New Delhi: India saw a 36 percent dip in its exports of refined petroleum products this year as compared to the last, government data shows. Experts put these fluctuations chiefly down to one major geopolitical event — the ongoing Russia-Ukraine conflict.

According to data from the Ministry of Commerce and Industry, India’s refined petroleum exports for FY 2023-24 (April-December 2023) stood at $61.41 billion as compared to $96.57 billion in FY 2022-23. India’s overall production value of these commodities also fell 30 percent to $316.7 billion this year from over $451 billion in the last, the data shows.

Trade in refined petroleum represents 3.55 percent of total world trade. India contributes 19.39 percent to this trade globally for the current financial year. Earlier, it held a 21.41 percent share of the same.

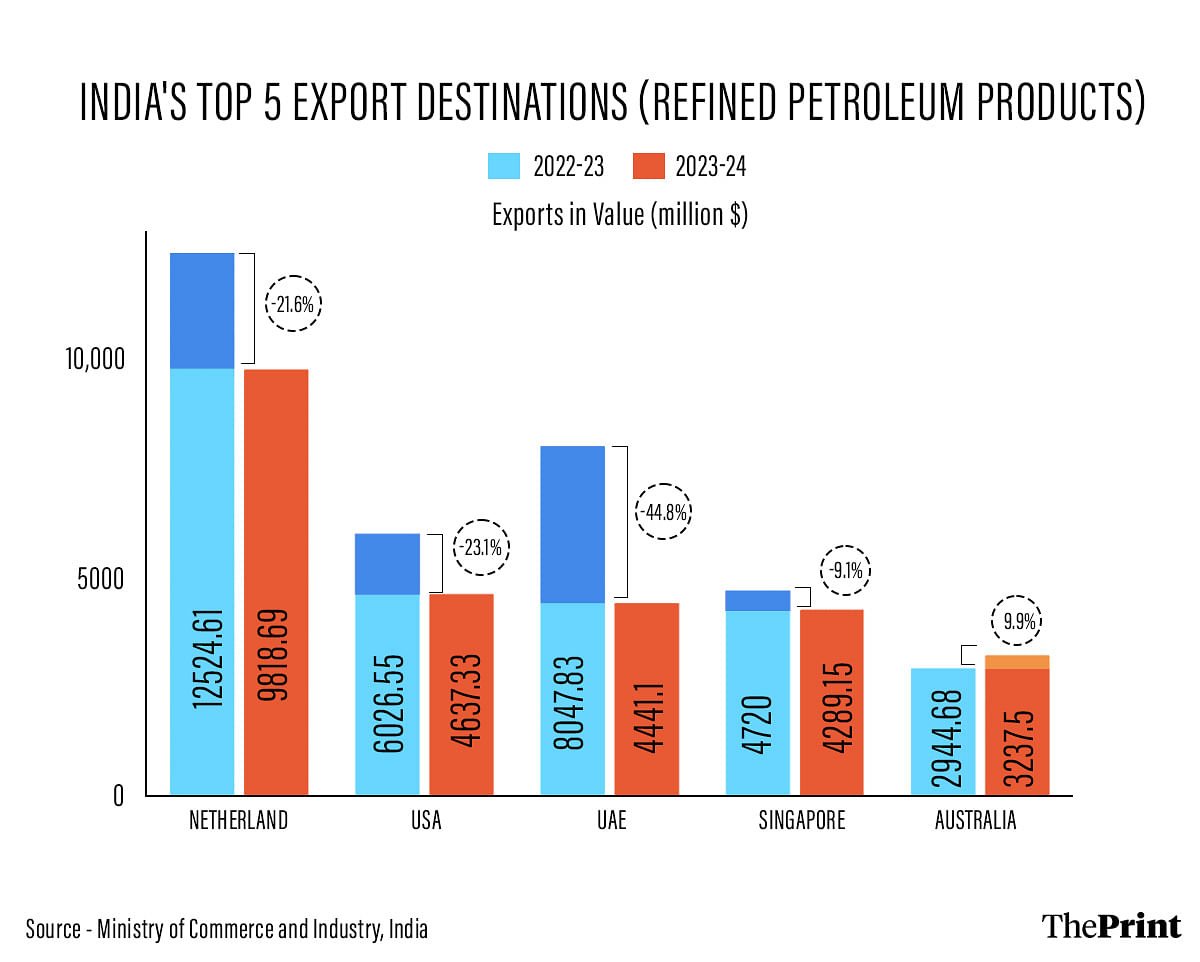

The ministry’s data further reveals that India’s exports to the Netherlands, US, UAE, and Singapore — the four biggest exporters of ITS refined petroleum products — have seen a decline.

