In an earlier column, I wrote about growth scenarios that will shape India’s path to the ranks of middle-income countries (MICs). In this column, I examine the role that a central character in this story—the Indian firm—is playing, and must play, in India’s transformation.

I use the Prowess database—assembled and managed by the Centre for Monitoring Indian Economy—to estimate the age and size structure of India’s firms. For the 2016-2021 period, it includes comprehensive data on 12,460 firms This group includes almost all listed firms and many, but not all, privately owned firms.

Several caveats are to be noted at the outset. The database does not include the multitude of small businesses—everything from the corner shop to the mom-and-pop business—that make up much of India’s informal sector. It includes some of the fast-growing startups— including more than 100 firms that are unicorns today. For instance, Flipkart, Zoho, and Zerodha are included in the database but BYJU’S, Udaan and OYO are not. Many state-owned companies are excluded from the database. And some companies in the database are subsidiaries of foreign companies.

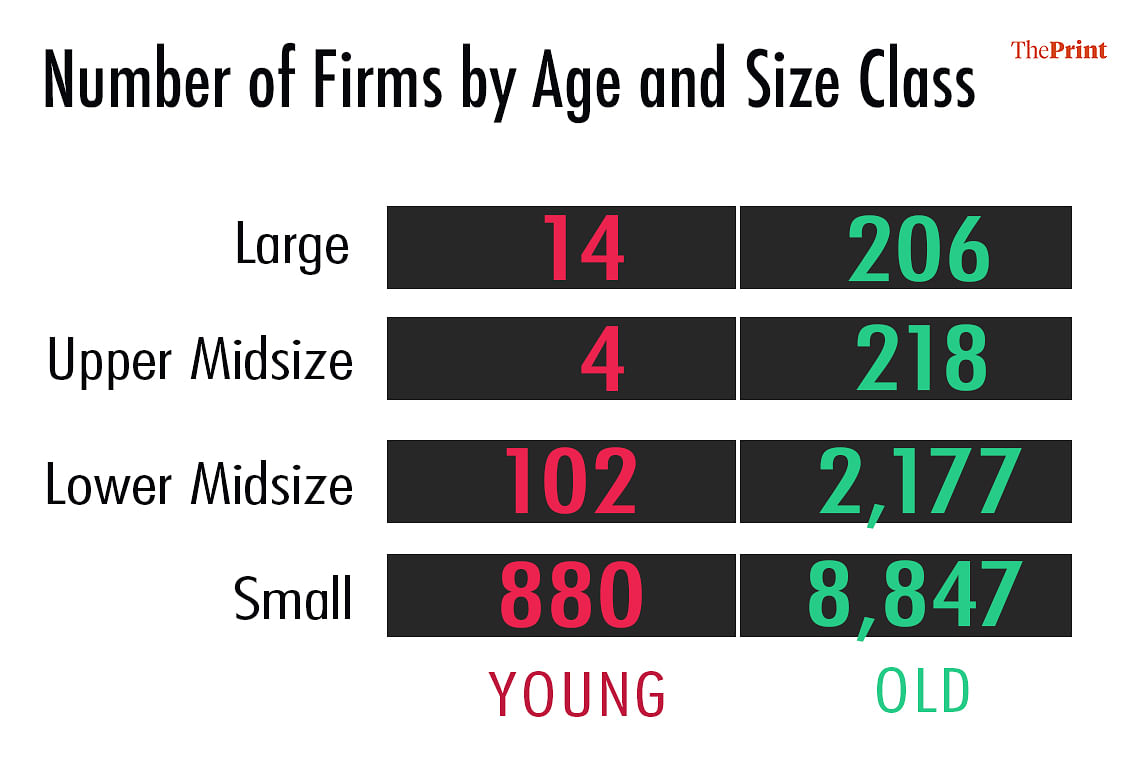

I use this database of 12,460 firms to answer two questions. First, what is the distribution of India’s firms by size and age? That is, how many firms are large (greater than $1 billion in annual revenues), how many are upper midsize (annual revenues between $500 million and $1 billion), how many are lower midsize (annual revenues between $50 million and $500 million) and how many a small (annual revenues less than $50 million)? And how many firms are old (greater than 10 years in age) and how many are young (less than 10 years in age)?

