New Delhi: In just two years, from 2021 to 2023, Germany’s exports of cars to the Central Asian nation of Kyrgyzstan surged a staggering 31,000 percent. The export of German cars to Kazakhstan saw a relatively slower, but still eye-wateringly high growth of 1,300 percent over this period. What happened in the intervening period? The Russia-Ukraine war, and the resultant Western trade sanctions on Russia.

It’s not just cars, and it’s not just Germany. Several European nations have seen their exports to the five Central Asian nations of Kyrgyzstan, Kazakhstan, Tajikistan, Turkmenistan and Uzbekistan surging by between 1,000 and 2,000 percent for merchandise as varied as ships, toys, industrial steel, and books.

These findings are part of an analysis by ThePrint of trade data from Eurostat, the European Union’s statistical office, comparing the January-September 2023 period with the same period of 2021, before the Russia-Ukraine war started.

This sudden huge spurt in exports from EU nations to the ‘-stans’ has given rise to speculation that Russia — facing tough Western sanctions since it began its offensive on Ukraine in February 2022 — may have found a way to beat some of these restrictions.

The allegation is that some of these countries — or entities based there — may be rerouting the sanctioned goods to Russia, although there is no way to prove this yet.

Adding heft to the argument is the fact that this growth — which admittedly comes on a low base — can be traced to the aftermath of the war, and that the spike in demand is not backed by a commensurate growth in the sizes of these Central Asian economies.

In fact, International Monetary Fund (IMF) estimates suggest at least three of them will end 2023 at a slower growth rate than 2022.

Also Read: Either Kyiv addresses Moscow’s security concerns, or we ‘solve this by force’: Putin

Zooming car exports

Among German exports to these countries from January to September 2023 (the period for which the latest data is available), cars account for nearly 14 percent — or €530 million out of €3.8 billion.

Of the €531 million worth of goods Germany exported to Kyrgyzstan in this period, about €228 million — or 43 percent — were vehicles. The volume of car exports to Kyrgyzstan from Germany was €0.72 million from January-September 2021, a 31,500 percent increase.

Of Germany’s €2.37 billion exports to Kazakhstan, €227 million or roughly 10 percent were cars, up 1,300 percent compared to January-September 2021 (€15.6 million).

Tajikistan and Uzbekistan accounted for tiny fractions of the total exports, and data for car exports to Turkmenistan was patchy.

Germany also seems to have more than offset any losses it might have faced by cutting off its exports to Russia by instead exporting to these Central Asian countries.

Germany’s car exports to Russia have declined by €459 million — to €158 million in 2023, from €617 million in 2021 — but the gain in car exports to just four of the -stans was over €500 million.

‘Floating structures’

Other items that registered a notable export growth include ships and boats and other water vehicles. While these Central Asian countries are landlocked, they do have some big lakes.

For instance, Kazakhstan received about €0.4 million worth of ‘ships, boats and floating structures’ from the EU in the first nine months of 2021, which jumped to about €8.23 million in 2023, a 2,000 percent rise.

Kyrgyzstan did not even receive a single such vehicle/carrier from the EU in the first nine months of 2021, but received €8.8 million worth of them this year.

Uzbekistan and Tajikistan also received water vehicles worth €1.8 million and €0.36 million, respectively, compared to €2,070 and €5,440, respectively).

Kazakhstan also saw a 1,000 percent jump in imports of iron and steel — €43.4 million in 2023, from €3.6 million in 2021 — from Europe.

Among the EU’s exports to Kyrgyzstan, toys, games and sporting goods rose to €21.4 million from €85,000.

Uzbekistan saw a 1,000 percent increase in imports of aircraft, spacecraft and their parts, €161.4 million in 2023 from €14.5 million in 2021.

Tajikistan recorded a rise in books and other printed material imported from the EU, €14.62 million from €0.04 million.

