New Delhi: Prime Minister Narendra Modi, during his visit to the US last week, urged foreign investors to bet on India, promising to bring more reforms and remove impediments.

He had started his first term with a similar promise as well. But data shows his government failed to sustain the initial rush of foreign investments that followed his election as India’s first majority leader in three decades.

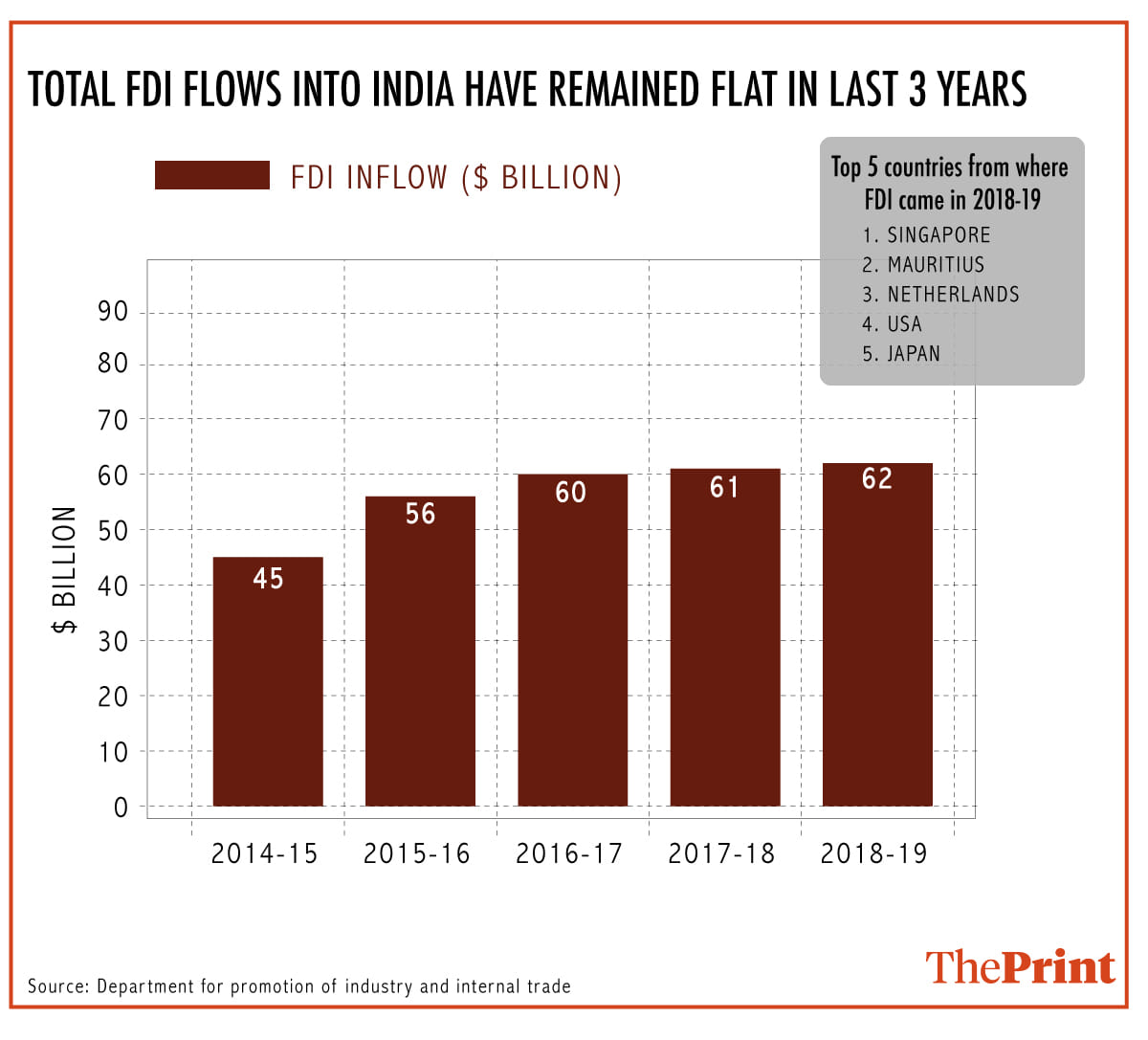

According to FDI data for Modi’s first term as PM (2014-2019), obtained from the department for promotion of industry and internal trade (DPIIT), there was a sharp jump in inflows in the first two years, but they plateaued over the next three.

