Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

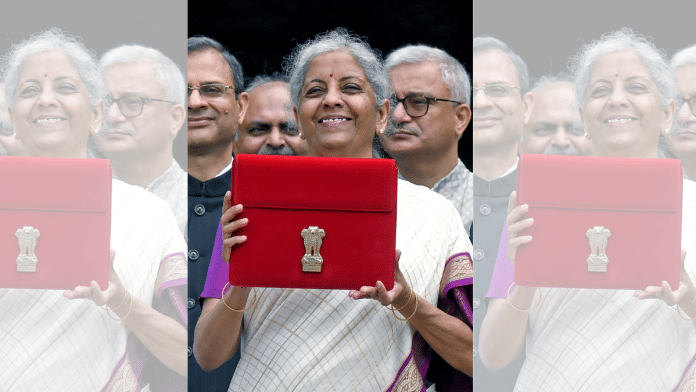

Inspired by the thinking of Professor Dudley Seers that the consumption pattern of the rich is relatively more capital intensive than that of the poor – in my view, it’s also relatively more import intensive – the International Labour Organization, back in the 1970s, launched an Income Distribution and Employment Programme as a part of its World Employment Programme. The Government of India’s budget for 2024-25, presented by Finance Minister Nirmala Sitharaman, does not directly address the challenge of inequality, but it does propose to address the challenge of unemployment through seven interventions.

Firstly, the Government will “provide one-month wage to all persons newly entering the workforce in all formal sectors. The direct benefit transfer of one-month salary in 3 instalments to first-time employees, as registered in the EPFO, will be up to Rs. 15,000. The eligibility limit will be a salary of Rs. 1 lakh per month. The scheme is expected to benefit 210 lakh youth.”

Secondly, the Government “will incentivize additional employment in the manufacturing sector, linked to the employment of first-time employees. An incentive will be provided at specified scale directly both to the employee and the employer with respect to their EPFO contribution in the first 4 years of employment. The scheme is expected to benefit 30 lakh youth entering employment, and their employers.”

Thirdly, the Government “will cover additional employment in all sectors. All additional employment within a salary of Rs. 1 lakh per month will be counted. The government will reimburse to employers up to Rs. 3,000 per month for 2 years towards their EPFO contribution for each additional employee. The scheme is expected to incentivize additional employment of 50 lakh persons.”

Fourthly, the Government “will facilitate higher participation of women in the workforce through setting up of working women hostels in collaboration with industry, and establishing creches. In addition, the partnership will seek to organize women-specific skilling programmes, and promotion of market access for women SHG enterprises.”

Fifthly, the Finance Minister has announced “a new centrally sponsored scheme for skilling in collaboration with state governments and industry. 20 lakh youth will be skilled over a 5-year period. 1,000 Industrial Training Institutes will be upgraded in hub and spoke arrangements with outcome orientation. Course content and design will be aligned to the skill needs of industry, and new courses will be introduced for emerging needs.”

Sixthly, “the Model Skill Loan Scheme will be revised to facilitate loans up to Rs. 7.5 lakh with a guarantee from a government promoted Fund. This measure is expected to help 25,000 students every year.”

Finally, for helping the country’s youth who have not been eligible for any benefit under government schemes and policies, the Finance Minister has announced “a financial support for loans upto Rs. 10 lakh for higher education in domestic institutions. E-vouchers for this purpose will be given directly to 1 lakh students every year for annual interest subvention of 3 per cent of the loan amount.”

These are excellent interventions. I welcome them. The Government has clearly recognized the severity of the unemployment problem India faces. I wish the Government had also recognized the problem of huge income inequality in the country and done something to address it. The Finance Minister could have at least proposed a new tax rate of, say, 40 per cent applicable on personal incomes exceeding Rs. 50 lakh a year.

Having said all this, let me raise the question of whether the interventions proposed by the Finance Minister to address the priority of Employment and Skilling, will deliver the intended outcomes?

I very much hope they will, but one cannot be sure. Take, for example, the case of the first intervention relating to the transfer of one-month salary in three instalments to a person newly entering the workforce in a formal sector. In case the person in question is simply unemployable, no one will employ him. There is reason to believe that there are many young people who are simply unemployable. But in case these people get equipped with the skills in demand under the fifth intervention, they should have no problem.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint