New Delhi: Corporate tax collections fell below personal income tax last fiscal — for the first time in years — on account of the adverse fallout of the Covid-19 pandemic on businesses as well as the lower tax rates that came into effect two years ago.

Corporate tax collections levied on profits of firms contracted 18 per cent in 2020-21 while personal income tax collections fell by only 2.3 per cent.

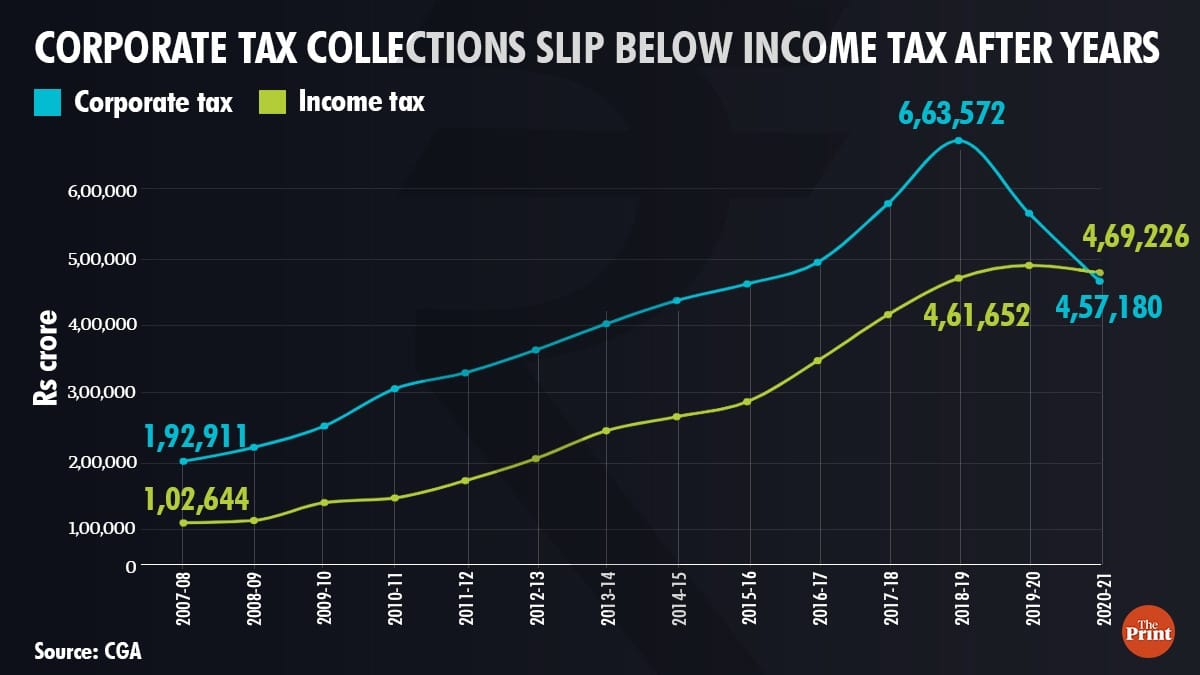

Data released by the Controller General of Accounts showed that corporate income tax collections were at Rs 4.57 lakh crore and personal income tax at Rs 4.69 lakh crore in 2020-21.

While corporate tax is levied on profits of companies, income tax is levied on incomes earned by individuals.

After coming to power for a second term, the Narendra Modi government had slashed corporate tax rates in September 2019 by around 10 percentage points. The effective tax rates were brought down to around 25 per cent for existing companies and to around 17 per cent for new companies in the manufacturing space.

Also read: Moody’s pegs India GDP growth at 9.3% for current financial year, 7.9% in FY23

Factors that affected collection

N.R. Bhanumurthy, vice-chancellor at Bengaluru’s Dr B.R. Ambedkar School of Economics University, said a combination of factors may explain the fall in corporate tax collections in 2020-21.

“A reduction in tax rates and contraction in GDP due to the pandemic could explain the fall in corporate tax collections,” he said.

Even though the manufacturing sector was able to resume activity after the initial months of lockdown in 2020, the services sector is still struggling and is either completely shut or operating at reduced capacity.

This has adversely impacted profitability of firms in sectors like civil aviation, entertainment and hospitality. Many small sized firms are also said to have shut down due to the pandemic.

Bhanumurthy pointed out that the resilience seen in personal income tax collections could be on account of better reporting of all incomes and possibly higher dividend payouts by companies in the absence of investment activity.

“Profits are used for expansionary activities and for dividends. But when future demand is uncertain, companies may have paid higher dividends to shareholders leading to an increase in personal incomes. Better reporting of incomes in forms like 26AS also may have added to the increase in personal income taxes,” he said.

Drop over last two years

Due to the sharp reduction in the tax rates as well as the economic slowdown, corporate tax collections have been falling over the last two years after peaking at Rs 6.6 lakh crore in 2018-19.

Corporate tax collections fell 16 per cent in 2019-20 and then 18 per cent in 2020-21. The collections have actually fallen by more than 31 per cent over the levels seen in 2018-19.

Tax return filings of firms also back this trend.

Nearly 15 lakh income tax returns were filed by firms in 2020-21 for income earned the previous year. However, only 13 per cent of these returns were for income ranges of more than Rs 5 lakh. The remaining 87 per cent of the returns were for income up to Rs 5 lakh.

In contrast, over 13 lakh returns were filed in 2019-20 (for income earned in 2018-19), with 18 per cent of the returns were for income ranges of over Rs 5 lakh. The remaining 82 per cent were returns filed for income of up to Rs 5 lakh.

Also read: Second Covid wave’s economic impact won’t be large, CEA KV Subramanian says