Mumbai: A global stocks sell-off that started in the U.S. on Friday has extended to Indian equities. U.S. futures signaled further declines after a range of economic data dimmed the outlook for global growth.

The S&P BSE Sensex fell 0.9 percent to 37,819.90 as of 10:13 a.m. in Mumbai, declining for a second session even after it capped five straight weeks of gains through Friday. The NSE Nifty 50 Index also dropped 0.9 percent.

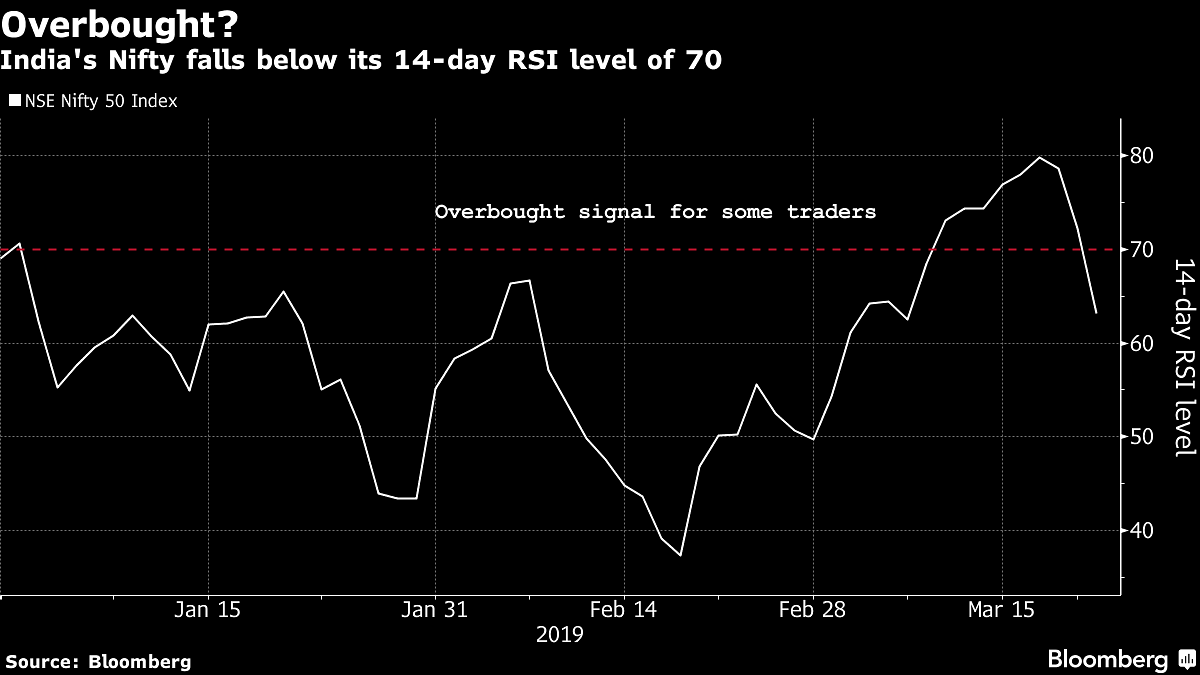

India’s equity market has been in overbought territory for the past eight days, signaling gains might have come too quickly to hold. A surge in foreign flows led to a recent rebound in local equities on bets of a revival in company earnings, low-interest rates and an increasing chance of another five-year term for Prime Minister Narendra Modi in a national poll scheduled through May.

Strategist View

“It makes sense not to take any aggressive bets currently as the situation is still uncertain and it’s better not to deviate portfolios much from their benchmarks,” said Hemant Kanawala, equities head at Kotak Mahindra Life Insurance Co. in Mumbai.

The Numbers

Sixteen of the 19 sector indexes compiled by BSE Ltd. dropped, led by a gauge of metal stocks. Six of those indexes fell more than 1 percent. Twenty-six of the 31 Sensex members and 41 of the 50 Nifty stocks retreated. Both the Sensex and Nifty had held above the 14-day RSI level of 70 for eight days, a signal to some traders that they were overbought. Aluminum producer Hindalco Industries Ltd.’s 2.7 percent drop, its first in five days, was the steepest among Nifty members. State-owned refiner Indian Oil Corp. gained 2.8 percent as Brent crude futures dropped for a third day to its lowest price in more than two weeks. Karnataka Bank Ltd. dropped 2.9 percent, the most in a month, after reporting a fraud totaling 132.6 million rupees ($1.9 million). Consumer goods maker TTK Prestige Ltd. climbed 3.8 percent as its board will meet March 29 to consider a free-share issue. Guar gum polymer maker Vikas WSP Ltd. rose 5.8 percent after winning about 1.8 billion-rupee of orders.

Also read: India needs more, not less, globalisation for its workers to enjoy higher salaries

For the US Fed to virtually rule out further rate increases this year is a bearish indication.