Exports to the biggest importer, the Netherlands, have fallen from $12.52 billion in FY 2022-23 to $9.81 billion this year. This was followed by the US, where it fell from $6.02 billion to $4.63 billion; and the UAE, from $8.04 billion to $4.44 billion.

According to an official from India’s Petroleum Planning & Analysis Cell (PPAC), the decline in exports is mainly due to the Russia-Ukraine war, which has now been raging for more than two years. Coming under the Union Ministry of Petroleum and Natural Gas, the cell is tasked with tracking trends in the oil and gas sector.

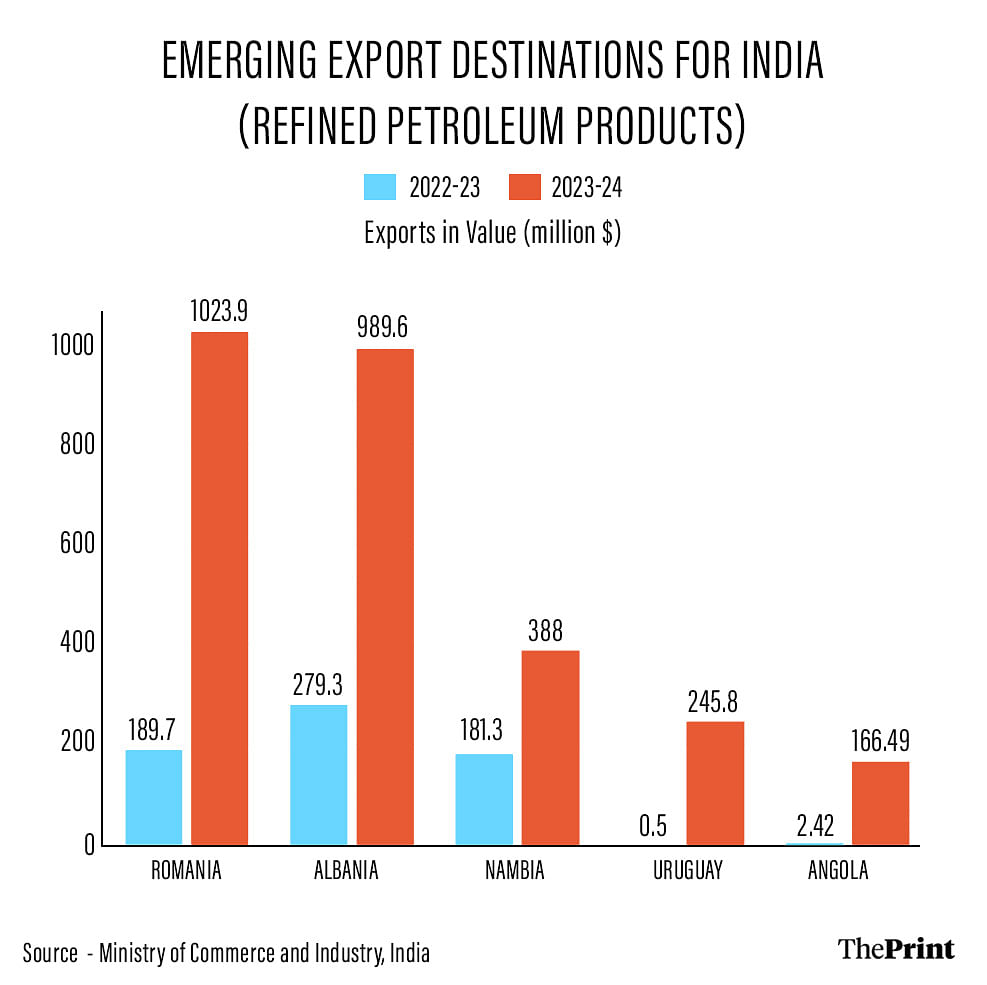

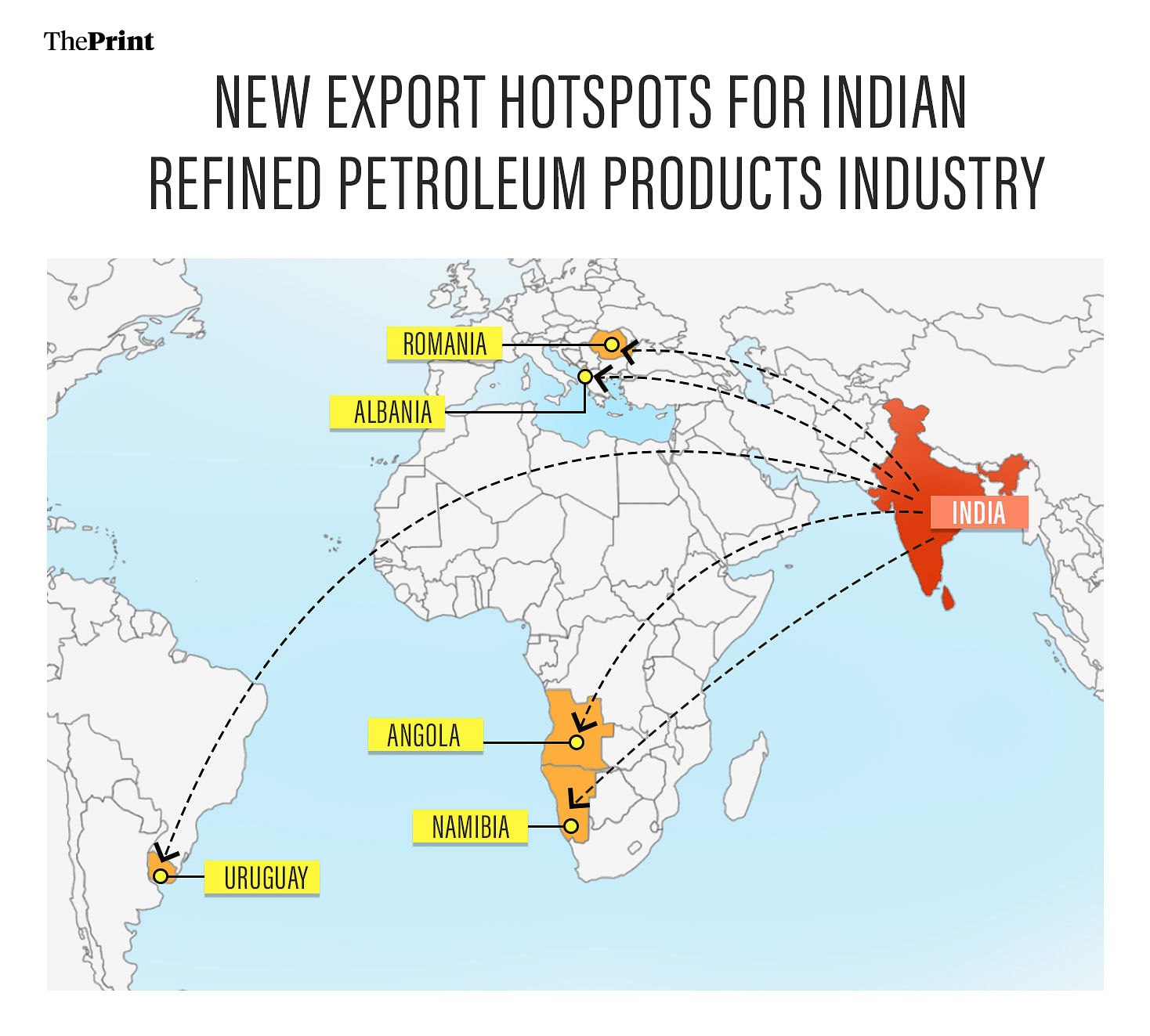

There is, however, a silver lining. The year FY2023-24 also saw India’s refined petroleum exports to several Asian, African, and even Eastern European countries rise substantially. These include Romania, Albania, Namibia, Uruguay, Maldives, Angola, Ecuador, the Philippines, and Hong Kong.

For instance, Romania’s imported refined petroleum products stood at $1.02 billion this year compared to $189.74 million in 2022-23 — a 439 percent increase. Similarly, Albania saw a 254 percent increase (from $279.32 million to $989.68 million) and Namibia 113 per cent (from $181.39 million to $ 388.06 million). Uruguay’s imports from India jumped by over 490 times, from $0.5 million to $245.84 million.