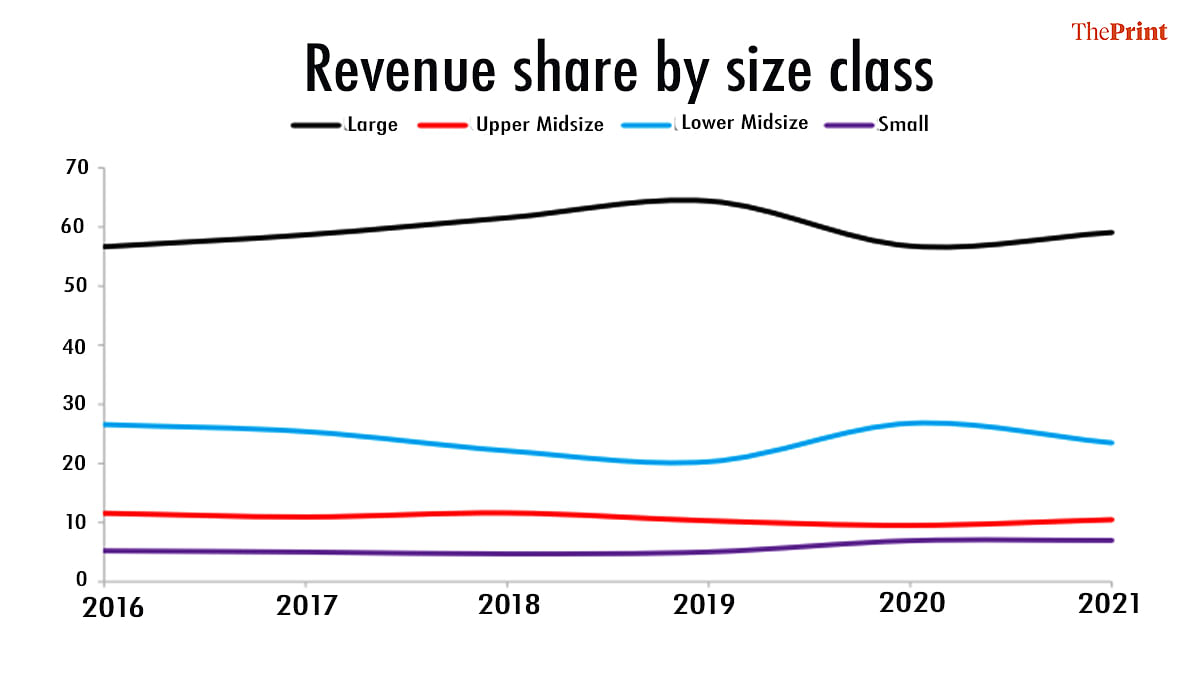

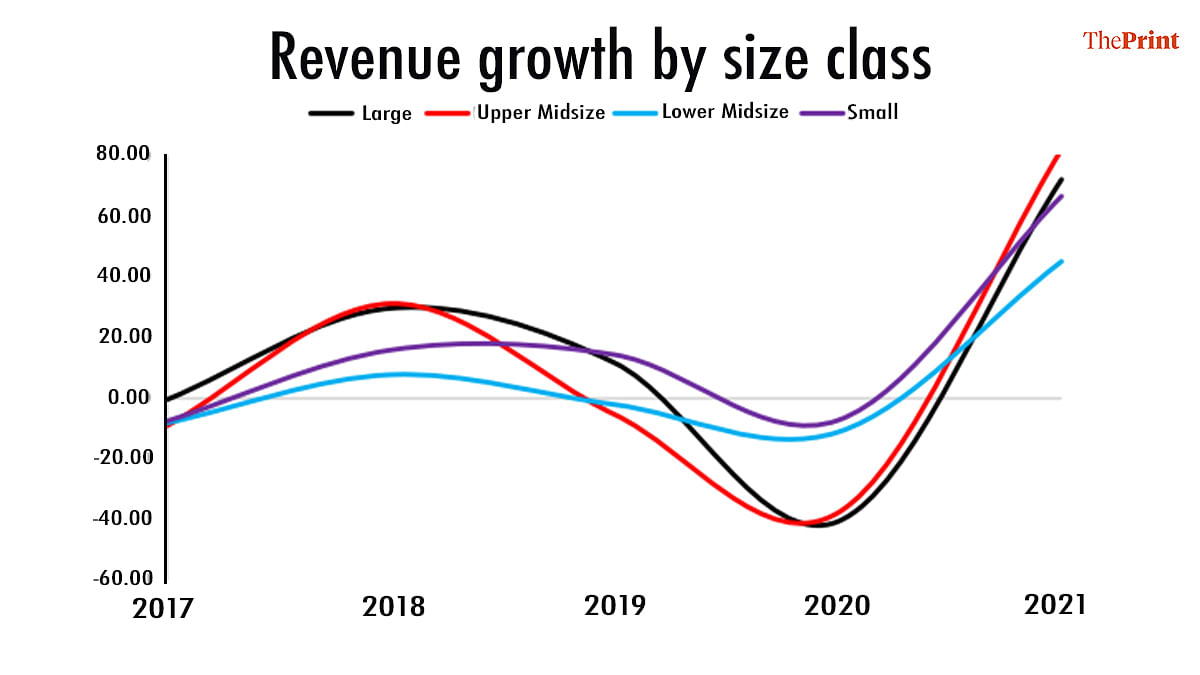

Second, how have revenue shares and revenue growth rates of each size class changed since 2016? Importantly, what do the revenue shares and growth rates of each size class reveal regarding the pivotal policy questions that will shape economic growth over the next few decades?

Table 1 provides a visual summary of the distribution of firms by size (along the rows) and by age (along the columns).

Also read: India’s forex reserves dip by $4.85 bn; hit lowest level since July 2020

“Missing middle”

There are five takeaways from Table 1. First, 91 per cent of India’s firms are old, 78 per cent are small, and 71 per cent are old and small. Given that the Prowess database does not include many small firms, the true estimate of the share of small firms in the population of firms is likely much greater.

Second, the 220 large firms represent less than 1.75 per cent of all firms in this sample and, as a group, likely constitute a much smaller share of the true population of firms. Many of the old and large firms will be familiar to readers. This group includes Reliance Jio, Patanjali Ayurved, Amazon India, Apple India and many others. Of the 14 young and large firms, Kia Motors, Xiaomi, Vivo Mobile and Suzuki Motor Gujarat are subsidiaries of foreign firms. Some firms, such as Adani Power Mundra and Jindal Stainless, are new firms started by established conglomerates.

Third, evidence for the “missing middle”—a paucity of midsize firms—can be seen in the Table. Notice that upper-midsize firms make up more or less the same fraction of the sample as large firms. The phenomenon of the “missing middle” is not unique to India. Hsieh and Klenow (2009) assert that many small firms in developing countries do not grow to become larger firms because they lack managerial knowledge and face financing constraints. Bloom, Mahajan, McKenzie and Roberts (2010) present evidence that the quality of management practices—most notably, the setting of targets, the monitoring of performance and the creation of incentives—is the primary reason why many small firms do not scale up. In their study of 620 Indian firms, Bloom and Van Reenen (2010) find that a high proportion of Indian firms, like their counterparts in China, Greece and Brazil, scored poorly on many dimensions of management practices.

