New Delhi: The trade war between the US and China is hardly abating, but even in the melee of new headlines, a particular export from China has attracted considerable attention — rare earth elements (REEs).

According to various estimates, China presently accounts for approximately 80 per cent of the “mining, refining and processing” of REEs, a group of 17 elements which are used for a range of high-tech applications like superconductors, magnets and lasers.

Given the centrality of these elements in high-end technologies used for consumer devices and defence production, concerns have been raised that US’s reliance on China for these elements may put it in a vulnerable position.

For instance, when asked if Chinese monopoly on REEs threatens US national security, former White House official Dan McGroarty told CBS News, “Unchecked, yes”.

Moreover, the Chinese government has implicitly threatened to use REE exports as a strategic tool in the ongoing US-China trade war.

However, many experts have also argued that the concerns over any possible Chinese restrictions on REE exports are far-fetched.

With the trade war finding new faultlines everyday, ThePrint details what the REE exports mean in the ongoing dispute and the strategic value they hold for China.

Not that rare

Rare earth elements comprise lanthanum, lanthanide series elements like cerium and neodymium, and scandium and yttrium. They serve a variety of purposes: for instance, scandium is used in aerospace components, promethium in nuclear batteries, gadolinium in cancer therapy, and neodymium in cell phones.

Despite what the name suggests, these elements aren’t exactly rare. The problem, however, is that they are rarely found in sufficient quantities in a single location which makes their mining economically unviable.

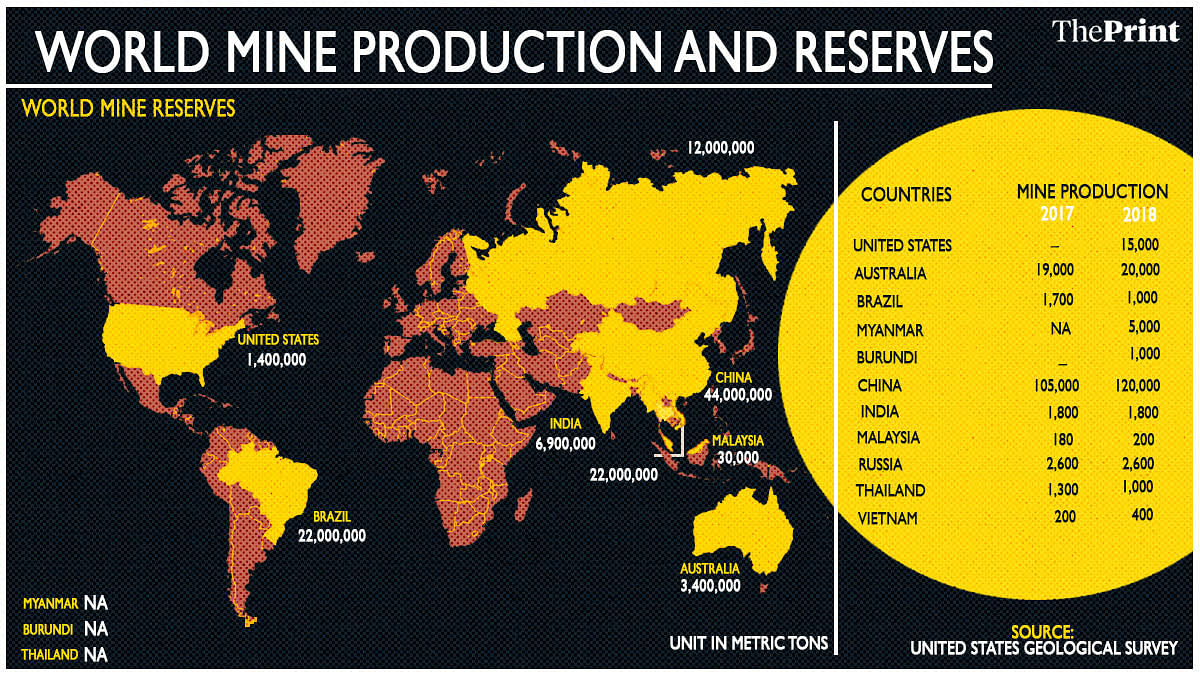

While China is believed to have the largest amount of REE reserves, other countries like Australia, Brazil, Malaysia, US and India also have good amounts of REE reserves.

