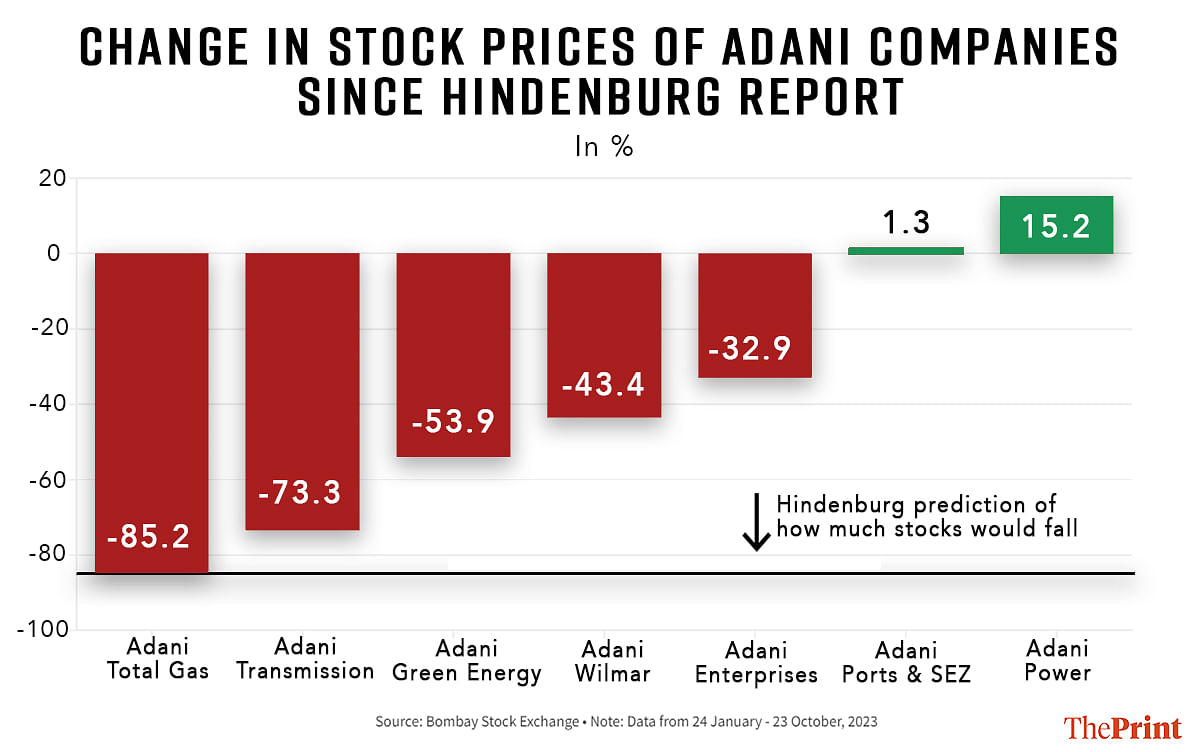

New Delhi: In the nine months since Hindenburg Research made public its report on the Adani Group, only one of its ‘seven key listed companies’ — Adani Total Gas — has met the US-based short seller’s estimate of being 85 percent “over-valued”, an analysis by ThePrint shows.

At the same time, two Adani Group companies, Adani Power and Adani Ports & SEZ, ended these nine months with higher stock prices than when Hindenburg released its report in January this year.

In its report, Hindenburg Research had accused Gautam Adani, chairperson of the Adani Group and third-richest person in the world at the time, of “pulling the largest con in corporate history”.

The report alleged several instances of corporate malpractice and illegal share price manipulation — all of which the Adani Group has denied. This alleged stock price manipulation, Hindenburg Research said, contributed to “sky-high valuations” for the Adani Group companies, adding that this could entail a significant downside for investors in the near future.

“Even if you ignore the findings of our investigation and take the financials of Adani Group at face value, its seven key listed companies have 85 percent downside purely on a fundamental basis owing to sky-high valuations,” read the Hindenburg report released on 24 January.

Simply put, this meant that Hindenburg said it was expecting the stocks of ‘seven key listed companies’ of the Adani Group to fall 85 percent following the publication of its report. These seven are: Adani Power, Adani Green Energy, Adani Total Gas, Adani Transmission (now Adani Energy Solutions), Adani Enterprises, Adani Wilmar, and Adani Ports & SEZ.

An analysis of daily stock trading data on the Bombay Stock Exchange (BSE) shows that of the ‘seven key listed companies’ of the Adani Group, only the stock price of Adani Total Gas has fallen 85 percent compared to its level on 24 January, in line with Hindenburg’s predictions.

The analysis is up to Monday (23 October) since stock markets were closed Tuesday (24 October) on account of Dussehra.

This could perhaps be a reflection of the relatively weak 7 percent growth in Adani Total Gas’s net profit in the June 2023 quarter, compared with the same quarter of the previous year.

Besides Adani Total Gas, Adani Energy Solutions saw the biggest fall in its stock price (73.3 percent) following the publication of the Hindenburg report on 24 January this year.

Adani Green Energy’s stock price fell by a significant 54 percent since the Hindenburg report came out, Adani Wilmar’s by 43 percent, and the flagship Adani Enterprises by 33 percent.

Notably, the stock prices of both Adani Power and Adani Ports & SEZ are higher now — by 15 percent and 1 percent, respectively — than when the Hindenburg report came out.

Adani Power’s stock price increase coincides with a remarkable turnaround in the company’s financial performance. Its profits have grown sharply over the last two quarters to Rs 4,851 crore in the March 2023 quarter and further to Rs 8,133 crore in the June 2023 quarter, following three successive quarters of losses.

Adani Ports & SEZ registered a profit of Rs 394 crore in the June 2023 quarter, compared with losses of around the same amount in the same quarter of the previous year.

Although it is important to note that the apparent relationship between stock price movement and net profits doesn’t always hold strong. For example, Adani Energy Solutions’ stock price fell significantly despite registering a profit of Rs 300 crore in the June 2023 quarter, up from a loss of Rs 0.17 crore in the June 2022 quarter.

(Edited by Amrtansh Arora)

Also Read: Adani Group overpaid for coal imports, then charged Indians extra for power, claims FT report