It’s not just Germany

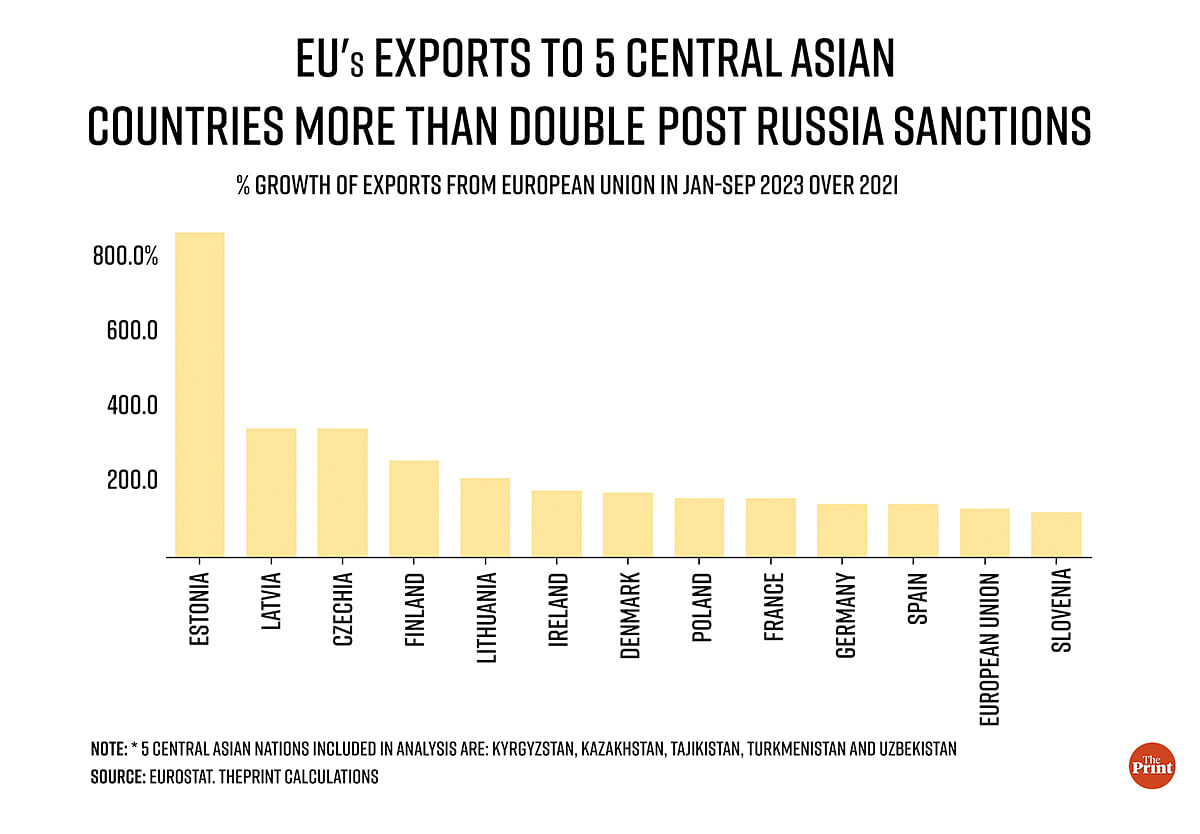

According to the data available with EuroStat, EU exports to Kyrgyzstan, Kazakhstan, Tajikistan, Turkmenistan and Uzbekistan grew 120 percent between January-September 2021 and January-September 2023.

Between January and September 2021, Estonia’s exports to the five central Asian countries of Kyrgyzstan, Kazakhstan, Tajikistan, Turkmenistan and Uzbekistan totalled €20.7 million. Cut to January-September 2023, exports had soared nearly 10 times to €197.6 million, according to data from Eurostat, the European Union’s statistical office.

A similar trend emerged in Latvia, a fellow EU member and Russian neighbour, where the exports to the five ‘-stans’ rose by more than 300 percent, to about €464 million from €105.6 million, in the same period.

