Sources in the CBI say 293 more LoUs that were issued in past two years are being investigated.

New Delhi: Union Law Minister Ravi Shankar Prasad claimed Friday that a majority of the “loans” sanctioned to businessman Nirav Modi was during Congress rule between 2011 and 2014. However, the FIR lodged by the CBI on 31 January refers to just eight Letters of Undertaking (LoUs), all of which were issued after 2017, during the NDA’s regime.

Sources in the CBI also said that a further 293 LoUs were issued to Nirav and his companies in the last two years. So far, there is no LoU older than that has been revealed during investigations.

A Letter of Undertaking, or LoU, is not a loan. It is a guarantee given by a bank branch in India to an overseas bank that it will meet the liability if the firm borrowing from it (the foreign bank) defaults. Diamond firms use LoUs for securing cheap, low interest “buyer’s credit” in dollars overseas, mostly to purchase rough diamonds. Banks are always supposed to cover their LoUs against collaterals, which wasn’t allegedly done in this case.

The CBI suspects there could be more LoUs, but that could take time to establish since the bank employees accused in the case — Gokulnath Shetty (a deputy manager, now retired) and Manoj Hanumant Kharat (a single window operator) — did not keep an official record of the LoUs issued. Despite several audits, including internal and concurrent ones, the fraud was not detected by bank officials.

The BJP-led NDA government fielded senior Cabinet ministers Friday to say that the scam started in 2011, when Congress-led UPA was in power. But as details show, all the LoUs in question are from the past two years. Sources said the government, including the Prime Minister’s Office, was alerted about the ongoing fraud several times. However, no action was taken.

In the first instance, a complaint was given on 7 May 2015 to the Ministry of Corporate Affairs by one Vaibhav Khuraniya & R.M. Green Solution Private Limited. A copy was also sent to the Prime Minister’s Office, Enforcement Directorate, and Serious Fraud Investigation Office, but no action was taken.

Another person named Digvijaysing Jadeja filed an FIR in the Ahmedabad Economic Offences Wing in Gujarat against Mehul Choksi and others for defrauding him. Jadeja also filed an affidavit on 20 July 2016 pointing out that Choksi – who is Nirav’s maternal uncle – and others owed Rs 9,872 crore to banks, and were likely to escape from India. But no case was registered.

In a third instance, a Bengaluru-based entrepreneur Hari Prasad had written to the Prime Minister’s Office (PMO), bringing to its notice financial discrepancies that could lead to a huge scam involving Choksi, and listed details of all balance and audit sheets.

The letter, dated 29 July 2016, bore the subject line: “Complaint lodged at PMO and CIC against Gitanjali Gems Ltd and its MD Mehul C. Choksi”.

It stated: “We wish to bring to the government’s notice, a major financial scam, similar to that of Vijay Mallya, Subrata Roy of Sahara group or Ramalingaraju of Satyam group… This scam and fraud done by the person based in Mumbai involving loss of Rs 1,000 crore of Indian public money.”

The complainant also enclosed copies of complaints by franchisee victims against Choksi and various firms linked to him. It accused Gitanjali Gems and Choksi of siphoning off thousands of crores through subsidiary companies floated in India, and fictitious companies abroad.

However, no action was taken.

