New Delhi: Electric cabs seem to be taking over the streets of Delhi, with green-plated cars and BluSmart taxis becoming an increasingly common sight. And there are numbers to prove it. Government data shows that the number of electric cabs registered in the capital has increased by over 15 times in the past five years. The trend for cabs using traditional fuels, however, is quite the opposite.

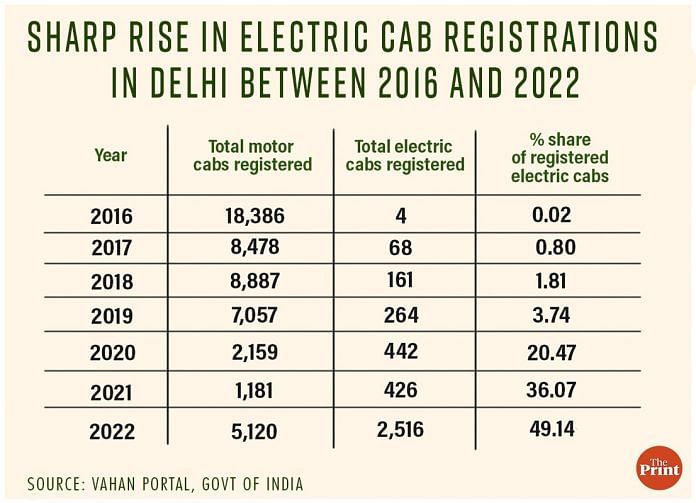

The government’s Vahan portal, which maintains a centralised database of all registered vehicles in India, shows that the yearly registrations of electric motor cabs in Delhi have increased from 161 in 2018, to 2,516 in 2022. For 2014, which is the year from when data is available, the number was 0, as it was in 2015.

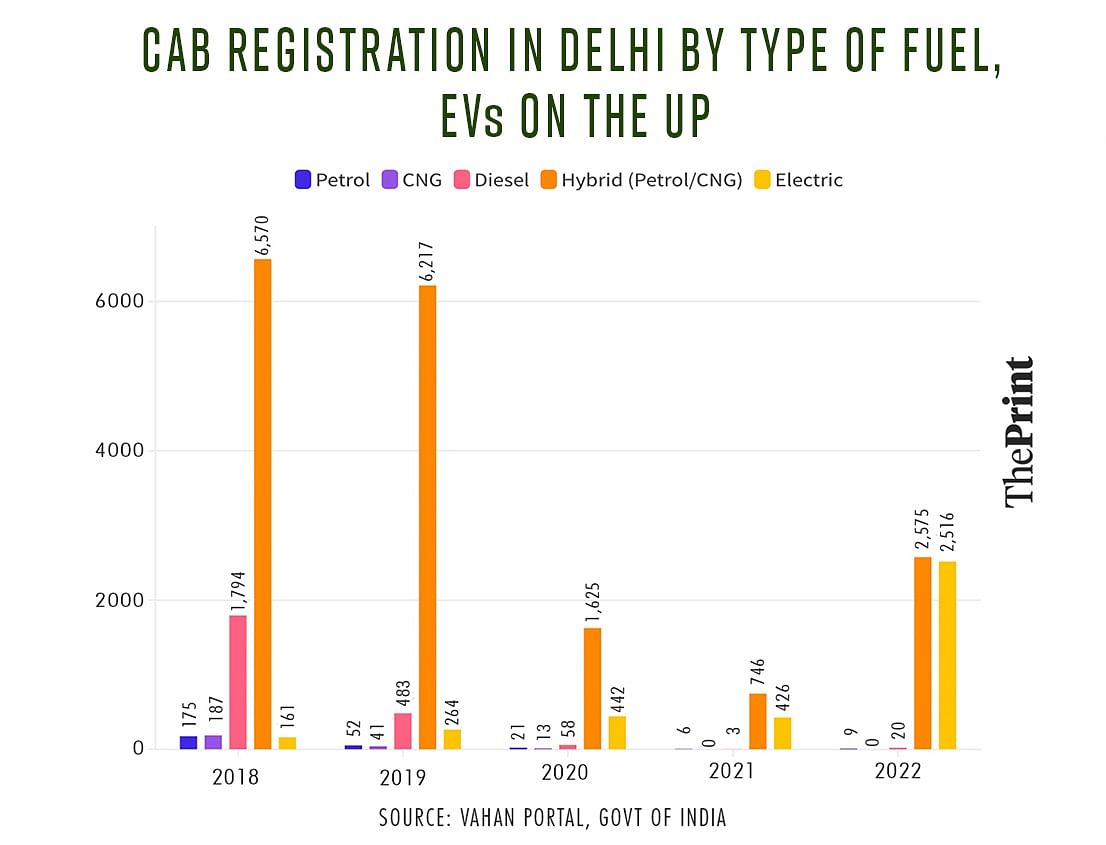

Meanwhile, the number of petrol, CNG, diesel, and hybrid cabs (petrol/CNG) registered annually have drastically reduced in Delhi over the past five years.

