Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

BoJ’s Stimulus measures –

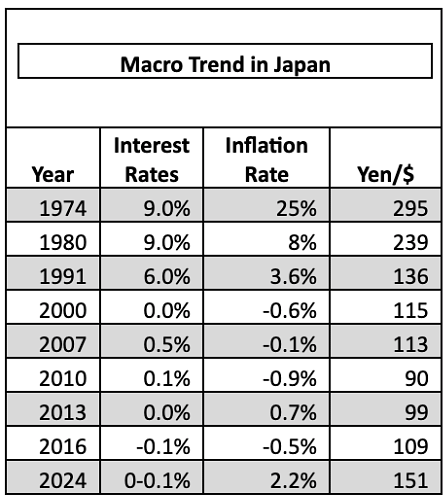

The Bank of Japan (BoJ) has opted to increase interest rates to 0.1% from 0% caused by the uptick in consumer prices and rise in wages. Inflation surged to 2.2% in Jan’24 marking the 21st consecutive month of price rise. Concurrently, Japanese companies have announced relatively robust wage hikes by 5.28% in negotiations signalling a potential shift in economic dynamics. Recently, for the first time in years, inflation in Japan was approaching BoJ target level of 2%. BoJ is likely to raise interest rates gradually with nuanced understanding of consumer sentiments and economic conditions. BoJ would reduce its possession of $475 bn of ETFs and decrease buying of corporate bonds to bring down its respective stimulus measures taken in the past.

Japan has witnessed higher energy prices owing to the geopolitical conflicts and Ukraine-Russia war that seems to have put pressure on demand for energy and food in the domestic economy.

Japan’s Nikkei 225 has touched an all-time high level of 40,787 points as of today. An attempt to abandon negative interest rates is greeted with optimism by the market. Japan’s manufacturing PMI reads 48.2 in Mar’24 over 47.2 in Feb’24. Services PMI reads at 54.9 in Mar’24 over 52.9 in Feb’24, signalling improving demand and resilience, bolstering growth momentum expectations.

With interest rates on the rise, Japanese consumers are poised to spend money accumulated over subdued years of spending. This would propel production levels among Japanese companies spurring corporate expansion and job creation, strengthening investments and capex push will be on the cards. The deflationary spiral for the last 8 years had lulled the consumer demand accompanied with supply overcapacity, and no financial innovations.

While the Japanese yen may stabilise at 150 relative to a dollar, BoJ will remain vigilant in managing government bond yields by not exceeding 0.1% to mitigate adverse impact on the household and corporate borrowing.

Back in the Era –

The Japanese economy took off in the 1950’s due to huge demand for Japanese goods overseas, and strong investments spurred by expanding domestic markets. Around the 1980’s, Japan had a comparable standard of living to other developed countries which led to appreciation of Yen within a few years however, the economy was also sustained by rapidly rising debts.

Nevertheless, Japan’s meltdown in 1990’s was preceded by an asset price bubble and excessive mortgage lending. The prices of real estate and stock prices which had skyrocketed, nosedived depressing the economy and the people triggering bouts of severe deflation. In the globalised world, either the foreign investors or the central banks are the major buyers of stocks, bonds and real estate, fuelling their prices, making them less stable and vulnerable to economic crashes.

Deflation in the Japanese economy had depressed the domestic demand and heavily indebted consumers began delaying their discretionary spending, waiting for prices to fall further. BoJ, outside their official mandate, had injected money to stimulate the economy by purchasing risky assets like ETFs and Japanese REITs in 2010. BoJ had set a yield curve policy in 2010 to buy government bonds to control interest rates and introduced targets and limits in the policy.

Japan entered negative interest rates in 2016 after it went into deep stagnation, resulting in soft yen. When prices fall, every unit of the yen is effectively worth more, and hard pressed borrowers are forced to pay loans in an increasingly valuable currency. Weaker yen also signifies strong exports, helps tourism by boosting buying power but at the same time, imports of energy and food get more expensive, hitting consumers who cannot keep up with the rise in living costs in the country.

Final Thoughts –

BoJ is known for maintaining a broadly accommodative monetary policy stance aimed to stimulate its economy from downward spiral since 1990’s bubble burst. BoJ has adopted zero or negative interest rates and large scale asset purchases to bring liquidity in the market. It has encouraged its people to spend more instead of parking money in bank accounts and banks are encouraged to lend more to uplift the consumption and production sentiments within. The Bank of Japan on witnessing the much awaited inflation has shifted its policy amid rising wages and high inflation thereby normalising its interest rates with a hike between 0-0.1 percent for the time being.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint