Economists expect shortfall in GST collections to be around Rs 1.5 lakh crore. The budgeted collection was Rs 7.44 lakh crore.

New Delhi: Shortfall in tax revenues, particularly from the Goods and Services Tax (GST), will pose a massive challenge for the Modi government ahead of Union budget 2019 as it looks to meet the fiscal deficit target of 3.3 per cent of GDP in 2018-19.

While direct tax collections are expected to meet budgeted targets, with the taxmen working aggressively to achieve the same, it is unlikely to compensate for the massive shortfall in GST collections during the year as frequent rate cuts and massive tax evasion have impacted tax buoyancy in this new indirect tax regime.

For the 2019-20 fiscal as well, the government will be constrained from setting aggressive collection targets under GST as implementation of anti-evasion measures — like the e-way bill and tax collection at source — have also not been able to prop up collections.

Economists expect the shortfall in GST collections to be around Rs 1.5 lakh crore. The budgeted collection was Rs 7.44 lakh crore.

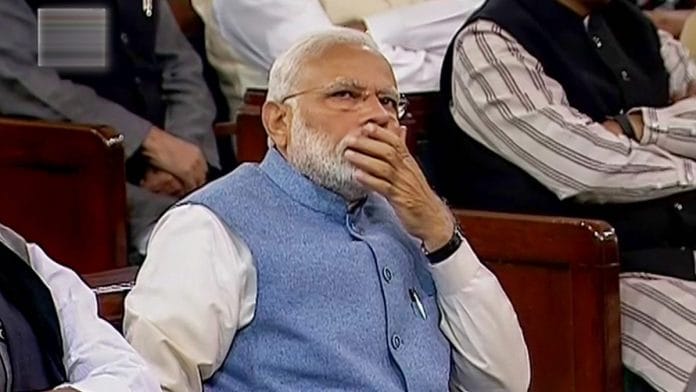

Also read: Utilise Budget session for constructive debate, Modi urges ahead of his govt’s last session

‘Worries come to pass’

In a note released Wednesday, economists Sajjid Z. Chinoy and Toshi Jain of JP Morgan Chase said the fiscal challenge this year is real.

“We had worried on Budget day itself last year that GST revenues had been budgeted too ambitiously and, unfortunately, this has come to pass, compounded both by repeated tax cuts by the GST Council in 2018-19 and patchy GST compliance throughout the year,” said the note.

“Therefore aggregate GST revenues have only grown by 6.6% over a year ago period between August and December, much below nominal GDP growth. Consequently, we expect gross GST collections to be short by about 0.8% of GDP,” it said.

The economists said that since 42 per cent of the divisible pool goes to states, the net impact on Centre will be close to 0.5 per cent of GDP — an anticipated GST revenue shortfall as high as Rs 1.5 lakh crore in 2018-19.

Also read: Nothing easy about GST’s e-way bill, it’s fickle & breeds corruption, truckers complain

Large shortfall

State Bank of India’s group chief economic advisor Soumya Kanti Ghosh said in a note that Rs 8.71 lakh crore have been collected under GST in FY19 so far.

“Adjusting for SGST component and share of states in IGST collections, the total GST collections for the Center amounts to Rs 4.44 lakh crore,” he said in a note released on 30 January, adding that some of this shortfall could be reduced by higher excise duty collections.

With only one quarter left, the government is unlikely to significantly close the gap.

The government had budgeted central GST collections at Rs 6.04 lakh crore and the total GST collection, including integrated GST and compensation cess, at Rs 7.44 lakh crore in 2018-19, budget documents showed.

On the direct tax front, the government claims that the taxpayer base has expanded.

However, the tax collections have not kept pace. The e-filing website of the tax department shows that till December 2018, 6.24 crore taxpayers filed their tax returns, as against 6.74 crore taxpayers in the entire 2017-18.

Direct tax collections was at Rs 5.42 lakh crore as of November end, data from the controller general of accounts showed. The full year target is a daunting Rs 11.5 lakh crore, but the tax department is confident of achieving it.

Smoke and mirrors.