But due to the huge environmental costs associated with the mining and processing of REEs, many developed countries are sometimes reluctant to do it themselves. The US had closed its Mountain Pass mine in California in 1998 — where the majority of the world’s REE supply was actually produced — after it was reported that radioactive water had seeped into nearby areas. The mine did open later but only after it adopted a more environment friendly technology.

Similarly, the Malaysian government recently asked Lynas, an Australian rare-earths mining company, to ship its radioactive waste back to Australia if it wanted to renew its operating license.

Also read: Apple iPhone, Amazon Echo production moving to India from China

China’s REE monopoly

In May this year, Chinese President Xi Jinping visited a rare-earth mining facility. Observers argued that Xi’s idea was to signal to the US administration that China could use REEs as a strategic tool in the trade war.

Providing further credence to such interpretations, a Chinese government official remarked, “It is normal that the top leader investigates relevant industrial policies. I hope everyone can interpret it correctly.”

Markets do seem to be cautiously listening to the rhetoric coming out of China. Given the possibility of REEs becoming a trade war weapon, their prices have been surging over the past few months.

This raises the question — how much can China hurt the US if it decides to radically curb REE exports to the US?

The two schools of thought

The Political Economy of Rare Earth Elements: Rising Powers and Technological Change, a 2015 book edited by Ryan David Kiggins, argued that REEs are a “strategic commodity over which states and other actors do and will compete for control”.

Broadly, there seem to be two schools of thought regarding China’s monopoly over REEs and their strategic utility.

One set of experts argue that REEs are not really rare — because vast amount of their deposits exist across a range of countries. Thus, in emergency situations, the US and its allies would make the necessary investments and create alternate supplies of REEs.

Meanwhile, the other set of experts argue that if China decides to weaponise REEs, the US firms and consumers would have to bear the costs. According to these experts, the key issue is that the refining and processing facilities predominantly exist in China — giving it a huge strategic advantage.

Is the strategic utility of REEs overstated?

According to Tim Worstall, senior fellow at UK-based policy think-tank Adam Smith Institute, the fears of China’s monopoly are overstated. Making his point, he said a sudden hike in REE prices by China wouldn’t affect the US economy adversely for two reasons.

Firstly, “the world uses products that contain rare earths. But near all of them are actually made in China”. Most of China’s rare earth production isn’t exported directly. Rather REEs are “exported embedded into products”, not as raw material.

Secondly, Worstall argued that “a near monopoly is a wonderful thing to have”, but if it is a “contestable monopoly”, then people would create alternate supply chains after “you try to throw your weight around in the market”.

“By far the cheapest and fastest way to bring more material into the market — if there was a disruption — is just sitting there in California. It’s not like starting from scratch,” Eugene Gholz, political scientist at the University of Notre Dame, told The Verge.

But there is a more fundamental geo-economic dilemma the US government and firms face with respect to ramping up the REE supply.

The actual volumes of REEs demanded by the global economy are relatively meagre. This market is already captured by a handful of Chinese players, making it hard for smaller players to survive. So, over the long-run, entering REE mining is not a profitable venture.

“Given the contradictory forces of national security and profits in the REE sector, only governments can influence significantly the outcomes in a positive way,” wrote political scientist Steve Dobransky.

If countries such as the US want to effectively challenge the Chinese REE monopoly by entering the mining process, they would need to absorb the losses associated with such a move.

Also read: US-China trade war, Russia inclusion make G7 summit a sinkhole for global governance

Nice to read the updates.

Actually the most important RareEarths Deposit in North America is Sandharvestable (no Drilling, Blasting, Crushing) from the SacandagaBasin (SB) of Upstate New York and SB Minerals are lower actinide RareEarths! A Comparison with Mountain Pass shows SB RareEarths are much much higher in Heavy REE! Think Great Sacandaga Energy Metals @GSEM Arthur Michael Ambrosino, CEO

Australian Strategic Materials in conjunction with Korean firm Zircon Technology have developed a new, cost effective method of producing rare earth metals, a technique which is clean and uses less that 45% less energy. Consequentially China is gazumped when it comes to REEs.

There is a source of REE that hasn’t been industrialised. I have been working on a patent application for the extraction of REE from red mud (Bauxite residue).

No acids, chemicals or solvants. This can and will remove the reliance on China’s strangle hold on the rest of the world. The global stockpiles of RM is estimated at 4 billion tonnes and growing daily.