New Delhi: Russia and China are “partners coming through the front door” and conduct relations without “arrogance”, Democratic Republic of Congo (DRC) President Felix Tshisekedi said in May.

He surmised that Russia and China would “come out on top” — a reference to jostling with the West over influence in Africa.

As President of the DRC since 2019, Tshisekedi represents a resource-rich country in the heart of Africa with a population of nearly 100 million and a GDP per capita of $653.7 (World Bank) as of 2022.

Catering to over 70 percent of the global demand of cobalt, the DRC is sitting on an opportunity to contribute to low-carbon transition and leverage its comparative advantage in cobalt to meet its developmental objectives, reduce poverty and boost shared prosperity.

But for all of this, it needs the support of global partners, like China.

What’s in it for Beijing? The DRC plays a significant role in China’s emerging electric vehicle (EV) industry — over three-quarters of Chinese cobalt imports from the Democratic Republic of Congo are directed towards this sector.

Cobalt is vital for lithium-ion batteries, which power most all-electric or plug-in hybrid EVs.

At the same time, China also aims to bolster domestic consumption and production in line with its ‘Dual Circulation Strategy’, adapting to a less globally interconnected economy while promoting internal growth.

Beijing’s climate commitments are also at stake here, crucial for its strategic positioning. Control of mining in DRC, in whatever measure, significantly enhances its competitive edge in the energy and tech sectors, posing a challenge to US ambitions for clean energy.

According to a 2023 paper by S&P Global, Chinese mining firm CMOC Group, viewed as the world’s second-biggest cobalt producer, holds an 80 percent stake in the Tenke Fungurume Mining (TFM) copper-cobalt ore project in the DRC.

And in January, Kinshasa confirmed that it was set to receive $7 billion in financing under a renewed ‘minerals-for-infrastructure’ contract between a group of Chinese state-owned construction firms and the DRC’s state-owned copper company, Gécamines.

With Chinese entities as primary stakeholders, this venture obtained considerable copper and cobalt reserves in the Katanga province. This was viewed as a revival of the Sino-Congolese mining enterprise, Sicomines.

The agreement came close on the heels of the formation of the national cabinet after a six-month delay, with Tshisekedi securing his second term in office.

According to Abhishek Mishra, associate fellow with the Manohar Parrikar Institute for Defence Studies and Analysis (MP-IDSA), the relationship between the DRC and China “is mainly an extractive one, marked by minerals and infrastructure for contract deals”.

Talking to ThePrint about the Sicomines agreement, Mishra says it “constituted an important deal in 2008 between both nations”.

But the bigger picture, he feels, is that “[i]t is not just a matter of who controls the value chains but basically how African countries’ developmental partners could support local value addition of commodities and tend to the local markets in the region”.

There is also a growing perception that China’s investments in Africa are not necessarily ones driven by mutual benefits but based on extracting most value for Chinese industries.

For instance, Zambia in 2021 became the first African country to default on its sovereign debt, a large part of which was owed to China. Against this backdrop, revival of the Sicomines agreement indicates the appetite for African countries to seek infrastructural aid from China in the form of Belt and Road Initiative (BRI) projects or otherwise.

Introduced by Chinese President Xi Jinping in 2013, the BRI had two main components: the overland Silk Road Economic Belt and the Maritime Silk Road. Initially referred to as the One Belt, One Road initiative, it later evolved into the BRI. The overarching goal was to enhance global utilisation of the Chinese currency, the renminbi, while dealing with connectivity challenges in Asia.

Figures available with AidData indicate that the DRC has undertaken as many as 253 projects in the region with Chinese funding to the tune of $13.7 billion. It does not, however, specify which of the projects were undertaken as part of the BRI, which the DRC officially joined in 2021.

Sectorally, most number of projects were allocated to the health sector (51) followed by transport and storage, government and civil society (42), other social service/infrastructure (26), education (20), and the industry/mining/construction sector (14).

In terms of sector-wise allocation of funds, industry/mining/construction received the most funds ($8 billion), followed by transport and storage and energy (with $2 billion each), and communication ($1 billion).

The number of projects undertaken in the DRC peaked in 2015 with 40, but declined post 2015, with seven projects undertaken as recently as 2021.

ThePrint reached the DRC Embassy in New Delhi for comment on relations with China, but received no response by the time of publication. This report will be updated if and when a response is received.

Also Read: With defence push, India looks to capture markets in Africa beyond western Indian Ocean

‘Minerals-for-infra’: The Sicomine arrangement

Until 2021, the DRC is said to have received $13.7 billion from China of which at least $5 billion were received in 2008. Moreover, according to AidData, there were upward trends of funding received in 2010 and 2014, with the peaks of $1 billion and $2 billion in 2011 and 2016, respectively. Post 2016, there has been a declining amount of funds and loans.

The China-DRC relationship has come to be exemplified by the Sicomines agreement, which stemmed from the DRC’s successful general election in 2006, prompting increased engagement from Beijing.

