New Delhi: Importers and other stakeholders fear that the central government’s decision to impose a stock limit on pulses will kill May initiative, through which it allowed free import of the commodity to cool down prices.

The importers also claim that while the central government has allowed them stock holding of 200 metric tonnes (MT), this is just a fraction of the pulses they import.

According to them, the decision is likely to impact the ongoing sowing of Kharif pulses such as Tur, Urad, and Moong, because with stock limits prices have crashed, discouraging farmers from growing more of the crops.

The government had imposed the stock limit on 2 July. According to its order, wholesalers can only stock up 200 MT (provided there should not be more than 100 MT of one variety) of pulses, retailers can only stock 5 MT, while for millers, it is either the last three months of production or 25 per cent of annual installed capacity, whichever is higher. The stock limits are in place until 31 October.

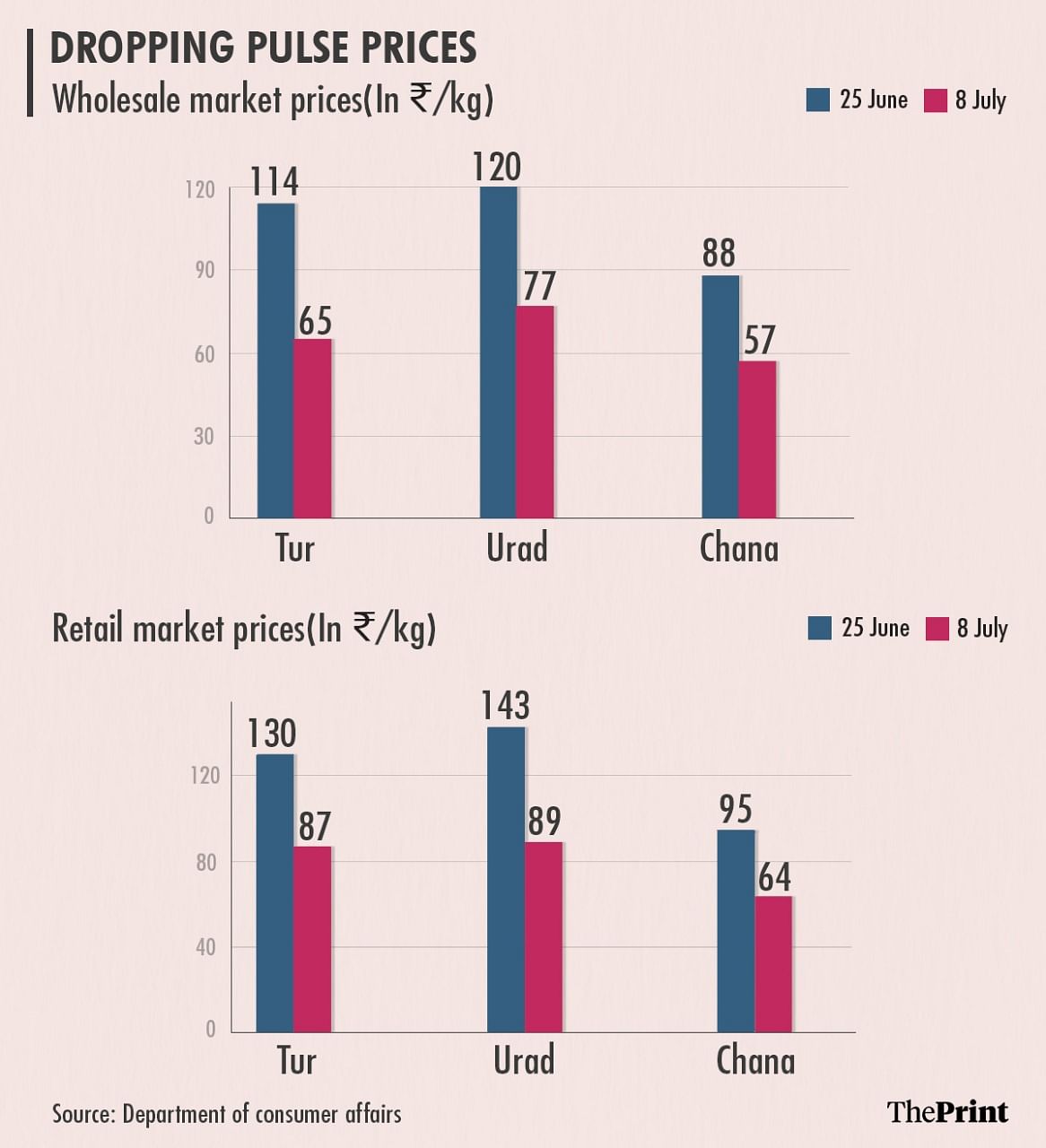

But in the week since the order, the prices of pulses have plunged over 30 per cent on average, with the maximum impact on retail and wholesale rates of Kharif pulses. For instance, the wholesale rates of Tur dal dropped from Rs 114/kg on 25 June to Rs 65/kg on 8 July. Retail prices of the dal dropped from Rs 130/kg to Rs 87/kg in the same period (see graphic).

Temporary relief

Experts told ThePrint that while the government has achieved its objective and reduced prices, the relief is temporary.

The India Pulses and Grains Association (IPGA), in a statement, termed the move as “quite a regressive step by the government that will severely impact not only wholesales, retailers and importers but also the farmers and consumers”.

Bimal Kothari, the IPGA vice president, told ThePrint that the price crash was triggered by massive liquidation by those looking to comply with stock limits.

“Kharif crop is being sown but with stock limit, wholesalers will have to sell excess stock in the market thereby crashing prices,” he said. “This will discourage farmers from growing pulses, as they will shift to more remunerative crops like soybean and cotton. We already have a deficit in our pulse crop production and with a further decrease in sowing, it’ll disrupt every stakeholder from traders to farmers.”

According to reports, India’s pulse production increased from 15-16 MT in 2014-15 to 22-23 MT in 2019-20 but domestic demand has also been growing. The country is expected to consume 25-26 MT of pulses in this fiscal.

Also read: Kabuli chana price set to rise, could cost Rs 130/kg ahead of festive season as states unlock

