New Delhi: Crude oil and edible oil have been the two main commodities driving up inflation in the country for the past few months. Their prices have risen sharply in the last six months, chiefly because of the high taxes that the government levies on them.

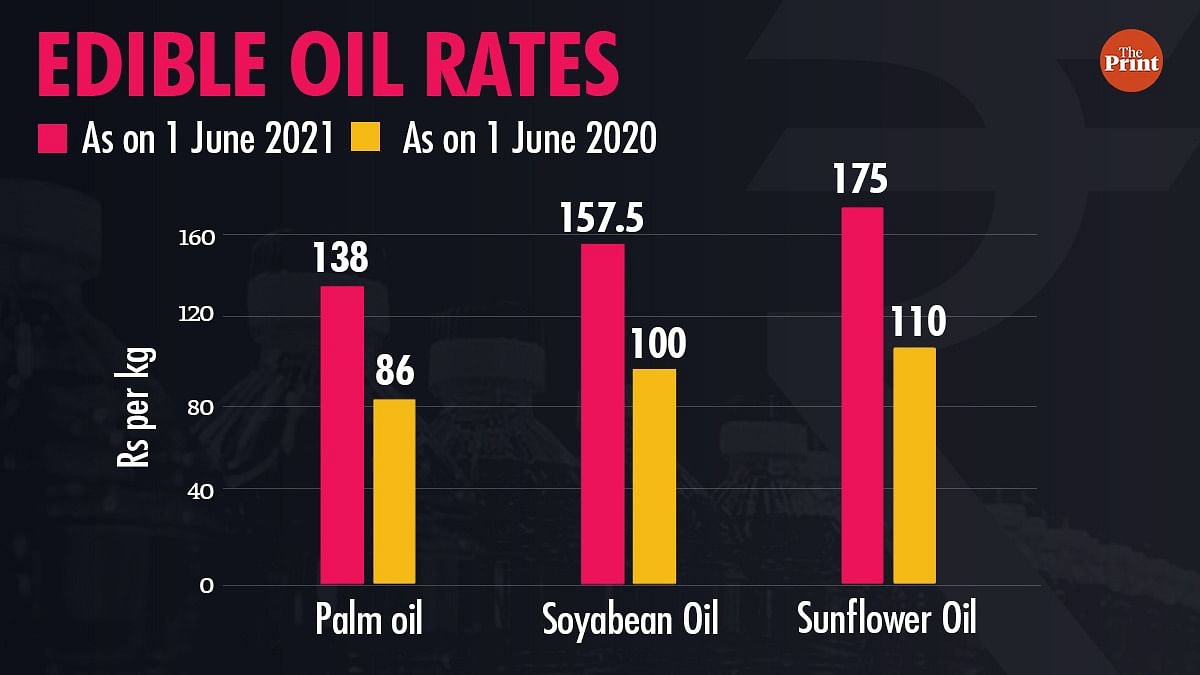

While prices of petrol and diesel have breached the psychological Rs 100/litre mark in many cities, the rate of palm oil, the most imported edible oil in the country, has increased by over 60 per cent in the past year to Rs 138/kg as on 1 June 2021 from Rs 86/kg on 1 June 2020 — its highest recorded price in the last 11 years.

Similarly, the price of other edible oils has also touched new levels in the same period — soybean from Rs 100/kg to Rs 153.5/kg and sunflower from Rs 110/kg to Rs 172/kg oil.

But while the central government appears to be worried about edible oils — it has moved to cut import duty on crude palm oil and refined palm oil — it has not given any relief to petrol and diesel prices.

Analysts differ on why the central government has not intervened to reduce the prices of petrol and diesel. One school of thought is that petrol and diesel, which are heavily taxed, provide a substantial chunk of revenue as compared to edible oil. Another view is that the cut in import duty in case of edible oil will not hurt the government much as their international prices are soaring. So high are the prices, that revenue from edible oil imports will continue to remain high.

Why import duties have been cut on edible oil

The central government, in an order issued last week, reduced import duty on crude palm oil to 30.25 per cent by cutting 5 per cent basic duty. The import duty on refined palm oil has also been reduced to 41.25 per cent from the earlier 49.5 per cent.

Visiting senior fellow at ICRIER (Indian Council for Research on International Economic Relations) and former agriculture secretary, Siraj Hussain, said a chief reason that this hasn’t happened in the crude oil sector is that petrol and diesel provide the government with a lot of revenue.

“The quantum of revenue collected by the central government is much more in petroleum as compared to edible oils. In fact, petroleum is a major source of revenue especially after the government abruptly slashed rates of corporation tax just a few months after presenting the union budget in 2019,” he told ThePrint.

