by Smriti Sinha)

Also read: Indians believe in US’s economic power more than people in its fellow NATO countries — Pew essay