In 2018, the annual registrations for motor cabs running on petrol, CNG, diesel, and hybrid models (petrol/CNG) were 175, 187, 1,794, and 6,570, respectively. However, in 2022, the registrations dropped significantly to 9, 0, 20, and 2,575, respectively.

The yearly registrations for hybrid cabs have gone down by more than 60 per cent between 2018 and 2022.

The year-wise data from the Vahan portal also reveals that the share of electric vehicles in the total number of registered motor cabs has increased steadily over the past five years.

The share of electric cabs in Delhi was just 1.81 per cent in 2018, going up to 3.74 per cent in 2019, 20.3 per cent in 2020, 36 per cent in 2021, and 49.1 per cent in 2022. Electric cabs now account for almost half of all the cabs registered in Delhi.

The yearly registration of non-commercially operated electric vehicles (private cars) in the national capital also went up during the same period, from 257 in 2018 to 3,127 in 2022.

Experts attribute the surge in the national capital’s electric cabs to a confluence of factors, including escalating fuel prices, central and Delhi government subsidies, an ongoing effort to expand charging infrastructure, and the allure for cab companies to take the lead as “first movers” in a nascent sector.

“It’s simple economics,” said Pawan Mulukutla, director (integrated transport, electric mobility & hydrogen) at the research nonprofit World Resources Institute (WRI) India.

He pointed out that the market is “strongly in favour of electric cabs” because of the low expense of charging an electric vehicle (EV) as compared to fuelling traditional cars, making them more cost-effective in the long run.

For instance, Punit K. Goyal, co-founder, BluSmart told ThePrint that the average running cost of one of the company’s e-cabs is about Rs 1.6 per km. He claimed that this would be four to five times higher for a CNG vehicle and up to eight to nine times higher for petrol and diesel vehicles. Over a few years, this difference could amount to lakhs in savings.

Other perks of using EVs for cab companies include improved visibility, increased scope for entrepreneurship and venture capital funding due to the novel nature of the segment, and more respect for “innovation”, Mulukutla said.

There are a few challenges, however, such as training of drivers and varying charging rates at EV stations, say operators. But on the whole the future looks promising for electric cabs.

Also read: How lithium deposits found in J&K could help bring down cost of electric vehicles in India

Who are the top EV taxi players?

Companies such as BluSmart, eee-Taxi, and Evera cabs by Prakriti E-Mobility have been at the forefront of the trend by using all-electric fleets. Meanwhile, other leading ride services have either introduced some electric cabs in their fleets, for instance Uber, or like Ola, are in the process of doing so.

Several entrepreneurs with a background in renewable energy have shifted gears into the electric cab business. Others too highlight environmental consciousness and sustainability as their top USP.

Speaking to ThePrint, Gaurav Trivedi, chief business officer, eee-Taxi said: “We were the first electric feeder registered in the commercial space in 2016. We did it because we sensed that metros like Delhi were being labelled as among the most polluted cities — where transport accounted for 30 to 40 per cent of the pollution.”

Currently, eee-Taxi has about 100 electric cabs plying on Delhi roads and 100 more are to be introduced soon. It also provides services in Bengaluru and Hyderabad. The company currently caters to corporate and government clients and not the general public.

“When we started, EVs were not that alien a concept. Some original equipment manufacturers (OEMs) were manufacturing EVs at that time. Yes, it was difficult to explain to our clients how our cabs would not run on petrol/diesel but on a battery. Those companies that had sustainability goals or were trying to follow global emissions standards could be persuaded,” Trivedi said.

BluSmart and Evera cabs are both ride-sharing aggregators that cater to the general public and use their own electric charging hubs. Their respective founders’ background in the renewable energy industry inspired them to enter the nascent market, they said.

“I had built and founded three solar energy companies and have experience working in a very capital-intensive business, just like my co-founder Anmol Singh Jaggi. In 2018, I came up with the idea of starting a fully electric ride-sharing service because of our co-expertise and thus set up a network of electric charging stations,” BluSmart co-founder Goyal told ThePrint.

According to Goyal, BluSmart started with 10 cabs and one electric charging station in 2019 and now has a fleet of about 3,200 electric cabs in Delhi. It also runs cabs in other parts of the NCR, Mumbai, and Bengaluru.

Similarly, Nimish Trivedi, CEO and co-founder of Evera Cabs, has a fleet of 238 e-cabs and has signed an MoU with Tata Motors to introduce 2,000 more in Delhi. He told ThePrint he previously worked in the area of solar rooftops, which inspired him to venture into the arena of “solarised charging stations”.

Policy push since 2019

Nimish Trivedi of Evera Cabs said that entering the e-cab industry was not just “exciting”, but seemed like a “natural transition” given the policy push that was given to the sector since 2019.

“People earlier used to wonder what these green-plated cars were, but now they know what it is,” he said.

According to a report by the market ratings agency Crisil earlier this year, subsidies have played a major role in the penetration of EVs in India.