“Moreover, edible oil inflation directly impacts common citizens by pushing up food inflation, which is not the case with petroleum prices,” he added. “So the government has decided to reduce import tariffs on edible oils but not on crude oil.”

Hussain also pointed out that the government has called for stocks of commodities to be communicated to it regularly, adding that it is a very inefficient way of knowing private stocks.

“A much easier and efficient way would be making electronic-Negotiable Warehouse Receipt (e-NWR) compulsory across the country. It would enable the government to get real-time and much more accurate updates about the stock availability as well as movement across the country,” he said. “This can go a long way in ensuring better decision-making and policy formulation regarding food inflation in future.”

Other experts feel that the central government opted for a duty cut because even after the decision, it won’t lose much in case of edible oils due to the high international rates.

“Last year with lower edible oil prices, the government of India earned around Rs 30,000 crore as revenue from a total import of Rs 75,000 crore from November 2019 to October 2020,” B.V. Mehta, executive director of the Solvent Extractors’ Association of India (SEAI), told ThePrint.

“In the current cycle, since 20 November 2020, the price has gone up by 70-80 per cent,” he added. “The total import bill will be not less than Rs 1,20,000 crore, of which the government will get revenue of Rs 40,000-45,000 crore. The government should use part of this fund for raising productivity of oilseed to reduce our dependence on imported oil, which is now nearly 65 per cent.”

In the international market, prices of edible oils have jumped sharply in recent months.

The price of crude palm oil for actively traded futures contracts at the Bursa Malaysia derivatives exchange was quoted at Rs 69547.45/tonne on 25 May, compared to Rs 40780.91/tonne on the same day a year ago.

Similarly, at the Chicago Board of Trade, the closing price of soybean for July delivery was Rs 41579.79/tonne as against Rs 22752.17/tonne on 24 May.

“The government might have also reduced duty on palm oil in anticipation of the gradual unlocking and the upcoming festive season, which might lead to increased consumption of edible oil,” Mehta said.

Also read: Why Modi govt’s prized food scheme went from ‘dal of choice’ to no dal at all

The edible & crude oil conundrum

India meets a major part of its domestic crude as well as edible oil demand mainly through imports with both being among the top three imported commodities in the country along with gold.

According to data from the Solvent Extractors’ Association of India and the Department of Food and public distribution, import duty on crude palm oil has been increased from 0 per cent in 2012 to 35.75 per cent in 2021. The peak import duty on crude palm oil stood at 44 per cent in 2018.

Refined, bleached and deodorised palm oil duty was also just 7.5 per cent in 2012 but was hiked up to 54 per cent in 2018. Crude Sunflower and Soybean oil also attract 38.5 per cent import duty in the country.

There is similar heavy taxation on petrol and diesel as well. As reported by ThePrint, the Union government levies excise duty and cess on fuel and the state levy a value-added tax (VAT).

Taxes together constitute 58 per cent of the retail selling price of petrol and around 52 per cent of the retail selling price of diesel at present. This means that if the price of petrol is Rs 100 per litre, taxes levied by central government and state governments together account for Rs 58. Of this, the union government’s excise duty is around Rs 32-33 and the remaining is VAT that is levied by the states.

In addition to such heavy taxation levied, both of these commodities have been marred by severe inflation in the past few months.

India’s fuel inflation in many cities grew at 11.6 per cent in May, as against 7.9 per cent in April and 4.5 per cent in March.

Edible oil also recorded a maximum jump of 30.8 per cent in May propelling retail inflation, according to central government data, to more than 6 per cent.

The increase in domestic prices of edible oils is also a reflection of international prices because India imports more than 50 per cent of its domestic demand through imports.

While our domestic production of vegetable oils is about 7.5 to 8 million tonnes, imports constitute 13-14 million tonnes valued at $10 billion (Rs 75,000 crore).

Growing imports

The import of edible oil has also been growing in tandem with the increasing demand in the country.

While the total consumption of edible oil in the country grew from 249.52 lakh metric Tonnes (LMT) in 2017-18 to 259.22 LMT in 2018-19, the edible oil import in the corresponding period increased from 145.92 LMT to 155.70 LMT.

The availability of domestic edible oil in the same period has moved slightly within 103 LMT, maintaining the country’s dependency on imports. Also, the country’s palm oil import has shot up by 13 per cent from 73.98 LMT in 2019 to 84 LMT in 2020.

Similarly, data with the Ministry of Petroleum and Natural Gas shows that the crude oil import has grown from 333.48 LMT in 2018-19 to 437.88 LMT in 2019-20.

(Edited by Arun Prashanth)

Also read: Modi govt imposes stock limit on pulses to rein in surging prices