Mumbai: With the loan moratorium benefit coming to an end on 31 August, banks have asked the Reserve Bank of India (RBI) to allow them a one-time restructuring of loans the borrowers availed while noting that this can be on a case-to-case basis.

When a loan is restructured — the revision of the original repayment schedule — banks need to set aside capital, known as provision in banking parlance.

The Indian Banks’ Association (IBA) has written to the central bank requesting for a dispensation so that they can restructure the loan without setting aside capital. The recast needs to be completed by September to prevent fresh bad loan creation, the IBA said.

“The repayment schedule for the loans sanctioned earlier is based on the pre-pandemic estimate,” the chief executive of a large public sector bank said on the condition of anonymity.

“However, post the pandemic those estimates changed. So you cannot ask them to pay according to the old repayment schedule,” the official told ThePrint, while explaining the rationale for the debt recast.

At the same time, banks have suggested that there is no need for a blanket debt recast, even for sectors like aviation and hospitality that are particularly hit due to the Covid-19 pandemic. They have suggested that the decision to extend debt recast for a particular entity should be left to them, which will depend on cash flows of the company.

“We have asked for restructuring and said the choice should be with the banker,” the official said. “Even if you take the aviation sector, not all the airline companies are having a problem. There are companies who are sitting on cash. So restructuring has to be done on a case to case basis, because then only you can conserve the value.”

Also read: The risky game Indian banks are playing as Covid loans moratorium nears its end

‘Should depend on viability of unit’

After the nationwide lockdown was imposed in the last week of March to contain the spread of the Covid-19 pandemic, the RBI had allowed banks to offer moratorium on repayment of term loans. The regulator also allowed deferment of interest on working capital facilities. These benefits are set to expire on 31 August.

“Debt recast should be based on the viability of the unit,” the chief executive of a mid-sized public sector bank said.

“If the issue is liquidity, which is temporary, then the bank should step in to help the company. However, if it is a solvency issue, then banks cannot do much. It is better to classify the account as non-performing and proceed for recovery,” the official added.

The IBA has communicated the contours of the debt restructuring plan to the banking regulator and emphasised that the decision should be announced as early as possible so that the exercise can be completed by September to avoid fresh bad loan creation.

Last week, Finance Minister Nirmala Sitharaman also said the government is actively engaged with RBI on restructuring of loans to help industry tide over the impact of the pandemic.

Also read: Why August rains hold the key to India’s economic recovery after erratic monsoon

Restructuring only for stressed firms

Banks also suggested that debt recast should be allowed to companies that are impacted only due to the pandemic.

Bankers by and large agreed that there is no need for the loan moratorium to be extended. The moratorium is only a temporary postponement of the problem and if business is not coming to normal even after months then there is a need to restructure the loan by revising the repayment schedule.

They said only assets that are standard and stressed as on 31 March and are not sub-standard should be considered for restructuring.

Last month, Deepak Parekh, chairman of Housing Development and Finance Corporation (HDFC) — the country’s largest mortgage lender — had also argued against further extension of the moratorium. He argued that even individuals and firms who have the ability to pay are taking advantage of the moratorium and not paying. Parekh said moratorium will hurt, particularly the smaller non-banking finance companies.

Other bankers like State Bank of India (SBI) chairman Rajnish Kumar have also argued against the extension of the loan moratorium and suggested debt restructuring instead.

A loan becomes sub-standard if the repayment is due for over 90 days. A stressed standard asset is when repayment is due but for less than 90 days.

While allowing moratorium in March, RBI invoked the standstill clause which means the asset classification remains the same as it was before the moratorium.

‘Companies opting for breather’

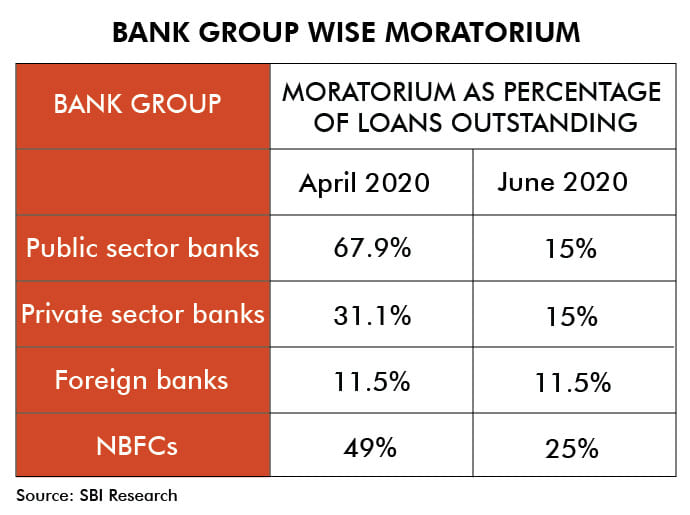

An SBI report Monday showed moratorium as a percentage of loans has fallen sharply in June as compared to April.