Other countries that registered massive growth in exports to the five nations include: The Czech Republic (growth of 338.6 percent, to €812 million from €185 million), Finland (250 percent, to €374 million from €106 million), and Lithuania (200 percent, €1,244 million from about €405 million), Poland (€1,633 million from €644 million), and Germany (140 percent, to €3.8 billion from €1.6 billion).

Can Russia be gaining from this?

In July, the US Treasury Department said “the use of third-party intermediaries and transshipment points outside of Russia… [is] one of the most common tactics Russian entities have used to continue their importation of foreign-made electronics and technology”.

According to the US think tank Atlantic Council, there are roughly 13,000 designations where sanctions have been imposed on Russia.

The restrictions on exports cover dual-use goods — those with civilian as well as military uses — as well as luxury products, new and second-hand cars above a certain engine size, and certain advanced technology.

There are also targeted “export bans in areas in which Russia is vulnerable due to its high dependency on EU supplies”.

“This includes… quantum computing, advanced semiconductors, sensitive machinery, transportation and chemicals. It also includes specialist catalysts for use in the refinery industry,” according to the website of the European Commission, the EU’s political arm.

Following the sanctions, the EU’s exports to Russia fell to €28.63 billion in January-September 2023, down from €62.47 billion in 2021.

The EU is a European bloc with 27 member states. The sanctions imposed on Russia are largely led by the EU and G7.

While it is important to note that the growth appears larger because of the low base, it is equally significant that the spurt has happened at a time when the economic growth in three of these countries is predicted to slow down or stagnate.

In October 2023, the IMF estimated that the Kyrgyz Republic would end 2023 with an economic growth of 3.4 percent, down from 6.3 percent in 2022.

Uzbekistan is expected to see growth slow to 5.5 percent in 2023, from 5.7 percent the previous year. Tajikistan, meanwhile, will see growth slow to 6.5 percent from 8 percent over the same period, according to IMF estimates.

Meanwhile, Turkmenistan is expected to see its growth accelerate to 2.5 percent, up from 1.6 percent in 2022, Kazakhstan’s economy is forecast to grow to 4.6 percent in 2023 from 3.3 percent in 2022.

‘Evasions game’

In an August 2023 article published in Belgium-based magazine ‘International Politics and Society’, Ukrainian journalist Anna Romandash said Russia’s sanctions evasion game is quite strong.

She mentioned how Western-manufactured chips and microprocessors were found in the weapons recovered from Ukraine, based on a study by an expert group assessing the sanctions on Russia. Romandash also said some “shady” entities were enabling such trade to bypass the sanctions.

Kazakhstan, Kyrgyzstan and Russia (apart from Armenia and Belarus) are also part of the Eurasian Economic Union — an agreement that enhances the mobility of goods and labour between these countries, with fewer restrictions.

According to Robin Brooks, chief economist at the International Institute of Finance, the global association of the finance industry, there is a strong likelihood that there is a movement of Western goods from these countries to Russia.

Last week, Brooks took to ‘X’ (formerly Twitter), and wrote: “Trade patterns across Central Asia have gone nuts since Russia invaded Ukraine… Unprecedented levels across the board. This is Western goods getting shuffled around before they go to Russia.”

However, these countries have denied their involvement in such evasion.

In July, Kyrgyzstan denied re-exporting sanctioned goods to Russia. Its Prime Minister Akylbek Zhaparov told the press that “measures will be taken in the future so that sanctioned goods do not cross our border and, moreover, do not go where there are sanctions”.

The same month, the US sanctioned 120 firms on these allegations, including some Kyrgyz companies. In March this year, Kazakhstan also denied providing semiconductor chips to Russia.

There were fears of sanctions on the Central Asian countries, but, in June, the European Union vowed to not to do it.

Charles Michel, the president of the European Council — which directs the EU’s general political direction — has said that sanctions will be imposed only on those who “enable the Russian military machine”.

Speaking to the press, he said, “We do not apply the principle of extraterritoriality, and, most importantly, we want to work with all of our partners around the world only through dialogue.”

Also Read: What Russia-Ukraine war teaches us — 5 big tactical takeaways for India