Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/

There is consensus in the European Union regarding the systemic risk of ‘human induced’ climate change and that it is crucial to control temperature rise within 2C to reinstate the ‘dynamic equilibrium of the carbon cycle’.

EU’s 2020 climate action plan committed to a net domestic reduction of at least 55% in greenhouse gas (GHGs) emissions by 2030 compared to 1990 levels and become the first carbon neutral continent by 2050. This Green Deal implements several complementary policies which cater not only to curbing emissions (e.g., target to produce 40% of energy thru renewable sources) but also towards enhancing ‘carbon sinks’ (e.g., plant 3 billion trees by 2030). However, the most interesting regulation and the source of our current conundrum is the CBAM – Carbon Border Adjustment Mechanism.

CBAM is complimentary to EU ETS (a cap-and-trade system for GHG emissions covering 40% of EUs emissions) and an alternative solution to the problem of ‘carbon leakage’ (i.e., exodus of European factories moving production offshore to avoid the cost disadvantage posed by ETS). To mitigate this risk, EU has been allocating free emission rights to some industries in the past. The CBAM will replace this interventionist policy and create a more market-oriented solution for carbon leakage.

The conundrum

EU’s July announcement on CBAM has been concerning for many – especially on the notion that it is a form of import tariffs and is thus against the WTO rules of open economies.

This notion is flawed.

First, on technical grounds, CBAM is not equivalent to an import tax – it is not a mandatory cost (lump sum or ad valorem) that has to be incurred whatsoever. It considers the ‘carbon intensity’ of imports –total emissions, carbon price these importers would have paid in a third country etc.- carbon prices in EU and a plethora of other factors before a cost is attached to an import.

Moreover, a quick glance at WTO’s founding principles details goals like – ‘nondiscriminatory treatment by and among members, opening of national markets for international trade, sustainable development and raise people’s welfare’ etc.

This leads us to the second reason demonstrating the compatibility of CBAM and WTO philosophies – opening of new and globalized Carbon Markets. It is a much bigger win for the world and WTO.

https://www.cer.eu/insights/avoiding-pitfalls-eu-carbon-border-adjustment-mechanism

The fact is that, very few countries have strived to make carbon a rare commodity – EU ETS accounts for 90% of global carbon markets (Korea having the only other successful system covering 66% of its emissions). On the other hand, China (world’s biggest emitter) has just opened its market in 2020 and US markets are regional only.

CBAM not only makes emission costly when trading with EU but also incentivizes trading partners to either design their own ETS (for exemptions on CBAM) or integrate their systems with EU ETS (to reduce the reporting/compliance costs of their exporters) or maybe even take the shorter route of simply adopting the EU ETS system (if they take their Paris commitments seriously).

Globalization of these carbon markets is inevitable in the long run.

For instance, the average carbon price in China hovers around $4.60; much below EU’s $49.4 per ton (2021). This is not reflective of true market conditions and will seize to serve its purpose. However, with CBAM in place, this carbon price discrepancy of Chinese exports (3rd largest exporter to be impacted) will be normalized (at least for the EU market). In time, this normalization would support emission optimization for all of China’s markets (not just EU) – a big advantage given China’s size of trade (domestic and international)!

Third, EU’s successful run with climate legislation – a 24% reduction in GHG emissions while the bloc has grown by 60% in the same period – has demonstrated that it is possible to decouple growth from emissions. The world should be more concerned with adopting this newfound ‘growth-emission dualism’ – CBAM provides a slow/phased route towards its adoption

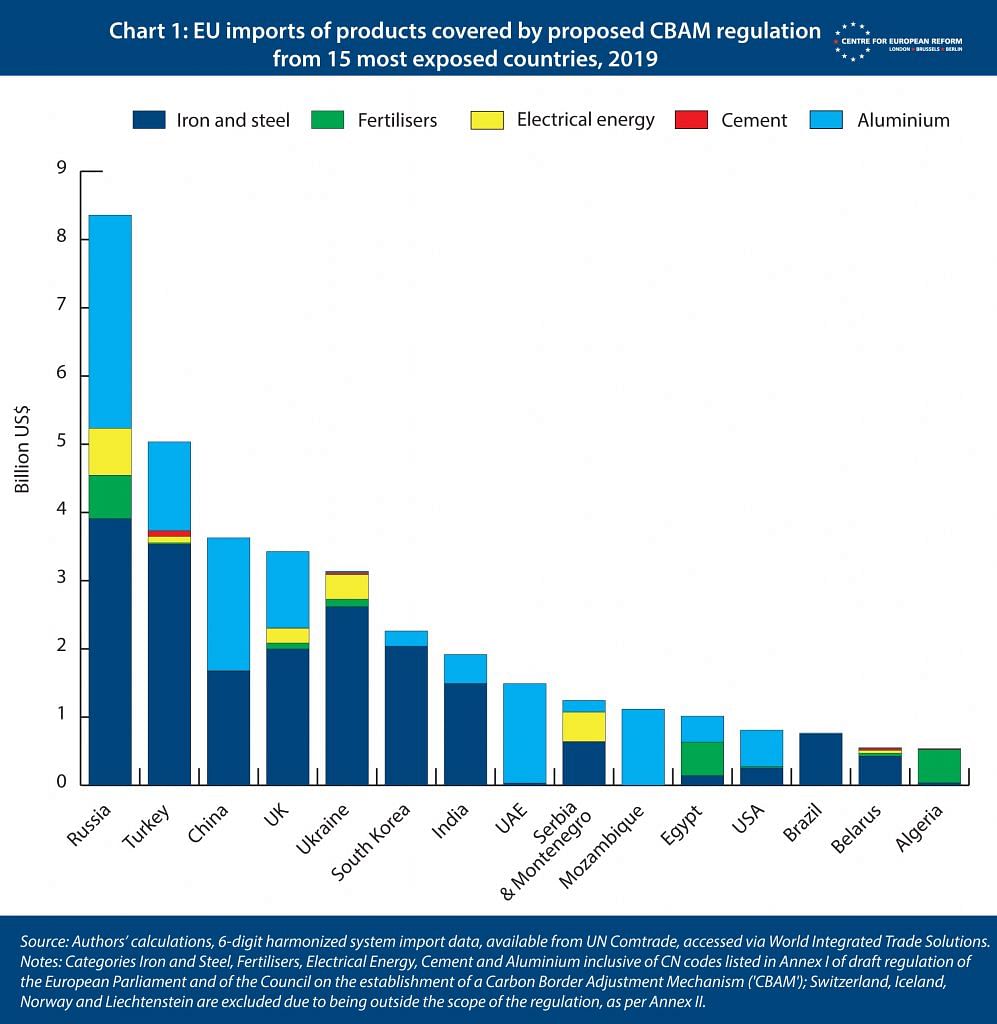

Fourth, CBAM also presents a route to bring WTO members like Russia, Turkey, and China (EU’s biggest trading partners affected by CBAM) into the mainstream geopolitical arena. WTO rule compliance reports for all these 3 countries rate them as ‘poor’ given their nationalist and autocratic policies and practices. CBAM pushes them to take climate change seriously (unlike other demagogues like Trump and Bolsonaro).

All in all, CBAM is EU’s effort towards leading the world on climate policy. It is not at odds with free world institutions like WTO. Instead, it will help integrate the world economies further on a unique welfare system. However, we are at initial stages right now and still need to work out coverage, pricing mechanism, technological platforms, institutional framework etc. A long road to travel -but a start, nonetheless.

Also read: SubscriberWrites: When Ganga says no – our respect for the goddess fuels our disregard for the river

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.

COMMENTS