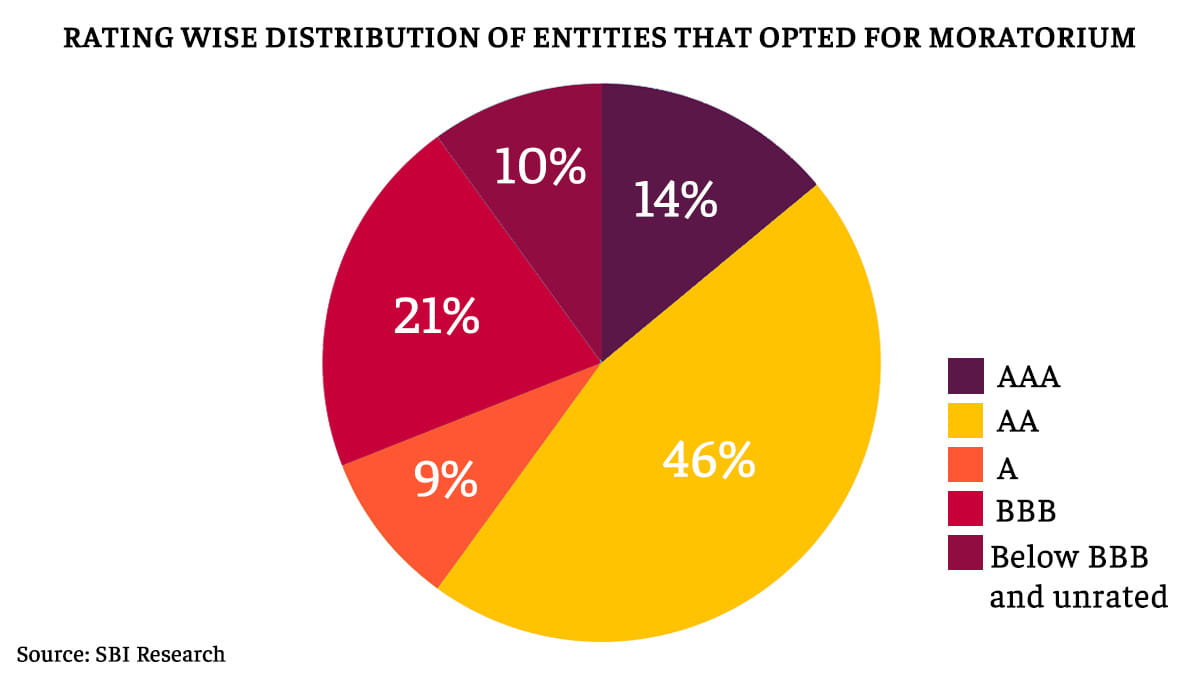

In addition, a rating-wise distribution of entities opted for moratorium showed, 69 per cent companies that have opted for the moratorium are rated A and above.

“As far as the corporate portfolio is concerned, our analysis clearly reveals that companies with adequate balance sheet strength have also opted for a breather. We believe such companies are purely using the moratorium to conserve cash in current uncertain times,” said the report authored by SBI group chief economic adviser, Soumya Kanti Ghosh.

Also read: Why RBI Governor Shaktikanta Das is not likely to risk another rate cut this week

As moratorium gets over On 31 august , Does ,Emi will start from 1st september…? Banks are supposed to help with one time restructuring which may include extention of moratarium .. But , still banks have not started restructuring at individual levels , as they may be awaiting guidelines.. So technically , until such period moratorium should be extended. My perdonal view is that moratorium to be extended till 31st december 2020 and wef Jan 50% emi to start for 6-9 months and then convert to regular emis.. By doing so it will be a win win situation for borrowers and banks as NPA will be less, Borrowers will get 3 months more time and will be able to pay 50% emi post 3 months and in next 6-8 months will be able to start paying emis normally..Request to RBI, Government to consider ..

Home loans restructure will decide by bank and moratorium allow for 2 year. Private banking sector has profit and middleclass will suffered..during covid /Corona period central government failed to solve middleclass problems. Many people are suffering but media also failed to solve middleclass problems. They are just reports on suicide or corrona. How many die or increase numbers of patients. Don’t you understand many lost their jobs working for half salary .