This resulted in a ‘minerals-for-infrastructure’ pact valued at $6 billion in 2008. Under it, China committed $3 billion to mining ventures and an equal amount to infrastructure projects, including construction of roads, railways, hospitals, schools, dams, and mine development.

In return, China was expected to receive 10 million tonnes of copper and 600,000 tonnes of cobalt. Between 2008 and 2014, approximately $459.764 million was spent on infrastructure development, with an additional $250 million allocated in 2015.

Asked about the revival of the 2008 pact, albeit in a new avatar, in January, Mishra says, “BRI is here to stay in Africa and in Congo, but at a much smaller scale as compared to what it was during its prime years 2013-19, marking the period before the pandemic.”

The beginning of the second decade of the 21st century took a huge toll on China, globally and economically, affecting the prospects of the BRI, he says, adding that the result was Beijing being more economical with funds allocated for projects.

How should one then view its commitment of $7 billion to the DRC? Mishra says DRC being an important country in terms of green energy and natural resources, the past few years have seen tensions between Chinese workers and locals, and a loss of narrative of sorts for Beijing.

This renewed agreement can be seen to give impetus to the relationship with the DRC as well as other African countries by extension through a show of good faith and reliance, he adds.

As part of the renewed ‘minerals-for-infrastructure’ agreement, the DRC will get 1.2 percent royalty from Sicomines copper-cobalt mine while Gecamines will market 32 percent of the mine’s production. In May, the DRC said it aimed to boost its stake in a cobalt and copper joint venture with Chinese firms from 32 percent to 70 percent, in light of concerns that the deal gave away too much of its resources with little material benefit.

Earlier, Tshisekedi established an ad hoc commission in March to align the negotiating positions of Congolese institutions overseeing the execution of such deals.

The commission, according to a Reuters report, asserted that DRC should seek a larger stake in Sicomines, citing the 2008 agreement’s failure to consider an estimated $90.9 billion worth of reserves brought by Gecamines to the deal. Consequently, the panel proposed doubling the infrastructure financing envelope from $3 billion to $6 billion, citing the inadequate allocation relative to Gecamines’ mineral reserves.

Additionally, it advocated pushing for compensation in renegotiation talks, including a $2 billion lump sum, due to alleged undervaluation of mineral sales by Sicomines.

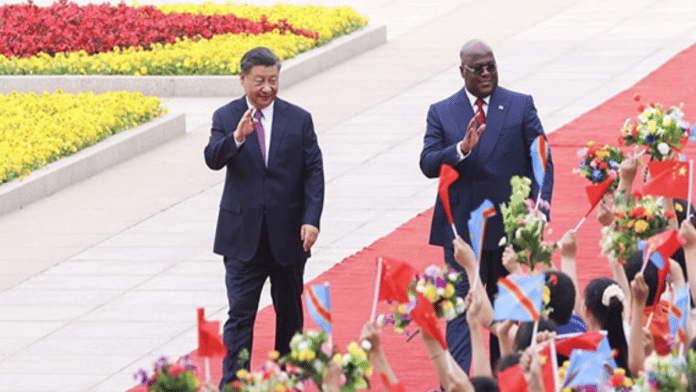

The inaugural state visit to China in May last year by President Tshisekedi marked the most recent instance in a series of diplomatic engagements between the two countries.

During the visit, President Tshisekedi and his Chinese counterpart Xi announced the elevation of their bilateral relationship from a mutually beneficial strategic cooperative partnership to a comprehensive strategic cooperative partnership.

China holds significant investments in the DRC, where it predominantly controls the lucrative mining sector through entities like Sicomines.

However, President Tshisekedi has publicly committed to revisiting Congolese mining contracts, particularly the 2008 agreement signed by his predecessor Joseph Kabila (2001-2019) with the aim of securing improved terms for his nation.

Erik Nyindu Kibambe, Tshisekedi’s chief of communications, had reportedly said during the Congolese President’s visit to Beijing last year that the DRC aimed for a bilateral agreement directly involving the states, rather than individual agreements with mining companies.

But as large-scale extractive enterprises enter the region, it is also important to note that artisanal miners are being displaced from mining sites, occasionally through forceful means. One report by Amnesty International suggests that “the manner in which some of the evictions are carried out violates international law and standards”.

Tshisekedi has in the past faced criticism for his inability to effectively harness the nation’s abundant mineral resources, estimated at $24 trillion, including cobalt and coltan, and uplift the impoverished populace.

Analysts note a substantial influx of funds into state coffers, yet little to no improvement in the living standards of the approximately 100 million inhabitants. According to the World Bank, the DRC ranks among the five poorest nations globally. Furthermore, it is hemorrhaging wealth due to ongoing conflict in eastern regions, stemming from the aftermath of the Rwandan genocide, which has endured for nearly three decades.

Manavi Sharma is an intern with ThePrint

(Edited by Amrtansh Arora)

Also Read: India to fund solar energy projects in Africa, $25-mn infusion ‘gets in-principle nod’