Mumbai: The Reserve Bank of India is set to deliver its first back-to-back interest rate cut since the Monetary Policy Committee was formed in late 2016 as the central bank grapples with a slowdown both at home and abroad.

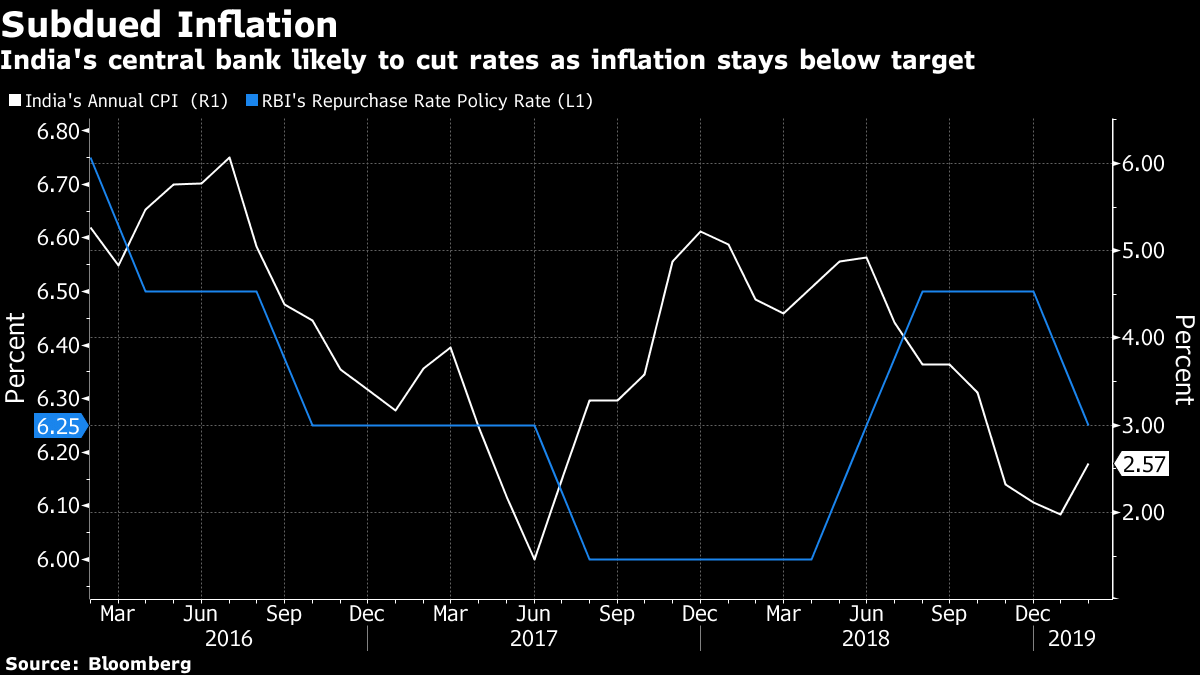

With inflation below the RBI’s 4 percent medium-term target, the six-member MPC headed by Governor Shaktikanta Das will probably drop the repurchase rate by 25 basis points to 6 percent on Thursday, according to all but two of the 43 economists surveyed by Bloomberg. Swap markets are factoring in more easing in coming months.

“Household inflation expectations have already been falling,” said Pranjul Bhandari, chief India economist at HSBC Holdings Plc in Mumbai. “Add to this the 7 percent appreciation in the rupee since October 2018, supported to a large extent by a favorable balance of payments, and the case for inflation remaining under 4 percent for longer strengthens.” She predicts another 25 basis-point cut in June to take the policy rate to 5.75 percent, the lowest since mid-2010.

The RBI’s decision comes a week before India’s sprawling, six-week election kicks off on April 11, in which Prime Minister Narendra Modi will seek a second term in office. Since taking over at the central bank in December, Governor Das has taken a series of steps to help support economic growth and spur lending.

The policy decision will be announced at 11:45 a.m. in Mumbai, followed by a press conference 15 minutes later by Das and other MPC members. Here’s a look at what else to watch out for in the statement:

Subdued Inflation

Inflation bottomed out at about 2 percent in January before picking up to 2.6 percent in February — still lower than the RBI’s forecast of 2.8 percent for the January-March quarter. Deflation in food prices is showing signs of abating while fuel prices have stabilized.

Core inflation, which strips out volatile food and fuel prices, has remained stubbornly elevated above 5 percent, giving policy makers reason to be cautious. But with demand in the economy cooling, the core measure is expected to ease in coming months.

“We believe the RBI will refrain from more aggressive easing given the uncertainty around the monsoon outlook, the inclination towards populist fiscal policies around elections, and the need to assess transmission by banks,” said Teresa John, an economist at Nirmal Bang Equities Pvt. in Mumbai.