The effect on traders

Rahul Chauhan, an agro commodity analyst of the market research firm Igrain India, said traders will now be reluctant to buy pulses due to a trust deficit.

“Due to stock limits, traders will be forced to sell stock in a hurry. They bought it from farmers at very high prices but will have to sell them at a lower rate incurring huge losses,” Chauhan said. “This will result in a lower price sentiment among farmers, discouraging them from growing more pulses.”

He added that although stock limits are applicable only up to 31 October this year, traders will be hesitant to buy pulses from farmers at higher prices even beyond that.

“Moong isn’t included in the stock limit commodities but its prices haven’t improved,” Chauhan said. “This is because traders fear that if its prices rise, it’ll also be included. From October onwards, when Kharif pulses reach mandis, traders will think twice before buying them at higher rates.”

‘Will hamper import decision’

Kothari said stock limits will also hamper the landmark free import of pulses, which the government implemented in May and one that was meant to fill the shortage in supply-demand caused by low production and yield owing to unseasonal rainfall. The decision was prompted by the fact that the shortage led to a price rise, which had forced the government to deprive ration card beneficiaries of free pulses this year.

“India needs 25 MT of pulses every year. This year, we are expecting a shortage,” Kothari said. “Normally, an importer imports 3,000-5,000 MT of one variety but imposing a limit to just 100 MT/variety will control supplies as importers will not be in a position to import large quantities together. Since the festival season is approaching from next month, supply may become a major constraint.”

He added that the government freed up imports, after foreseeing pulses shortage, especially in the festival period starting August.

“Also, Urad is harvested from October and Tur/Arhar from December,” Kothari said. “The government brought these commodities under free import to meet the increased demand in these months amidst a domestic shortage. However, the stock limit is a contradiction because bringing just 100-200 MT can’t fill the shortage.”

Chauhan said importers also have little incentive to bring in the pulses. “With stock limits, importing small quantities will be expensive owing to container shortage and high fares. It’s all a serious setback to being self-reliant in pulses,” he added.

(Edited by Arun Prashanth)

Also read: Oil price paradox: Why Modi govt is alarmed by edible oil prices but not petrol & diesel