The ruling may deliver an even bigger loss of credibility because it shows everyone, from the ministry down to the auditor and investigator, in poor light.

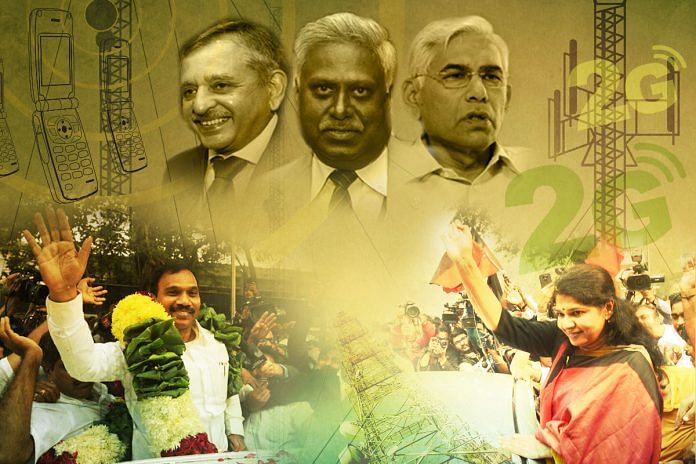

The political import of the 2G ruling has overshadowed the severe indictment of the Indian bureaucracy in this case; of how it failed institutions, misrepresented, confused and twisted facts to its convenience, and when the time came, showed little or no sense of collective responsibility.

At one level, you do feel for someone like H.C. Gupta, pronounced guilty by way of criminal conspiracy in the coal block allocation case for taking calls as the then Coal Secretary, which many argued were at the most an ‘administrative oversight’. But the 2G case showed us the other side of Indian bureaucracy.

Let’s sit back and examine – the secretary of the administrative ministry, in this case telecom, is a bureaucrat; the regulator (TRAI) is headed by a bureaucrat, also an ex-telecom secretary; the auditor who gives it the highest billing as a scam is also an IAS officer, who had just served out as secretary, financial services, in the Finance Ministry.

The investigators – the Central Bureau of Investigation and the Enforcement Directorate – are also headed by bureaucrats, though from a different service.

Together, the ministry, the regulator, the auditor and the investigator, ended up creating one big mess in which no recoveries were made, no one was found guilty, and the astronomical amounts of money that made their way into public consciousness are, to say the least, still unverified.

On the other hand, in these past seven to eight years, a growing sector saw a severe setback, jobs were lost, and India’s growth suffered a credibility jolt.

Worse, the recent ruling may end up delivering an even bigger loss of credibility because it shows all these institutions, from the ministry down to the auditor and investigator, in poor light.

This would scare any foreign investor. Until now, majority complaints over ease of doing business were on the unpredictability emerging from red tape, and a slow judicial system. Add to that the shortcomings of an enlightened, informed, more reformist bureaucracy, and you have a big cause for worry.

A closer reading of the ruling points to consistent ambiguity maintained by all actors in their language and use of jargon. The battle between the regulator Nripendra Misra and telecom secretary D.S. Mathur is recorded in full. At the end of the day, it was a successor-predecessor battle where Misra comes out looking better, though with little support from others.

This bares a big challenge for the government, of how things can go terribly wrong if the regulator and the administrative ministry are unable to strike the right balance. No one wants ‘regulator raj’ instead of the old ‘licence raj’, but at the same time, regulator oversight is critical to ensuring that rules of fair play don’t give way to cronyism.

This delicate balance is what builds the correct institutional framework for a sector expand and sustain beyond its initial growth phase.

The auditor has a very important institutional role in providing a different kind of oversight, which while keeping a check on the robustness of the system, also bares anomalies that should be looked into and investigated more deeply where necessary.

But what should be clear, at all times, is that the auditor, the policy-maker and the policy regulator cannot possibly interoperate. Because if they do, it will result in mayhem like what happened with the 2G auction.

Now, what was their wrongdoing? Well, that’s where investigating agencies must inspire confidence. While this case may move into appeal, it would be fair to conclude that the investigators have put up a poor show, unable to stitch together convincing evidence to nail a single case, or even a trail.

For all that was claimed, the investigative agencies should have at least been able to close all ends or points of doubt. Instead, what one gets is a tale of trails running cold, mostly once they move offshore, beyond the country’s sovereign limits.

That’s even worse. Because regardless of court rulings – whether they exonerate or pronounce you guilty – in cases such as these, the conspiracy will live on, doing more harm than good in the long run.

Which is why the declining track record of our investigative agencies, worsened by their susceptibility to political manipulation, is a big deterrence on foreign investors – a drag on building India’s economic profile.

The way the 2G case has gone so far, it appears to be turning into a monumental example of systemic failure – one effected by the very keepers of the system, the bureaucrats.

Sometimes feel having so many regulators – although TRAI is needed – is a cop out. It outsources decisions competent bureaucrats and principled ministers – A Raja does not fall in that category – are equipped to take. Does Indian Railways really require an external entity to fix the price of tickets or freight charges, normal commercial decisions it should be taking, day in and day out. I think in 2 G, Raja became an unstoppable force. If the PM and FM could not resteain him, he was hardly likely to listen to Secretary, DoT or Chairman, TRAI. Coalition compulsions have been a fact of political life in several governments, but some red lines should be enforced.

Now the “cover up”of what is a motivated and incredibly poor judgement starts as does the cover-up of Raja and the politicians – and if anything this article represents poor journalism at best, and motivated false analysis at worst. Some basic points

1. Are we denying that the process by which the allocations were made were wrong ie. sudden change of conditions, suddenly people with foresight that would rival the best soothsayers having drafts in hundreds of crores all prepared, even the camera evidence of assorted lalas pushing their way through. Answer – CANNOT BE DENIED

2. Is the circumstantial evidence of the money flows (much of which was “reversed” rather extraordinarily again with foresight of soothsayers), the trail of organisations, the “flips”of ownership all to be denied. Answer – ONLY IF ONE WANTS TO PRETEND NOTHING HAPPENED

3. Instead of casting blame where it really lies ie. at Mr. Raja, Mdm Kanimozhi and Mr. Behura along with their crony industrialists, we are blaming the people who may have been imperfect at worst but atleast highlighted the daylight robbery. Trying to cast the regulator’s objections as a predecessor-successor tiff is juvenile, and frankly a lie. Trying to cast Mr. Binod Rai’s efforts in poor light is motivated. Even if the number is wrong – and the number for the sake of argument is the lower one the CBI talked of ie. 20 or 30000 crores, we are talking of the BMC budget here. Answer – questioning the scale of a crime does not make a crime a non-crime

4. The “red herring”of hurt investors – guess what Mr. Dhal Samanta – if investors are coming into the country (take for the sake of example a Telenor who have pretty much failed in every market they entered barring the home market as a monopoly) do not perform the necessary due diligence and count on what are “questionable means” involving regulatory “arbitrage” (for the lack of a more polite word for what has been done here) and infact choose a cash strapped partner with NO telecom experience only for their ability to influence sweet deals out of the government – they have NO BUSINESS ENTERING THE COUNTRY. We need real investors, smart investors adn dedicated players – NOT FLY BY NIGHT CARPETBAGGER MNCs. Answer – Get real. If investors are upset that we actually enforce laws and stop crime, then you are perhaps canvassing the wrong investors.

My humble suggestion – dont’write for the sake of writing (or again worse motivations). Read up, and at the very least TRY to be objective and truthful