New Delhi: Public sector banks (PSBs) are increasingly raising funds to lend them further rather than to shore up their basic capital requirements, an indication of their stronger finances and desire to diversify the sources from where they raise money for lending purposes.

A shrinking dependence on external funds to meet basic capital requirements shows that the banks are being able to meet these requirements through their own internal resources, according to banking experts, adding that this is a sign of strength.

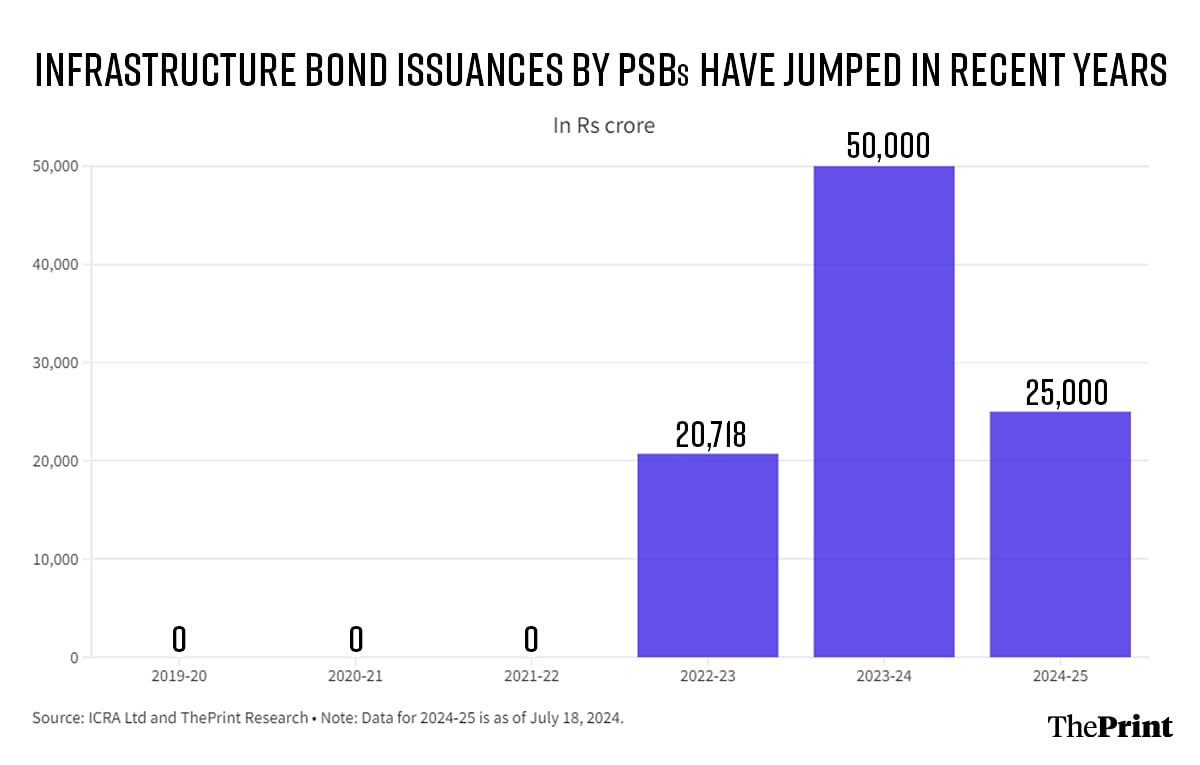

At the same time, their increased issuance of infrastructure bonds shows they are now looking to move beyond deposits to finance their lending activities, as is the case in developed countries.