Slow Transmission

Banks haven’t fully passed on the February rate cut to borrowers yet, putting more pressure on the RBI to ease policy to spur lending in the economy. The higher interest rate on deposits and competition from the government for small savings are holding back banks from lowering lending costs.

“Banks are not willing to cut rates as deposits and household financial savings are at historical lows,” said Prachi Mishra, chief India economist at Goldman Sachs Group Inc. Only eight banks have cut their lending rates by 5-10 basis points so far, she said.

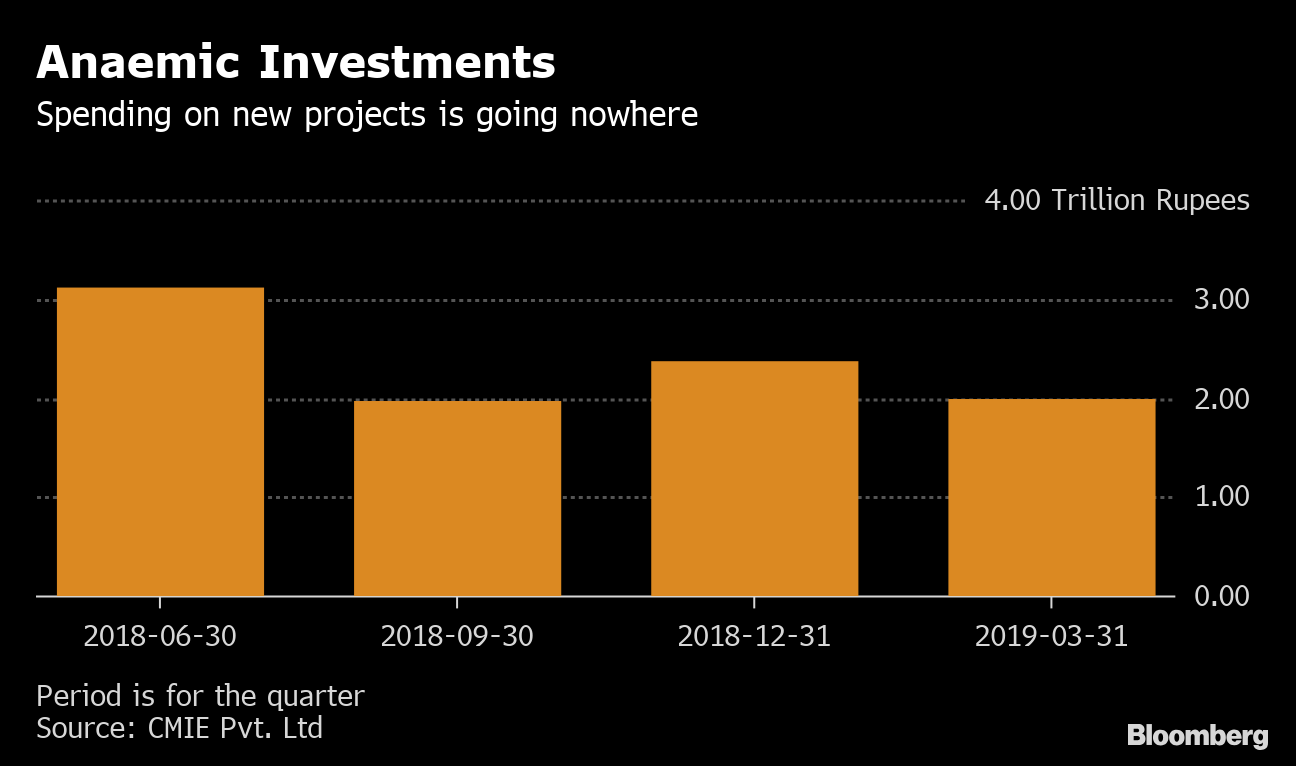

Growth Pangs

Businesses are curbing investments in an environment of mounting global risks and sluggish domestic demand. The total value of new projects in the quarter that ended in March fell to 1.99 trillion rupees ($29 billion) from 3.12 trillion rupees in the three months through June, according to data from the Center for Monitoring Indian Economy.

Tight liquidity conditions and a crisis in the shadow banking sector have hit consumption, dragging down overall growth. The central bank could tweak its growth forecast for the fiscal year to March 2020, having pegged it at 7.4 percent in February. The global outlook is also worsening, and with the U.S. Federal Reserve halting its rate tightening cycle, emerging-market central banks are getting some breathing space.

“The policy tone is likely to stay dovish, in line with the recent commentary by global central banks, led by the U.S. Fed,” said Kanika Pasricha, an economist at Standard Chartered Plc in India.-Bloomberg

Also read: India’s crony capitalism claims another victim — the RBI