The decline in India’s exports of refined petroleum products comes at a time when there are two raging conflicts — the Russia-Ukraine war and the ongoing Israel-Gaza hostilities that have now spilled over to the Red Sea. This is also a time when the world is looking to switch to cleaner and greener energy in light of climate change.

Anish De, partner and global head of energy natural resources and chemicals at consultancy firm KPMG International agreed with this analysis, although he added that decarbonisation and the slow switch to green energy have been contributing factors.

“The rise that we saw in oil product exports in FY 22-23 was majorly due to the Russia-Ukraine war. Oil exports from Russia to the Western world were cut off, and it opened opportunities for India to import Russian oil and export more refined products. This has been corrected in the current financial year, leading to a fall in exports,” De said.

Also Read: Share of Asian countries in India’s exports is falling, Europe’s is rising. Why this is worrying

Cause of declining imports — Russia-Ukraine conflict, transition to green energy

After Russia invaded Ukraine in 2022, the latter’s Western allies in America and Europe issued sanctions against Moscow and boycotted fuel imports from the country.

Russia is the world’s largest exporter of oil to global markets and the second-largest crude oil exporter behind Saudi Arabia.

However, India did not cut off trade with Russia. Instead, while global oil prices shot up due to the war, India began importing it from Russia at much lower prices and exporting a higher number of refined products.

According to import data from the commerce ministry, Russia remained the top supplier of oil to India in FY23. According to preliminary data from commodity market analytics firm Kpler, Russia accounted for 32.5 percent of India’s total oil imports that year.

Although India’s crude imports fell by 37 percent this year, its imports from Russia still saw 11 percent growth, going close to $35 billion in FY24 from $31 billion in FY23.

By contrast, in 2021-22 — that is, before the Ukraine invasion — Russian oil accounted for barely 2 percent of India’s total oil imports in fiscal year 2021-22.

According to De, while the Russia-Ukraine war has been the chief reason for the change in India’s refined petroleum exports, the global efforts towards decarbonisation have led to a fall in demand for petroleum products. The change is glaringly evident in the European and American countries that are more aligned toward meeting the decarbonisation target of 2030, he said.

To keep global warming to 1.5 degrees Celsius — as set by the Paris Agreement — global emissions need to be reduced by 45 percent by 2030 and reach net zero by 2050.

As for the Red Sea conflict, where Yemen-based and Iran-backed Houthi rebels have stepped up attacks on transiting merchant vessels in retaliation to Israel’s ongoing assault in Gaza, neither De nor the PPAC official believes its impact can be determined just yet.

According to the official, although the Red Sea conflict has increased freight charges by 25-30 percent on average globally, its impact on India is not significant yet.

De too believes it’s “too premature” to assess its impact on India’s economy.

“The impact of the Red Sea conflict on trade figures is inevitable, especially for the European market. It has increased the cost and time of shipping. However, the seriousness of the impact can only be determined in the longer run,” he said.

Expansion of Indian trade market

On 24 February, Prime Minister Narendra Modi signed a bilateral agreement with the UAE on the India-Middle-East-Europe Economic Corridor. Announced last September on the sidelines of the G20 summit in New Delhi, the corridor aims to extend from India across the Arabian Sea to the UAE, through Saudi Arabia before connecting through Jordan and Israel to Europe.

According to Vibhuti Garg, director of South Asia at the Institute for Energy Economics and Financial Analysis (IEEFA), given the geopolitical risks involved in its usual trade routes — such as the Red Sea — India is now looking at alternative trade ways to take its refined petroleum products to the Middle East.

Other potential markets, as seen this year, are the “emerging markets” of Asia and Africa “given not all countries in these regions have adequate refining capacity, especially Africa,” De added.

“India’s cost to produce in refineries is fairly efficient and the product output slate has flexibility to adjust to market needs,” he said.

In addition, the Indian government was also focused on increasing the domestic supply of refined petroleum products in the country, Garg said.

“As a measure, the government increased excise duties on the exports of these commodities,” she added.

But will India’s declining exports of refined petroleum products affect the domestic economy? Not significantly, since domestic demand remains robust, De said.

“The fall in this year’s exports cannot be seen as a major challenge to the Indian economy or Indian refineries. India’s domestic demand is robust and growing, so, it is a positive sign. The supply chain adjustments might appear as a shock, but it does not affect the Indian refinery ecosystem that much,” he said.

(Edited by Uttara Ramaswamy)

Also Read: Why Red Sea crisis could cost India—Modi govt sets energy goals but doesn’t follow through