(Bloomberg) — The new year opened much as the last one ended, with markets rising, Wall Street confidence intact and little sign the forces that powered 2025 have run their course. What’s less clear is how long the cross-asset synchrony can last.

Global stocks gained on January’s first session, extending a run that carried through much of last year as enthusiasm around artificial intelligence, easing inflation and supportive central banks overwhelmed trade disputes, geopolitical strain and stretched valuations. For investors, it reinforced a simple lesson: taking risk paid.

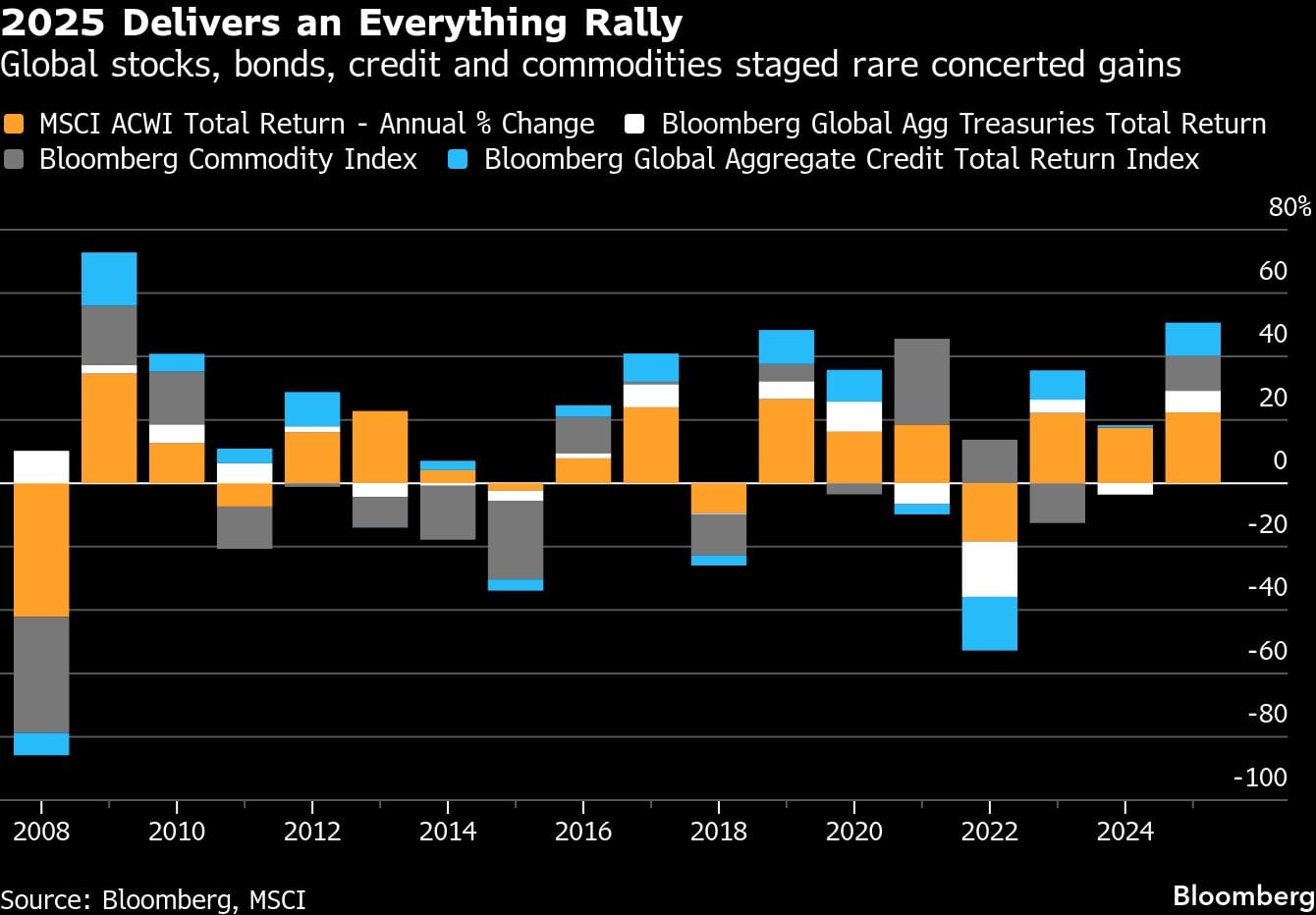

What made the year unusual, however, wasn’t just the strength of the rally but its reach across asset classes. Stocks and bonds rose together. Credit spreads tightened again. Commodities advanced even as inflation pressures eased. Gains were broad, sustained and unusually well aligned. By year-end, financial conditions had eased close to their loosest levels of 2025, underscoring rising valuations and a convergence of investor expectations around growth and AI.

Measured across global stocks, bonds, credit and commodities, 2025 delivered the strongest cross-asset performance since 2009 — a year marked by crisis-level valuations and sweeping policy intervention.

That alignment made diversification appear effortless — and in doing so, obscured how much depends on the forces that drove gains over the last 12 months remaining the same. When assets meant to offset one another move in the same direction, portfolios become less protected than they appear. Returns accumulate, but the margin for error narrows.

“We believe that 2025 has shown the risk of a diversification mirage,” said Jean Boivin, global head of the BlackRock Investment Institute. “This is not a story about diversification across these asset classes providing protection.”

As markets move deeper into 2026, the concern is not that last year’s rally was irrational, but that it may be difficult to repeat. Wall Street’s outlooks remain anchored to the same drivers — heavy AI investment, resilient growth and policymakers able to ease without reigniting inflation. Forecasts compiled by Bloomberg News from more than 60 institutions show broad agreement that those forces remain in place.

That optimism rests on a market that has already priced in a lot of good news.

“We are assuming that the torrid pace of valuation expansion we have seen in some sectors is not sustainable nor repeatable,” said Carl Kaufman, a portfolio manager at Osterweis, referring to AI and nuclear-related stocks. “We are cautiously optimistic that we can avoid a major collapse, but fearful that future returns could be anemic.”

The scale of last year’s rally helps explain why US stocks returned about 18%, marking a third consecutive year of double-digit gains, while global equities delivered roughly 23%. Government bonds also advanced, with global Treasuries up nearly 7% as the Federal Reserve cut interest rates three times.

