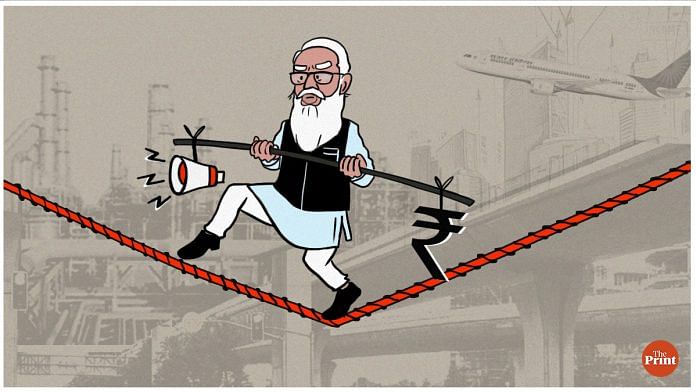

The difference between privatisation and “monetisation” is that the first takes the government out of a business; the second keeps the government in there as an active player. For that reason, privatisation is easier than monetisation. Yet a government with a sorry record on privatisation (Air India, Bharat Petroleum, etc) and of missing disinvestment targets by a mile, hopes to garner Rs 6 lakh crore through monetisation in four years — just after a bid to monetise railway assets has failed to attract much interest. But what good is an announcement if it is not ambitious in scale? Even if the ambition flies in the face of past experience?

There is another problem, which commentators have already highlighted: Cronyism. Remember Mr Modi’s old promise: “Na khaaunga, na khaane dunga (I will not be corrupt, nor will I allow others to be corrupt).” One can debate whether the electoral bonds qualify as “khaaunga”, but after an initial Modi-era improvement in India’s score on the Corruption Perception Index, constructed by Transparency International, the last couple of years have seen the improvement partially reversed and India’s rank among 180 countries drop from 78 to 86. There is a story there about how perceptions of the Modi government are changing.

In such a context, both privatisation and monetisation are fraught with risk. Ask the Manmohan Singh government, which was destroyed by the auction of telecom licences and coal mines. Private investors who believed in government processes were destroyed too, because the courts subsequently cancelled both sets of licences. In a country with no shortage of what Arvind Subramanian has called “stigmatised capital”, individual reputations too are on the line: If you believe what the French have said, Anil Ambani was very much the government’s favoured contractor.

Then look at contradictions and coincidences. The government frowned at big retail chains using their balance sheet strength to offer big discounts and capture market share, even as the Telecom Commission allowed Jio to do exactly that in telecom. And how the GVK group attracted the tender ministrations of the Central Bureau of Investigation and the Enforcement Directorate (whose senior official, it is reported, may join the Bharatiya Janata Party), when GVK stood in the way of the Adani group taking control of Mumbai’s airport.

Also Read: Nirmala Sitharaman is proving to be a pleasant surprise as finance minister

Another school for scandal

Such episodes are guaranteed to multiply under “agency raj”, and when generalist administrators make complex rules in different sectors for different projects. The corrupt Enron and its partners benefitted from the one-sided Dabhol power contract (it could have bankrupted the Maharashtra state electricity board), even as the then power secretary ruled that the statutory responsibility of the Central Electricity Authority, to assess the reasonableness of the project’s capital cost, could be given the go-by. More recently, how did the Adani group get 40 years to build and manage the Vizhinjam port in Kerala when the standard term for such contracts is 30 years?

Consider also, at the end of its contract period, how the Tatas’ Indian Hotels launched court action to prevent a fresh auction, resulting in extended control over a key luxury hotel in New Delhi (the company eventually won the bid for a fresh lease). And how toll road contractors were found to have hugely under-counted the revenue from tolls. And the entire history of Infrastructure Leasing and Financial Services. Then think of how, at each stage in the execution and monitoring of contracts, government officials will be arbiters, or (in post-retirement sinecures) sector regulators. Or better still, company directors! So much better than privatising and losing control.

In short, the Modi government has embarked on an obviously sub-optimal course across a minefield. One could compliment it for undertaking the task regardless, and for setting itself up to be measured against stiff targets. But given the record of past blunders and under-achievements, the vulnerabilities of India’s eroded institutions and the manifest influence of stigmatised capital, what the country might get is yet another school for scandal. And, unlike in the original, not as comedy.

By special arrangement with Business Standard

Also Read: Indian economy needs to fire on 4 engines to grow. But Modi govt is betting on just 2