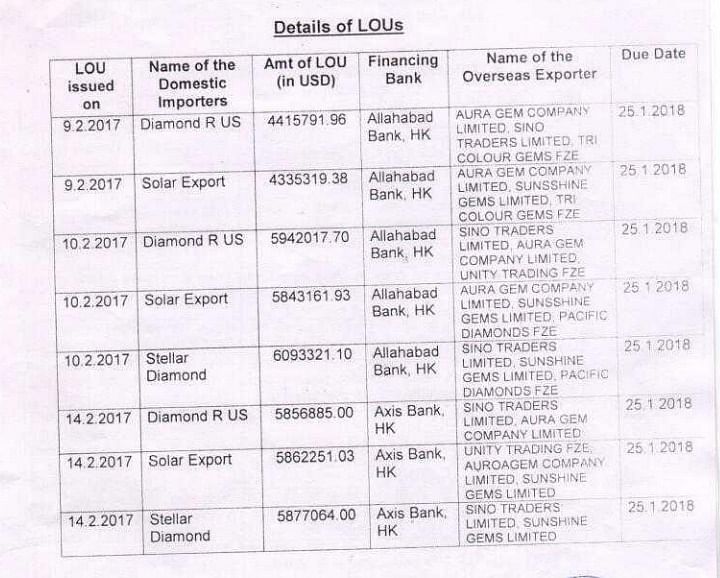

Details of the LOUs in the FIR (9 February 2017 to 14 February 2017)

Punjab National Bank (PNB), in its complaint, directly accused Nirav, wife Ami, brother Nishal, and Choksi of conniving with the two bank official to commit the fraud.

The bank says it scrutinised records of SWIFT (Society for Worldwide Interbank Financial Telecommunications) — a messaging network that financial institutions use to securely transmit information and instructions through a system of codes.

The bank says it found that Shetty and Kharat, on 9 February 2017, issued two LOUs on behalf of Diamond R US for $4,415,791.96 and Solar Exports for $4,335,391.38 (Nirav Modi is a partner in both firms). The due date of payments for both LOUs was 25 January 2018, favouring Allahabad Bank, Hong Kong.

The next day, the accused duo issued three LOUs on behalf of Diamond R US, Solar Exports, and Stellar Diamond for $5,942,017.70, $5,843,161.93 and $6,093,321.10 respectively, due on 25 January 2018, favouring Allahabad Bank, Hong Kong.

Then, on 14 February 2017, Shetty and Kharat once again issued three LOUs – on behalf of Diamond R US for $5,856,885.00, Solar Exports for $5,862,251.03, and Stellar Diamonds for $5,877,064.00, all having due dates on 25 January 2018, favouring Axis Bank, Hong Kong.

These eight LOUs reported by the PNB add up to $44,225,812.20 (approx. Rs 280.70 crore).

The bank official who filed the complaint stated: “We are making an in-depth enquiry (sic) of records of SWIFT messages to find out outstanding LOUs which are otherwise not available in the FINACLE system as these were issued without their details being entered in the CBS.”

The bank also suspects that buyers’ credit based on fake LOUs might have also been paid through NOSTRO, this official stated.

Case against Gitanjali group

The CBI has registered another case against the Gitanjali group of companies, of which Choksi is MD. Three firms – Gitanjali Gems, Gili India and Nakshtra Brand Ltd, have been accused of swindling PNB to the tune of Rs 4,886.72 crore.

This case allegedly involves 143 LoUs and 224 foreign letters of credit.

What next

Interpol’s help has been sought to seek Nirav and the others. Diffusion notices — requests for cooperation — have been issued against the three members of the Modi family and Choksi.

Raids and searches are now being conducted at 20 locations across five states.

The CBI investigation pinpoints the time line of the frauds starting from the 8 LOU’s issued from 09/02/2017 and a further 293 lou’s issued subsequently in continuation of the fraud perpetration.So it is as clear as daylight that the loot has taken place under the watch of the ‘Modi Government’.

Do the self anointed chowkidars aware of these facts or just relying on the ‘Whatsapp messages’they receive on their mobiles?

Everything is very open with a really clear clarification of the challenges.

It was truly informative. Your site is very useful.

Many thanks for sharing!

PNB fraud has seen day light when an alert bank employee alarmed the officials, if not it would have continued un noticed till next elections, as election funding is done by round tripping. Just a mistake of not taking care of the last man in the chain, it has costed so much for crony politicians. God knows how many frauds of round tripping of bank money is playing in our elections in our country. May God save…

Whether any contingent liability is shown in the balance sheet ended 31/03/2017

Political class has lost all credibility, they start indulging in mud slinging exercise on the drop of a hat. Politicising everything has become their culture. Instead of taking ownership and bringing in systematic changes in business processes, they prefer to play blame game.