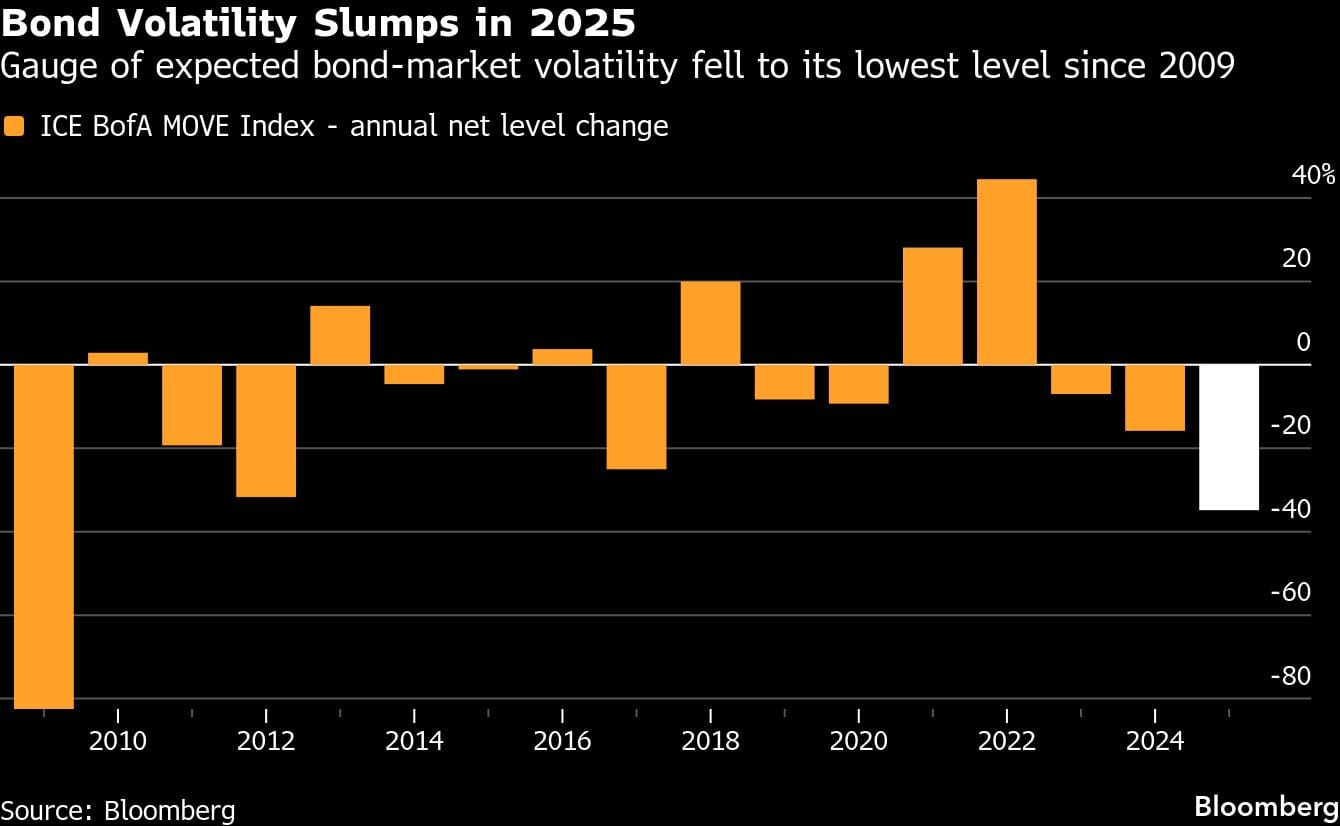

Volatility fell sharply and credit followed suit. Measures of US bond-market swings recorded their steepest annual decline since the aftermath of the financial crisis, while investment-grade spreads tightened for a third straight year, leaving average risk premiums below 80 basis points.

Commodities joined the advance. A Bloomberg index tracking the sector rose about 11%, led by precious metals. Gold reached a series of record highs, supported by central-bank buying, easier US monetary policy and a weaker dollar.

Inflation remains the fault line. While price pressures eased through much of 2025, some investors warn that energy markets or policy missteps could quickly reverse that progress.

“The key risk for us is whether inflation finally returns,” said Mina Krishnan at Schroders. “We envision a domino of events that could lead to inflation, and we see the most probable path beginning with a rise in energy prices.”

The tension is visible beyond markets. The world’s 500 richest people added a record $2.2 trillion to their collective fortunes last year, according to the Bloomberg Billionaires Index, even as US consumer confidence fell for a fifth consecutive month in December.

Last year also marked a comeback for old-school Wall Street diversifying strategies. The 60/40 portfolio which splits bets between stocks and bond returned 14% just as an index tracking the so-called risk parity quant strategy jumped 19% for its best year since 2020. Balanced strategies are yet to see investors chasing performance in that breed of funds that suffered long stretches of outflows.

Asset allocators in the main remain sanguine, arguing that economic momentum and policy support remain strong enough to offset richer valuations.

“We are looking to spend as much cash as possible to take advantage of the current environment,” said Josh Kutin, head of asset allocation for North America at Columbia Threadneedle Investments. “We really are not seeing any evidence that we should be concerned about that downturn in the immediate future.”

–With assistance from Ye Xie.

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.