New Delhi: The collapse of the Francis Scott Key Bridge in Baltimore, US, has led to concerns over how this would impact global trade, since a significant portion of America’s auto imports and coal exports go through the Baltimore port.

Shipping experts and economists, however, said the impact on coal-importing countries was likely to be negligible, and that India could potentially gain from this disruption if it was agile enough.

ThePrint explains the ramifications of the collapse for India, and for global trade.

What happened in Baltimore?

Early Tuesday morning in the US, a container ship named Dali — sailing from the Helen Delich Bentley Port of Baltimore to Sri Lanka — suffered a total power outage.

The US media reported that Clay Diamond, the executive director of the American Pilots’ Association, said the ship experienced a “full blackout” and lost both engines and the electrical supply to the vessel’s control and communications systems.

The 22-member, all-Indian crew used the ship’s backup power to issue a Mayday call about the outage, according to Wes Moore, the governor of Maryland (the US state in which Baltimore is located). This, he said, allowed authorities to stop additional vehicles from entering the bridge.

The rudderless ship soon crashed into the Francis Scott Key Bridge, crumpling the entire structure into the Patapsco River.

‘Auto markets will feel impact’

Apart from the possible loss of life and cost of damage to property, the Port of Baltimore and the Patapsco River are a key shipping route for trade with the US.

“Auto markets will be among the first to feel the impact of the disaster,” Harry Murphy Cruise, an economist at Moody’s Analytics, said in a note. Baltimore, which lies south of Philadelphia and north of Washington, is a key import hub for roll-on-roll-off stock.

“The Asia-Pacific region’s largest car exporters, particularly China and Japan, could face delays offloading and delivering stock,” he added.

Cruise further said that more than a quarter of US seaborne coal exports leave the country from Baltimore, with most of it being shipped to India, China, and Europe.

Impact on India?

While large parts of the US’s coal comes to India through Baltimore, America overall accounts for a relatively small share of India’s total imports.

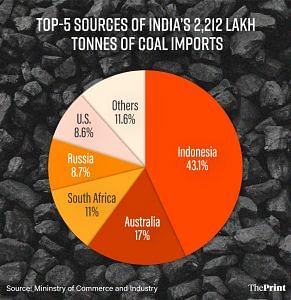

Data with the Ministry of Commerce and Industry showed that the US accounts for 8.6 percent of the 2,212 lakh tonnes of coal India imported in April 2023 to January 2024.

Indonesia accounts for the majority of India’s coal imports, at 43 percent, followed by Australia (17 percent), South Africa (11 percent), and Russia (8.7 percent).

“There are a lot of items that go through Baltimore from India, and (come) from there to India, but the main focus should be on coal,” Rahul Sharan, head of research at Drewry Shipping Consultants, told ThePrint. “Almost 50 percent of the coal from Baltimore goes to either India or China, and mostly to India. That will get disrupted.”

Therefore, if a quarter of US coal comes through Baltimore, and within that, if less than half comes to India, the impact on India’s coal supplies is likely to be minimal.

How can India benefit?

Analysis by Cruise for Moody’s included a brief on how coal markets have responded to crises in the recent past, and what that can tell us about how this will play out. The crux of the analysis is that coal supply lines have displayed agility, with importers quickly able to switch trading partners without affecting supply.

“In 2020, China imposed an unofficial ban on coal imports from Australia — the world’s second-largest exporter,” Cruise explained. “Rather than throwing global trade into disarray, what came next was the reshuffling of global suppliers.”

“China found new sellers in Russia and Indonesia, which then pushed Japan, India and South Korea to switch to Australian supplies,” he added.

All in all, Cruise said, aggregate global coal trade was largely unchanged, and a “similar game of musical chairs” occurred when the EU and US introduced sanctions on Russian coal in 2022.

Sharan, on the other hand, believes that this flexibility could even help Indian coal importers by reducing freight costs, which have shot up due to the crisis in the Red Sea.

“India might have to buy coal from alternative sources in the spot market and that is most likely to be from Indonesia,” Sharan said. “The shipping distance from Baltimore to India was about 8,000 nautical miles, when ships could go through the Suez Canal. But ever since the Red Sea crisis and the need for ships to go around the Cape of Good Hope, the distance is more than 11,000 nautical miles.”

Shipments from Indonesia, which is much closer, could mean a substantial lowering in freight rates.

“This will be good for India and purchasers of coal because it will lead to reduced freight costs, which means the overall cost of imported coal would be lower,” Sharan said.

(Edited by Tikli Basu)

Also read: Why did the Baltimore bridge collapse and what is the death toll?