Fourth, the 2,279 lower midsize firms account for 18.30 per cent of all firms and make a significant contribution to India’s corporate revenues and revenue growth. Familiar names from this group include Coffee Day Global, Amalgamations, United Breweries, Audi India, Chettinad Cement and more. Less familiar names from this group include Shri Mahavir Pulses, Penta Gold, Vantage Knowledge Academy, Maharani Paints and MK Proteins.

Fifth, the small firms that makeup 78 per cent of all firms in this sample likely constitute a significantly greater fraction of the population of firms. Significantly, 67 per cent of all small firms have less than $10 million in revenue and hardly grow from year to year. One might wonder why this is so. Hurst and Pugsley (2011) conclude that many small businesses remain small because their owners do not have the aspirations, worldview, or capabilities to grow. For those entrepreneurs who aspire to scale their firms but are unable to do so, factors such as the lack of managerial knowledge, inadequate access to capital, compliance burdens, and social capital (lack of connections), are the biggest inhibitors.

Also read: Inflation at just 3 per cent—why Japan’s economy is doing much better than fellow G7 nations

Small but steady growth of small firms

Figure 1 shows the share of revenues that accrue to each size class.

There are three takeaways from Figure 1. First, though large firms account for less than two per cent of all firms, they have an outsized influence on revenues. Large firms are, and will remain the most significant player in driving economic growth in India. They have the managerial capabilities, the capacity to hire, train and retain the best talent, and the ability to raise financial resources. Notice that large firms’ share of revenues declined with the onset of the pandemic in 2020, but have recovered lost ground in 2021.

Second, in comparison with lower midsize firms (in blue), upper midsize firms (in red) have punched far below their weight (compare the red and blue lines). Upper midsize firms account for just 10 per cent of revenues can be attributed to the “missing middle”—there just aren’t enough upper midsize firms to power the growth of their size class. In contrast, lower midsize firms have accounted for steady growth of 23 per cent+ of overall revenues because of the small, but steady, influx of small firms into their size class.

Third, small firms, though numerous, contributed a tiny five per cent to seven per cent of overall revenues. Though their share of revenues is unlikely to rise much, an influx of startups and small businesses could be a force multiplier.

The emphasis on market shares (in Figure 1) masks the volatility of revenues. Figure 2 displays annual revenue growth rates between 2016 and 2021.

Figure 2 provides visual confirmation that the 2016-2021 period was a difficult one for firms. Notice that the revenue cycles of each size class have moved in tandem (as one might expect) though their amplitudes have differed. After experiencing tepid growth in 2017, and a collapse in 2020, corporate revenues for all four class sizes recovered strongly in 2021. The strong performance of the upper midsize and lower midsize classes offers the promise that many firms from these size classes could move up one or two size classes over the next decade.

Also read: India will stand out with 7 pc growth rate in FY23 amid global gloom, says EAC-PM member Sanyal

Grassroots game changer

The firm is the engine that powers economic growth. Its most visible role is to combine labour, capital and other resources to produce the goods and services that consumers want. Its less visible role is as a change agent, a-la Joseph Schumpeter’s creator and destroyer. A 75-year-old economy surely needs new ideas, technologies, business models and ecosystems to replace the old.

Public policy vis-à-vis Indian firms must be geared towards two objectives. The first is to increase the number of firms of all sizes. Adjusted for GDP, India has fewer large and midsize firms than many countries. The McKinsey Global Institute (MGI) notes that China has two times, and South Korea three times, the number of large Indian firms. Grassroots efforts to make entrepreneurship a national passion could be the game changer.

The second objective of policy should be to help firms of all sizes improve their productivity. Even the largest and most productive Indian firms fall short of their foreign counterparts. The MGI reports that the average Chinese, South Korean, Malaysian and Thai firm is considerably more productive than its Indian counterpart. India’s objective should be to create an environment that makes it easy for businesses to solve their problems effectively and with speed.

Ram Shivakumar is a Professor of Economics & Strategy at the Booth School of Business at the University of Chicago. Views are personal.

(Edited by Ratan Priya)