In 2014-15, Modi’s first year in office, the total FDI inflows increased by 25 per cent, to $45 billion, over 2013-14. In 2015-16, they were up 23 per cent to $55.5 billion.

The year 2016-17 saw the rise slow to 8 per cent, with FDI inflows totalling $60.2 billion. They remained relatively static over the next two years, $61 billion in 2017-18 and $62 billion in 2018-19.

The total FDI inflows in Modi’s first tenure stood at nearly $284 billion, up 49 per cent from the five-year total of UPA-II, $190 billion.

Also Read: Modi meets US CEOs: Is India still an attractive investment destination in 2019?

Where is the money coming from?

Mauritius and Singapore, with whom New Delhi has signed investor-friendly tax treaties, remain the preferred route for investors to invest in India.

Many companies looking to invest in India route their investments through the two nations to benefit from the lower tax rates available under these treaties.

In 2018-19, Singapore replaced Mauritius as the most favoured route, according to DPIIT data, with inflows from the country accounting for nearly 37 per cent of the total FDI received by India. Mauritius accounted for 18 per cent.

Japan, the Netherlands, the UK, the US, Germany, Cyprus, France and the UAE are the other major source countries for investments in India.

Where is the money going?

FDI data shows that the flows have predominantly been in the services sector, which includes banking, insurance and research and development, followed by computer hardware and software, telecommunications and construction.

In 2018-19, FDI flows into the telecommunications and pharmaceuticals sectors fell sharply, by 57 per cent and 74 per cent, respectively, according to the data.

‘Good step, but more needed’

Lack of structural reforms, higher tax rates than other countries, and the need for many government approvals have been a sore point for investors looking to invest in India.

When he was voted to power in May 2014, Modi promised to remove impediments for foreign investors and improve India’s ranking in the ease of doing business index. He also announced liberalised FDI caps in many sectors, including insurance and defence, months after being sworn in.

The government launched the flagship ‘Make in India’ programme in 2014 to encourage domestic manufacturing and, in November 2015, it eased FDI norms in another 15 sectors.

Modi’s second tenure, which started in May, has followed a similar pattern.

In August, his government further relaxed FDI norms aimed at promoting investment and manufacturing, allowing 100 per cent FDI in contract manufacturing and removing conditions in single-brand retail trading.

Then, in another boost announced earlier this month, the government reduced corporate tax rates to effectively 25 per cent for all firms.

Analysts say the massive cut in corporate tax rates could encourage many foreign investors to start manufacturing in India, but needs to be accompanied by more reforms to make it sustainable.

“The corporate tax cuts definitely makes it more attractive for FDI investments into India,” said Anubhuti Sahay, a senior economist at Standard Chartered Bank. “However, other complimenting changes need to be made if we want to become more competitive globally and ensure a steady flow of foreign investment. These include land and labour reforms, reducing bureaucratic bottlenecks and fast-tracking approvals for projects,” she added.

‘More reforms on the anvil’

Addressing foreign investors in the US, Modi pointed to the series of reforms brought by his government, including the slashing of corporate tax rates, and promised that more were on the anvil.

“We have taken a number of steps to increase investment recently. After coming to power, we have done away with more than 50 laws that had become obstacles on the path of development,” he said.

“I must remind you that it has been only three to four months to the new government. I want to say from this stage that this is just the beginning. There is a long haul ahead of us. This is a golden opportunity for the global business community to partner with India In this journey,” he added.

He had made a similar appeal to US investors on a visit to the country in October 2014, where he interacted with several American business leaders.

Also read: Why people endorse Modi’s economic performance despite economic slowdown