New Delhi: Even as the automobile industry gears up for the best ever festive season this year with sales of passenger vehicles expected to cross 10 lakh units, deficit monsoon and high interest rate could play spoilsport.

Festive season, which begins in India with Chingam — the Malayalam New Year — and continues till the festival of Bhai Dooj, is significant for the auto sector as it contributes anywhere between 23-26 percent of automakers’ annual sales.

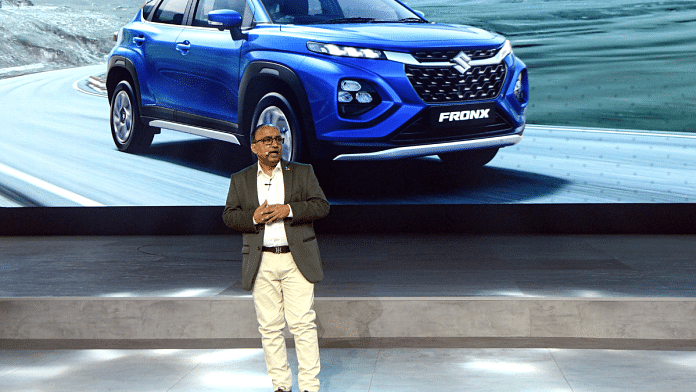

“The festive season starts on 17 August every year and ends on Bhai Dooj. This year Bhai Dooj is on 14 November, making the festive season a 83-day period,” Maruti Suzuki India’s Senior Executive Officer (Marketing & Sales) Shashank Srivastava said, speaking on the sidelines of the annual SIAM Convention Tuesday.

Srivastava added that this year, the industry is expected to see the best ever sales during the festive season, crossing one million units or 10 lakh units sales mark. “Festive period on an average accounts for roughly 23-26 percent of that year’s sales for a company. The year 2020-2021 was an exception when it accounted for 32 percent of the annual sales.”

This year’s expected sale is 40-41 lakh passenger vehicles, he further said. “So if we take 25 percent of this, sales should cross one million vehicles. It will be the first time that this will happen.”

Maruti Suzuki, Srivastava said, saw a 24 percent year-on-year increase in Onam sales this year. The previous high was in 2020-21, when the industry sold 9.34 lakh units as the festive period was longest at 92 days and there was a lot of pent up demand due to pandemic-induced lockdown in the first quarter of the year.

He, however, added that there are some uncertainties that could dampen the growth. “There are two red flags — one is the interest rates. They should not go up. They probably will go up if food inflation goes high. And food inflation can remain high.”

The second, he said, is rainfall deficit. “… rural sentiment should not be affected because of rainfall. Rainfall is currently at a deficit of 8%. If these two factors don’t happen then the industry will do fine,” Srivastava said, adding that currently consumer sentiments seem to be reasonably strong.

What’s driving growth — ‘fresh demand, healthy stocks’

Talking to ThePrint, Tarun Garg, the chief operating officer of Hyundai Motor India, said the industry expects a growth of around 9 percent in the festive season this year, which is very good as it is over a very strong base of last year.

“Last year (2022) saw the highest ever passenger vehicle sales. The base is already high. On that base, the industry growth from January-August is around 9-10 percent,” he said. “Hyundai has also grown by 9 percent. August was the start of the festival season with Onam, and has started on a very positive note.”

While in the last two years, stock levels were very low due to issues related to availability of semiconductors, that wasn’t the case this year, Garg said. Last year, Hyundai India had stock levels of 10-12 days as compared to 20-25 days now “which is very healthy”.

According to Garg, the pent up demand, which was a major factor in driving sales and pushing up waiting periods, is almost gone. However, the good part is that there is a good fresh demand coming in.

“Till about a year back, everybody was talking about so many pending bookings. Now no one is talking about that because pent up is gone. What is driving demand is – fresh demand, healthy stock levels at the dealerships and a plethora of new models that have been launched by Hyundai and by other players as well which have ignited the interest of the customers,” he said.

Also Read: India’s auto component industry is clocking billions but road to Atmanirbhar is still bumpy

Bottlenecks remain — rising inflation, rainfall deficit

Overall, the sentiment, including for rural sales, is positive. “There are some bottlenecks such as the interest rate that continues to go up, inflation and deficit in rainfall…But so far so good. Onam in Kerala saw a growth of 10 percent which augurs well for the festive season,” he said.

Echoing similar views, Manish Raj Singhania, president at Federation of Automobile Dealers Associations (FADA) told ThePrint that dealers are very optimistic about sales of passenger vehicles in this festive season.

“Supplies have increased with the dealers. We have up to 60 days of stocks… which is high but manageable. Dealers are confident that they will be able to liquidate the stocks,” Singhania said, adding that dealers missed the bus last year, because the demand was huge and they did not have the vehicles to give to customers.

Further, he said that the dealers of two-wheeler vehicles were a worried lot but a good August has brought some relief.

“Last year also we saw sales in the stressed rural market during auspicious days. The trend will continue. We will see a spike in rural sales in the festive season,” Singhania said. “But whether the spike will continue will need to be seen. Rural markets have been under stress and the deficit in monsoon could add to it. Urban markets, on the other hand, are galloping.”

Asked about discounts in the market during the festive season given the strong demand, Garg said for Indian customers now aspirations are driving the sales.

“Price as a factor has reduced its importance. Customers want safety, they want features, they want design, they want space, they do want connectivity and they want sunroof. They do not want to compromise,” he said.

He pointed out that in the company’s recently launched Exter, 75 percent of bookings are for the version with a sunroof.

Exter was launched in July with an introductory price in the range of Rs 6-Rs 10 lakh (ex-showroom).

“Now, who would have imagined that (in) a car of this price range, customers will want a sunroof. So this is the new India and we have to come out of this obsession with only price,” he said.

Talking about Diwali discounts, Garg further added that around Diwali, the company may still have better offers for consumers as compared to other months — in line with the company’s strategy.

“My only objection is that you are seeing discounts as one-factor driving sales in the festival. I think this is the mindset which we all need to change,” he said.

(Edited by Uttara Ramaswamy)

Also Read: Passenger vehicle wholesales hit record 39.7 lakh units in FY23, demand for UVs among drivers