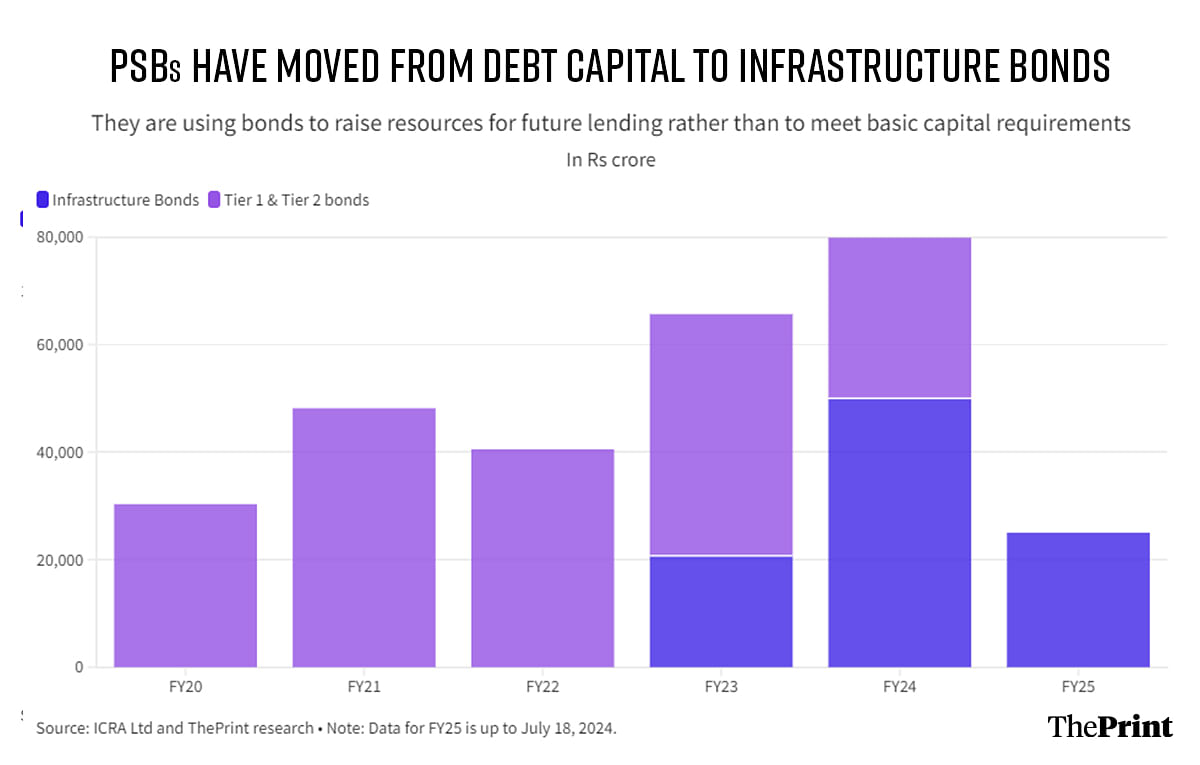

The PSBs have issued a total of Rs 2.89 lakh crore worth of bonds since 1 April 2019, with their composition increasingly leaning towards more infrastructure bonds — used to finance lending activities — and away from Tier-1 and Tier-2 bonds, which are used to shore up capital reserves of banks.

India’s largest lender, the State Bank of India, last week said it had raised Rs 10,000 crore in infrastructure bonds, following up on its June infra bonds issue, which was also of the same amount. In addition, the Bank of India Thursday raised Rs 5,000 crore through these bonds.

Neither the government nor the banks have a central database for these bonds, and so these calculations are based on data shared exclusively with ThePrint by the ratings agency ICRA.

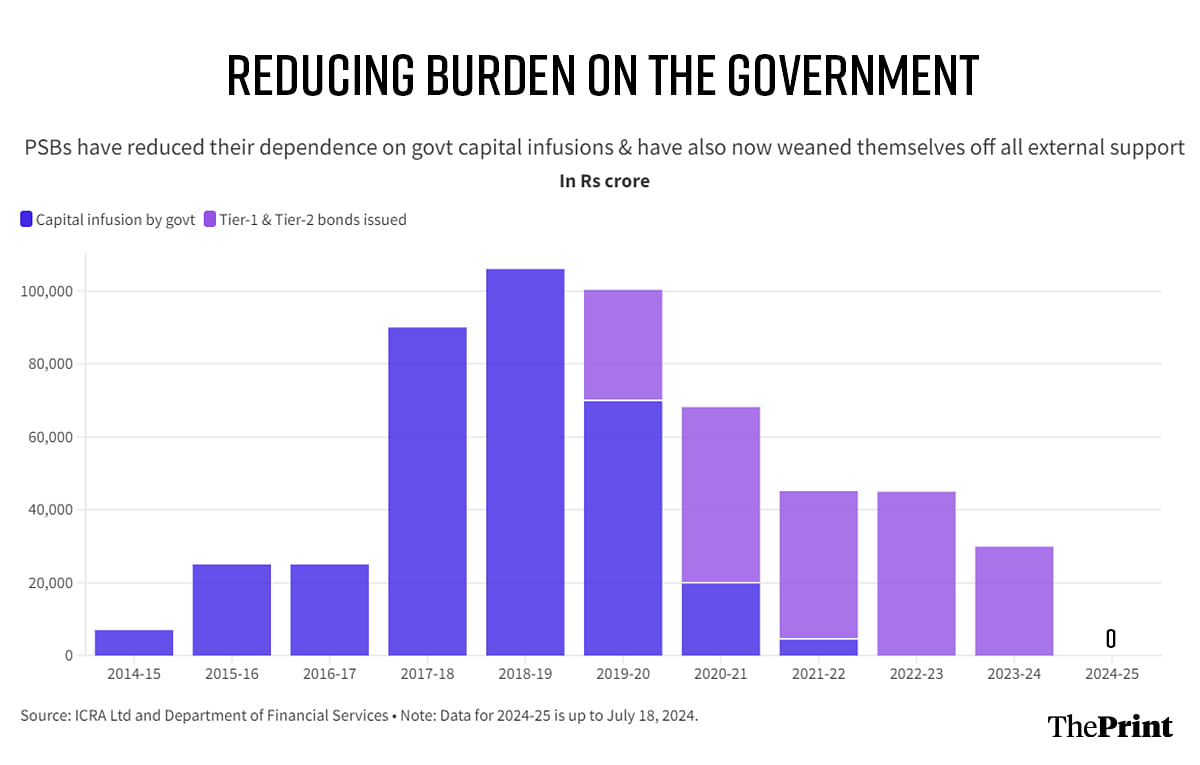

In the wake of and during the non-performing assets crisis faced in the 2014-19 period, the banks needed external support to raise capital to meet the RBI norms. This external support came in the form of capital infusions by the government, and bond issuances by the banks.