These include the central government’s Faster Adoption and Manufacturing of Hybrid and Electric Vehicle (FAME) scheme, launched in 2015, under the National Electric Mobility Mission Plan.

The government approved the second phase of this scheme, FAME II, in April 2019 with a total outlay of Rs 10,000 crore over a period of three years. One of the main objectives of the scheme, which comes under the Ministry of Heavy Industries, is to electrify public transport and commercial cabs by offering incentives for the purchase of EVs and establishing necessary charging infrastructure. In June 2021, the scheme was extended until March 2024.

The Delhi government has been providing an impetus to EVs too. In 2020, the Delhi Electric Vehicle Policy was introduced, under which incentives worth about Rs 100 crore have reportedly been offered as of last August. The Delhi government has also waived road tax and registration fees for EVs. The policy further granted 100 per cent subsidy for the purchase of charging equipment up to Rs 6,000 per charging point for the first 30,000 charging points.

Additionally, the Delhi government’s draft Delhi Motor Vehicle Aggregators Scheme, 2022, mandates a shift to an all-electric fleet for cab companies, food delivery firms and e-commerce entities by 1 April, 2030, and proposes a fine of Rs 50,000 per vehicle if the transition is not made. This policy is still awaiting approval.

However, while incentives have been helpful, EV cab players say that the road isn’t always smooth when it comes to managing costs and operational issues.

High capex cost, training woes, charging niggles

Electric cab companies insist that the future looks promising, but they also point to certain challenges.

Gaurav Trivedi from eee-Taxi emphasised that the capital expenditure cost for electric cabs is very high. According to him, electric vehicles cost considerably higher than similar models running on traditional fuels like petrol or diesel.

“While a Dezire will cost some Rs 8.20 lakh onwards, its equivalent model in EV would be about Rs 14.98 lakh,” he said.

The FAME II subsidy for buying electric cabs by commercial operators has been a boon, he added, but the capex investment for running EVs is still higher than for traditional engine cars.

“If you get FAME II subsidy of Rs 2.60 lakh, the prices will go down a little, but electric cabs will still be somewhere around Rs 12.6 lakh upwards. The capex is 30-40 per cent higher in comparison (to traditional models),” he said.

However, he pointed out that despite the high initial costs, the business could be adequately monetised as “the more one runs the car, the more the cost of running comes down”.

Nimish Trivedi also acknowledged the high investment cost but said that the business could be made profitable by “utilising their assets in the best way possible” and “keeping operating expenses minimal”.

He added that one of the bigger concerns for him was drivers’ preparedness in driving auto-transmission cabs since many were accustomed to manual cabs and needed training.

Meanwhile, Gaurav Trivedi noted that the lack of standardisation in charging rates at EV stations, which are run by different companies, posed a challenge.

“The cost will vary in different places because various startups and companies are factoring in their capex costs. Some argue that real estate is expensive, so they charge more. There is no standardised unit price for charging the cars,” he said.

The per unit price of charging an EV in the national capital ranges from approximately Rs 2.04 to Rs 15 or even higher, according to the prices updated in the Delhi government’s ‘One Delhi’ app.

Elusive profits?

Electric cab companies often extol the low cost of ‘fuelling’ their vehicles, but in the short term this may not necessarily translate into profits.

For instance, a 24 March story in The Ken reported that BluSmart was spending about Rs 2,850 daily per car in leasing, maintenance, and insurance costs, but earning only Rs 2,650 per car per day.

When asked about this, Goyal said that the goal was to increase the number of cabs in order to take advantage of economies of scale and optimise the low energy cost.

“The revenue, profitability, etc are difficult to calculate. Roughly, we are able to earn a revenue of Rs 3,000 in 12 hours for each cab. Once charged, an electric cab can go for about 230 to 250Kms (about five hours),” Gaurav Trivedi said.

Queried about the running time of Evera cabs after a charge, Nimish Trivedi gave a more conservative estimate of 180 km. He, however, declined to comment on cabs’ earnings.

What’s on the wishlist?

Lauding Delhi’s efforts to promote the adoption of electric mobility and claiming it ranked second only to London, Goyal said he hoped to eventually see “ultra low emission roads/zones” in Delhi.

The idea, he said, was that non-electric cabs would be required to pay an extra carbon tax, while EVs could be exempted from the charge. He argued that such a policy would encourage electrification. “Public transportation needs to be electrified ASAP in the face of severe pollution issues,” he said.

In contrast, Mulukutla believed that the best approach to promoting electric cabs is not through subsidies but by increasing supply-side options and implementing policies that encourage it.

“Demand for more electric cabs (in quantity and quality) should be made more evident in the market. Companies like Uber and Ola could openly announce how they are looking for a certain number of electric cabs in their goal to decarbonise mobility, which would naturally lead to better products and supply in the market,” he added.

(Edited by Asavari Singh)

Also read: EV sales cross 1 million mark in India. Govt can’t take its foot off subsidy pedal now