Is there any carry forward LOU of the UPA ? If not, stop making laughable excuses and, instead explain why the loot has happened and steps you are taking to stop such happenings in future. It is equally ridiculous of your attempt to compare Manu Singhvi renting out his property or Rahul’s going out to to N Modi’s exhibition with that of N Modi being present in the company of our PM. Do not consider us to be fools.

2011 is immaterial. WHY?

The basic point is this : – If the #LoUs were issued in 2011, the #liabilities under them must have been repaid/got #extinguished, because an LoU cannot have #indefinite #tenor (#validity). True, it’s possible to issue a #Revolving_LOU with a #revolution_clause, which means that once the earlier liabilities are extinguished, the value of the LoU is #reinstated. The effect is virtually the same as a non-revolving LoU. Unless the previous liabilities are extinguished, no further payments under the same is possible. So, it is very much clear that all the #outstandings (aggregating Rs.11k crores+, and counting) under LOUs are #current_dues, which the #Modis and #Choksis got the guts to default, just because they had blessings from the powers that be, and got safe passage before the #PNB #discovered the #fraud, and lodged an #FIR with #CBI!

right sir

Basic banking rules were disregarded like transfer after 1 to 2 years.

Swift has the highest standards of security. You have a person who makes an entry into the system and another person authorizes it. For large amounts authorization is required at several levels by several people.

Extremely basic things like reconciliation with the Nostro accounts of 2 banks, reconciliation between CBS and SWIFT, revenue and LOU was not done. Plus audits by internal auditor, external auditor, and RBI failed to unearth anything.

Sheer incompetence at its best.

It is very difficult to digest the fact that even though there is strict internal audit and RBI audit ,

this type of big scams are happening May be big fishes are involved in this scam.

Rules r for fools is a common slogan in govt offices yes it seems right now as rich high profile highly corrupt can get things done at the cost of common tax payer accountability of wrong doers promptly &severe punishment can only deter such immoral acts

Law governs the poor but fhe rich govern law..whether it is manmohan orModi

When Lou was kept on issuing without taking collateral security who is the minister or bureaucrat involved. CBI must investigate this fraud

even if swift were not recorded/posted into CBS, when on due date the customer pays to the foreign bank, that time foreign bank would have sent confirmation/intimation to PNB branch and may be with bank charges, so that time PNB branch CBS staff would have come to know that, that money received by foreign bank against a non posted swift. Still I am not comfortable to accept that swifts were not posted in cbs and 2 staff have separate swift message systems.

Please recheck the dates mentioned

Some of the dates are last week of January 2018

If correct- When did Mr Shetty retire ?

the author says the LOUs are issued in February 2017, how come people were able to complain in 2015 before the LOUs were issues. clearly this scam could have probably started much earlier probably UPA years and no one noticed it, clearly due diligence were deliberately overlooked by banks who were giving money to this people. looks like similar cases could soon emerge and atleast 5times tthe money reported will be unearthed if dug deep.

at my local bank town, these fcuking manager tried to delay my student loan process by six months because i was not willing to pay bribe. 50% of public bank emplayees specially managers in india are assholess

The complaints made in 2015, and onwards, weren’t about LOUs – they were about being personally defrauded by Choksi and his lot.

Case against Gitanjali group allegedly involves 143 LoUs and 224 foreign letters of credit.

Given the large sums involved, there ought to be a standard procedure by which the bank to whom the comfort letter is issued seeks confirmation from a level above the issuing branch. Collusion may still be possible, but it would widen the circle of officials who need to be compromised. 2. The Indian banking system needs to think of ways to deal effectively with defaulting tycoons who flee the country. More collateral should be insisted upon. 3. The diamond industry is especially difficult to deal with. Better safeguards need to be in place. Or leave this space for private sector banks to occupy.