Reduced dependence on government & external sources

Between 2014 and 2022, the government infused a total of Rs 3.47 lakh crore in PSBs, with the amounts tapering off significantly in the last two years of this period.

While capital infusions decreased, the PSBs began increasing the capital they raised from the market, so as to reduce the fiscal burden on the government.

The data shows that Rs 30,318 crore worth of Tier-1 and Tier-2 bonds were issued by PSBs in 2019-20, which increased to Rs 48,154 crore and Rs 40,518 crore in 2020-21 and 2021-22, respectively.

Much like what capital infusions by the government are used for, these kinds of bonds are issued to raise capital so that banks can meet minimum norms of financial health set by the Reserve Bank of India (RBI).

One such norm is called the Capital to Risk-weighted Assets Ratio (CRAR), which is the bank’s available capital as a percentage of its outstanding credit exposure. The RBI, based on the international Basel-III norms, specifies that this percentage should be 9 percent or more for Indian banks.

In keeping with the improving health of the banks and comfortable levels of the CRAR — it rose from 12.2 percent in 2019 to 15.5 percent as of March 2024 — the total amount of capital required from external sources by PSBs also fell.

“Post the last capital infusion in FY21 into any public sector bank by the Government of India, these banks have largely been able to meet their capital requirements independently,” Anil Gupta, senior vice-president and co-group head of financial sector ratings at ICRA, told ThePrint.

“Further, the profitability of the PSBs has been very strong in the last two financial years and hence the need to rely on the government or on even the debt capital instruments has gone down.”

The rise of infrastructure bonds

However, the PSBs seem to have switched gears now and are raising money through bonds so that they can carry on growing the credit they are disbursing.

For example, the SBI said after its most recent bond issuance that the proceeds would be utilised “in enhancing long-term resources for funding infrastructure and affordable housing segments”.

The Bank of India, too, said the funds raised through infrastructure bonds would be used to fund long-term projects in infrastructure sub-sectors and affordable housing.

From no infrastructure bond issuances up to the end of FY22, the PSBs raised Rs 20,718 crore through such bonds in FY23, and Rs 50,000 crore in FY24. So far in FY25, they have already raised Rs 25,000 crore, with the Canara Bank and a few others expected to issue more bonds in the near future.

Flagging deposit growth

There are a few connected factors that are driving this push to raise funds for lending from the market. The first is that banks’ own deposits are not growing fast enough to keep up with their lending activities.

The second factor is that Indian banks are now increasingly looking to diversify their sources of funding for lending purposes, in line with what happens in developed countries.

In the normal course of events, banks lend out the deposits that customers place with them. If they want to lend more, and quickly, then deposits need to keep up. However, banks have been finding that the credit they have been giving out has been growing far faster than the growth in deposits.

The ratio between the credit given out and the deposits coming in is called the incremental credit-deposit (C-D) ratio. The higher this ratio, the worse it is for the bank because it means credit growth is outstripping the growth in deposits.

Data with the RBI shows that the incremental C-D ratio of PSBs rose from 21.9 percent in 2020-21 to 118.4 percent in 2022-23, before easing slightly to 100.8 in 2023-24.

“Incremental C-D of greater than 100 percent is unsustainable as it implies that incremental credit growth is outpacing the incremental deposit growth,” Punjab National Bank said in a note issued earlier this month.

“Banks need the additional funds so that they can continue lending at a brisk pace,” a senior official in the State Bank of India explained to ThePrint. “With deposits not growing fast enough, the bank has to issue bonds to finance this.”

A move to diversify

Other banking sector experts told ThePrint that this move to source more funds from the market is in line with what’s happening in the developing world, where the bulk of these resources are raised from the market and the dependence on deposits is relatively low.

“Additionally, even if the banks raise the interest rates they pay customers on their deposits, it is highly unlikely to attract them away from mutual funds and equity markets any time soon, since the stock market is booming and is expected to continue this for some time,” one analyst explained.

The experts further said that there are a number of additional costs such as overheads that are associated with deposits that do not accompany the funds raised from the bond market. So, even when the interest rate on deposits is lower than on the bonds, the deposits still often work out to be more expensive for the banks.

(Edited by Tony Rai)

Also Read: Why is Modi govt afraid of its own successes? Banking, stock market, GST hold the answer