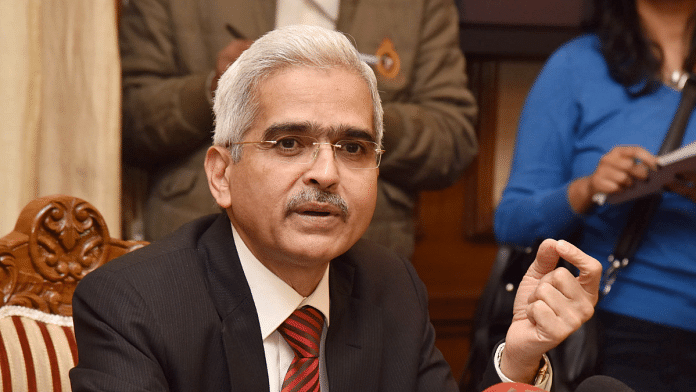

The Reserve Bank of India imposed several sanctions on Paytm Payments Bank last week, including the suspension of deposits, credit transactions, fund transfers, top-ups, and its digital wallet. RBI chief Shaktikanta Das has also said that the regulatory action will not be reviewed, effectively closing off any possibility of the RBI reversing its decision.

One could argue that innovation requires taking risks and pushing the boundaries of what regulatory bodies consider acceptable. Did Paytm go too far? Or is it that our regulations are so stringent that any innovation by a private entity is likely to find itself in regulatory crosshairs? The opacity surrounding the RBI’s actions makes it impossible to ascertain the specifics of what Paytm did wrong.

India has made impressive strides in fintech. Digital payments are at an all-time high, making some of us feel that we are ahead of several developed nations in payment technology. And yet, the Paytm episode is a reminder that we must evaluate the nature of our fintech regulation itself.

The problems with KYC in India

One of the primary compliance burdens in the fintech sector is the implementation of ‘know your customer’ (KYC) regulations. The RBI had flagged that Paytm was not adhering to KYC guidelines and might have been involved in money laundering.

Much has already been said about the challenges posed by KYC regulations in India, their high cost, and their potential to be used for surveillance purposes. It is quite possible that the current KYC burden, coupled with competitive pressures, compels firms to cut corners on compliance.

Nevertheless, the larger issue lies in the unpredictable enforcement actions by regulators. It is anybody’s guess if, when, and against whom enforcement actions may be initiated. Equally unclear is how specific provisions should be interpreted—a firm may not know until it faces enforcement action.

We need to move away from the current one-size-fits-all framework to a risk-based approach with a transparent, consistent, and proportionate enforcement strategy. Unless we do this, every fintech company will be saddled by some regulation or other that it is potentially violating.

Also read: Digital lending has got a bad rap, but don’t throw the baby out with the bathwater

Bank-driven fintech with limited competition

India’s payment and fintech industry is predominantly bank-driven. Whether it’s UPI, wallets, or digital lending, our regulatory processes insist on banks being at the centre of all financial transactions. The RBI recently reiterated that banks should remain central to digital lending, thereby ensuring that fintech stays within the boundaries of banking regulation.

But financial innovation is about disintermediating from banks. In Africa, telecommunications companies pioneered the m-pesa service decades mobile payments gained traction in India. This was possible because telecom firms in Africa were allowed to innovate, whereas in India, banks retained a monopoly on financial services.

The concept of “payment banks” is itself an example of constraint-driven regulation. Proposed in 2014, the idea saw several players surrendering their licences as the permitted activities did not leave much scope for earning profits. The one bank that found a way to navigate these constraints and become profitable now faces the threat of closure.

India’s fintech industry is still not competitive. Even UPI, which we are very proud of, did not open up the competition to alternative models and players. The rationale we use to justify this is that the government provides digital infrastructure and the private sector can innovate on top of it. There are two problems here.

First, not all private firms have access to this infrastructure, which is still controlled by the National Payments Corporation of India.

Second, the feasibility of innovation within this infrastructure is questionable. Why has innovation in this space been choked off?

The RBI will argue that the centrality of banks and the control of digital infrastructure ensure consumer protection. But the rise in UPI frauds doesn’t reassure us of this model. And now, the RBI is setting up a cloud services entity, entering a marketplace where several players already exist. Owning and controlling a market is not the same as regulating it for consumer protection.

Paytm in the land of bank-led fintech regulation

One must look at Paytm in the context of this regulatory framework. It was a leader in innovation and likely took risks that pushed the boundaries of what was acceptable to the regulator. That’s different from doing something illegal.

To know whether Paytm committed patent illegality, we must study the RBI orders. But as many have pointed out, the central bank doesn’t explicitly say what wrong Paytm did. Until the RBI releases its orders and we hear Paytm’s defence, we have to assume that the defendant is innocent. By making its orders public and reviewing its approach to fintech regulation, the RBI will increase its credibility.

Renuka Sane is research director at TrustBridge, which works on improving the rule of law for better economic outcomes for India. She tweets @resanering. Views are personal.

(Edited by Humra Laeeq)

Kudos to your article. This action smells use of Government and Regulator to right size an emerging business.

How do you expect a payment banks to open crores of accounts (which India ) needs and do traditional KYC.

That is preposterous requirement. Such a startup will never become profitable as it will drown itself in the cost of doing non sense KYC.

This action is analogous to India’s Jack Ma moment.

The big guys don’t want to share space with a new guy. They are doing everything in their power to right size the new guy.

But remember. You can have regulation and curtail someone. But you cannot take away power of great software. Software will win!

RBI is doing as much as possible to finish Fintech. But it can’t stop SBI from lending Adani Billions. Kamjor k liye sare niyam hote h.